AI in insurance is rapidly transforming the industry, introducing groundbreaking advancements in claims automation. With increasing data volume and complexity, insurers face the challenge of processing vast amounts of information efficiently and accurately. Traditional manual processes often lead to delays, errors, and inefficiencies, which not only affect operational costs but also customer satisfaction. By integrating AI-powered solutions, insurance companies can streamline their operations, improve decision-making, and provide enhanced customer service. In this blog post, we will explore how AI is revolutionising claims processing in the insurance sector, focusing on key technologies such as predictive analytics, data analysis, and automation.

>> Read more: Fraud detection in Insurance Use Case

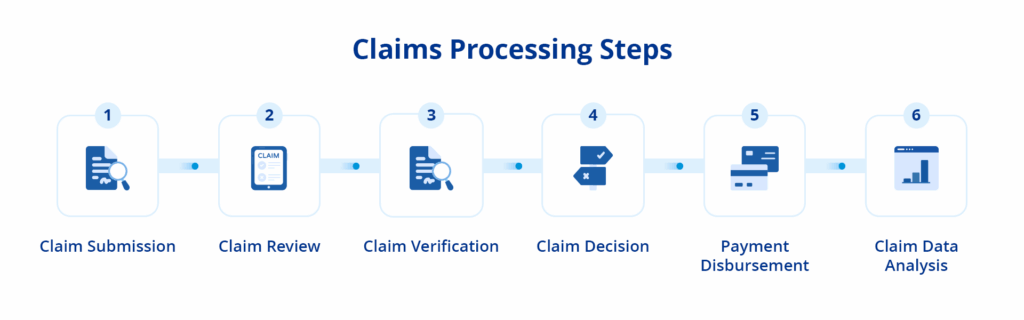

1. AI in Insurance to Streamline Claims Automation Process

One of the most significant areas where AI is making an impact in insurance is claims automation (Milinkovich et al. 2025). Traditional claims processing involves significant human intervention, which can be time-consuming, error-prone, and expensive. AI-powered systems, however, automate much of this process, enabling insurers to handle claims more quickly and efficiently.

- Faster claims processing: AI algorithms can analyse claims data in real time, instantly validating information, assessing damages, and determining the legitimacy of claims (Sharma, 2025). This drastically reduces the time spent on manual reviews and accelerates payout times.

- Improved accuracy: AI-powered automation helps reduce human errors in claims processing, ensuring more accurate evaluations. By integrating natural language processing (NLP), AI systems can read and understand unstructured text, such as claim forms and reports, without the need for manual input.

- Enhanced customer experience: With AI automating much of the claims process, customers experience faster response times and fewer errors, leading to higher satisfaction and retention rates.

By embracing claims automation, insurers can streamline their workflows, reduce operational costs, and offer a more responsive service to their customers.

2. Predictive Analytics in Insurance: Anticipating Risks and Claims

Predictive analytics is one of the most powerful AI applications in insurance. By leveraging vast amounts of data, AI models can forecast future risks and claim probabilities, providing insurers with a more comprehensive view of their portfolios (Paul, 2024).

>> Click here to explore more 5 ways retail predictive analytics drives growth in business

- Risk assessment: AI-driven predictive analytics can evaluate historical data, customer demographics, and even external factors (such as weather patterns or market conditions) to predict the likelihood of claims or specific risks. This allows insurers to price policies more accurately and set aside appropriate reserves for potential claims.

- Claims forecasting: AI can predict which claims are most likely to occur in the future, helping insurers proactively manage their resources and optimize their response strategies. For example, AI models can identify patterns in accident data, enabling insurers to predict areas or timeframes where claims are more likely to occur.

- Fraud detection: Predictive analytics is also instrumental in identifying fraudulent claims. By recognising unusual patterns or inconsistencies in claim submissions, AI can flag suspicious activity, reducing the chances of paying out fraudulent claims.

With predictive analytics, insurers can improve risk management, make more informed decisions, and enhance their ability to forecast potential losses.

3. Insurance Data Analysis and Risk Assessment: A Data-Driven Approach

In the world of insurance, data is the lifeblood of decision-making. AI-powered data analysis tools can process massive datasets at speed and scale, providing insurers with valuable insights that were previously difficult or impossible to extract manually (Nabeel, 2024).

- Real-time data processing: AI systems can analyse data in real time, providing insurers with up-to-date insights on market trends, customer behavior, and claims patterns. This allows for dynamic decision-making that is more aligned with current conditions.

- Enhanced risk modelling: AI tools can enhance traditional risk models by incorporating a wider range of data, including unstructured data (such as social media activity, weather reports, and satellite images). This comprehensive approach allows insurers to better assess the risks associated with policies and claims.

- Customised policy pricing: By analysing data more effectively, insurers can develop tailored policies for individual customers. AI can evaluate a wide range of personal, behavioral, and environmental factors to offer more precise pricing, ultimately improving customer satisfaction while reducing underwriting risk.

4. AI-Powered Chatbots: Improving Customer Interaction and Claims Support

AI-powered chatbots are increasingly being deployed by insurance companies to improve customer interactions, especially in claims support (Vamkeswaram, 2025; Ekechi et al. 2024). These virtual assistants can handle routine queries, provide information on claims statuses, and guide customers through the claims process, reducing the need for human agents.

- 24/7 Customer support: AI-powered chatbots provide customers with round-the-clock assistance, answering frequently asked questions, providing real-time updates on claims, and offering step-by-step guidance on how to file a claim. This enhances customer experience by offering faster, more accessible support.

- Cost savings: By automating routine customer service tasks, insurers can reduce operational costs and allocate human resources to more complex cases that require expert attention.

- Increased engagement: Chatbots can engage with customers in a more personalised manner, improving the relationship between the insurer and the insured. AI models can learn customer preferences and tailor interactions accordingly, making the service more customer-centric.

5. Automated Risk Mitigation and Policy Recommendations

AI is also being used to automate risk mitigation and policy recommendations based on real-time data and predictive analytics (Joni and Graepel 2024). By evaluating individual risk factors, AI systems can suggest preventative measures and recommend the best insurance policies for customers.

- Personalised Risk Mitigation: AI systems can analyse a customer’s history, behavior, and risk profile to provide personalised advice on how to reduce potential risks. For instance, an AI-powered system could suggest safe driving tips to a customer who has a history of accidents or offer lifestyle changes to a customer with health-related risks.

- Policy Optimisation: Based on real-time data and predictive insights, AI can recommend the most appropriate coverage and policy terms for individual customers. This improves the customer experience by ensuring they receive optimal value for their insurance, tailored to their specific needs and risks.

Automating risk mitigation and policy recommendations enables insurers to provide a more proactive service, helping customers avoid potential risks while ensuring they have the right coverage.

AI in insurance is not just a futuristic concept; it is already transforming how insurers operate, manage claims, and assess risks. By automating claims processing, leveraging predictive analytics, and enhancing data analysis, AI is making the insurance industry more efficient, responsive, and customer-centric. From improving risk assessment models to automating customer support through chatbots, AI technologies are enabling insurers to offer better, faster, and more personalised services. Contact us to have more insights about AI in insurance!