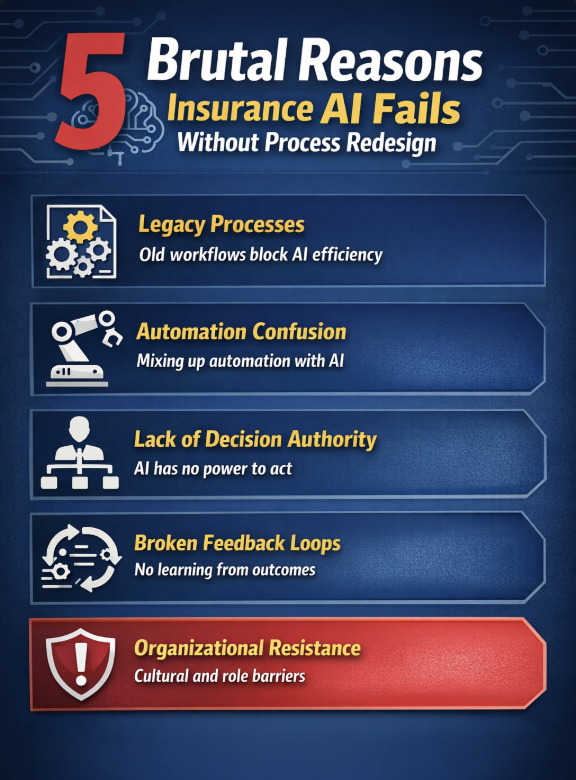

Insurance AI is often presented as a breakthrough solution for claims automation, underwriting accuracy, fraud detection, and customer experience. Yet despite heavy investment, many insurance AI initiatives fail to deliver meaningful returns. The problem is rarely the algorithms themselves. Instead, failure almost always traces back to one core issue: organizations attempt to layer AI onto legacy processes that were never designed for automation, intelligence, or scale.

>> Click to explore our AI use cases in insurance!

This article examines why Insurance AI fails without process redesign, and why insurance process automation, AI implementation in insurance, operational workflow redesign, and enterprise AI transformation must be treated as an integrated strategy rather than isolated initiatives.

1. The Illusion of “Plug-and-Play” Insurance AI

Many insurance executives are sold the idea that AI can be “plugged into” existing operations. Vendors promise faster claims settlement, better underwriting decisions, and reduced fraud with minimal disruption. In practice, this mindset creates a dangerous illusion.

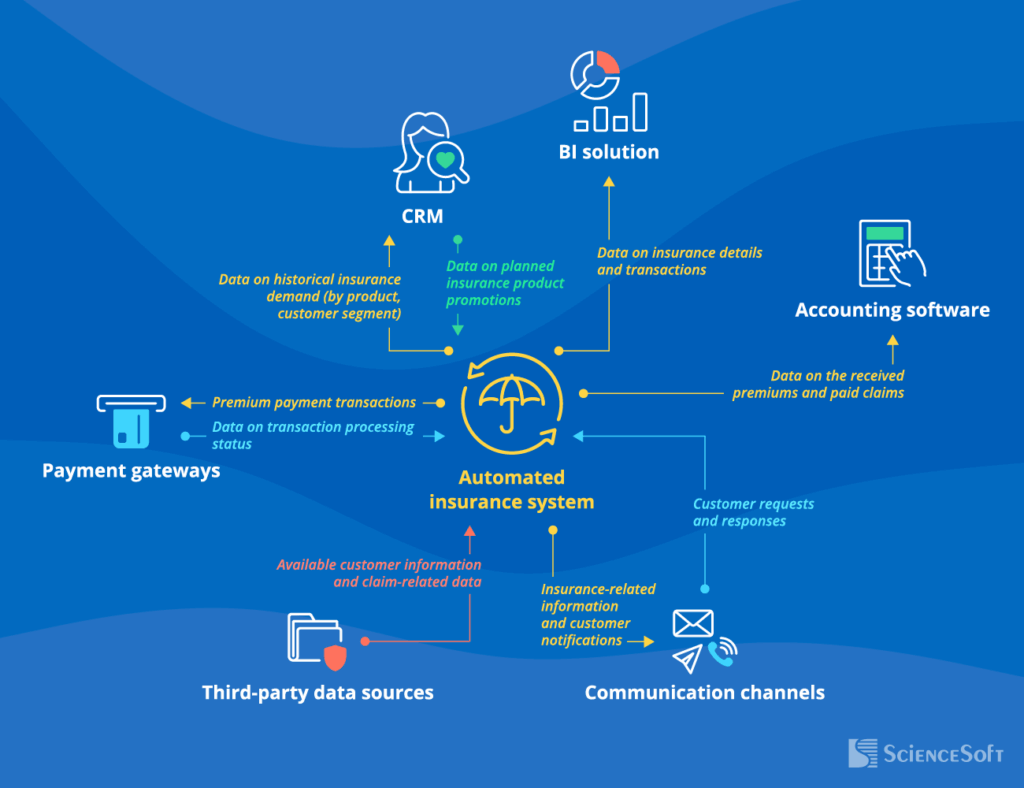

Traditional insurance processes evolved around human judgment, manual handoffs, paper-based documentation, and siloed decision-making. These workflows were optimized for compliance and risk control, not speed, adaptability, or data-driven learning. When AI is introduced without rethinking these foundations, it is forced to operate inside constraints that neutralize its value. AI does not fail because it lacks intelligence. It fails because the surrounding process cannot absorb or act on that intelligence.

2. Why Insurance Is Especially Vulnerable to AI Failure

Insurance is structurally more complex than many other industries. Several characteristics make AI adoption particularly fragile:

- Highly regulated processes with strict audit requirements

- Fragmented legacy systems built over decades

- Heavy reliance on expert judgment and exceptions

- Data scattered across policy, claims, billing, and third-party platforms

Without operational workflow redesign, AI becomes a narrow optimization tool rather than a transformational capability. It may improve one step in the process, but the end-to-end outcome remains unchanged. For example, an AI model may accurately flag suspicious claims. However, if investigation workflows remain manual, overloaded, and poorly prioritized, detection accuracy does not translate into faster resolution or cost savings.

3. Insurance Process Automation Is Not the Same as AI

A common mistake in AI implementation in insurance is confusing automation with intelligence. Automation focuses on executing predefined rules faster. AI focuses on learning, predicting, and adapting. When automation is layered onto broken workflows, it merely accelerates inefficiency. When AI is added on top of poor automation, it becomes underutilized or ignored.

True process automation must precede or evolve alongside AI. This includes:

- Eliminating unnecessary approval layers

- Standardizing inputs and decision criteria

- Reducing exception volume through clearer product design

- Defining ownership and accountability for each process stage

Without these changes, AI outputs arrive at the wrong time, to the wrong role, in the wrong format.

4. The Core Failure Pattern: AI Without Decision Authority

One of the most common reasons Insurance AI fails is that it is not embedded into decision-making authority. In many insurers, AI generates recommendations, but humans retain full control without clear guidance on when to trust the model. This creates several issues:

- AI insights are treated as optional suggestions

- Staff override recommendations without feedback loops

- No learning occurs from accepted or rejected outputs

- Model performance stagnates over time

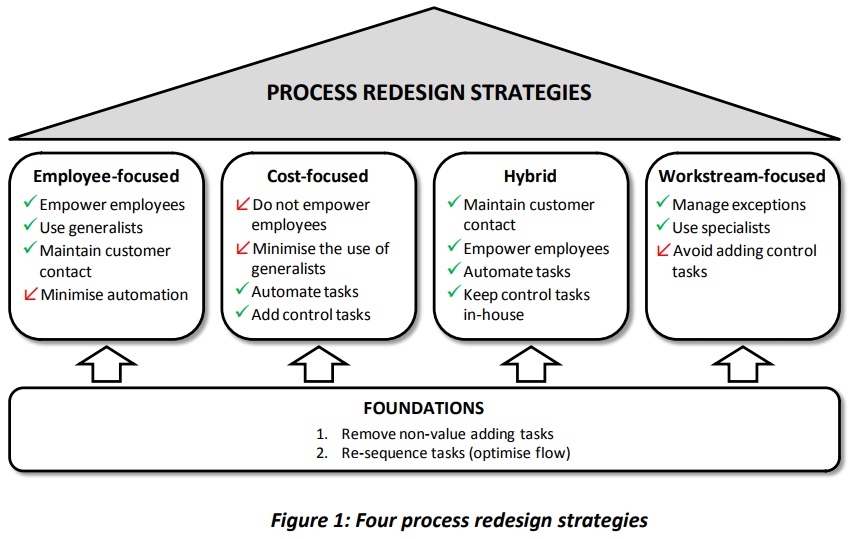

This problem is not technical. It is organizational. Effective operational workflow redesign clearly defines:

- Which decisions AI can make autonomously

- Which decisions require human review

- Which thresholds trigger escalation

- How outcomes feed back into model improvement

Without this clarity, AI becomes a reporting tool rather than an operational engine.

5. Legacy Workflows Break AI Feedback Loops

AI systems require continuous feedback to improve. Insurance workflows often block this feedback in subtle but damaging ways. For instance such as claims outcomes are recorded weeks or months after AI predictions, overrides are not tagged with reasons, customer behavior data is siloed from underwriting systems, and fraud investigation results are not looped back into detection models.

As a result, models cannot learn from real-world outcomes. Over time, performance degrades, trust declines, and stakeholders question the value of AI investments. A successful enterprise AI transformation treats data feedback as a first-class operational requirement, not an afterthought.

6. Process Redesign Is a Strategic, Not Technical, Decision

Many organizations delegate AI initiatives to IT or data science teams. This creates a structural mismatch. AI changes how decisions are made, who makes them, and how accountability is assigned. These are strategic and organizational questions, not technical ones. Without leadership-driven process redesign, AI teams are forced to work around constraints they cannot control.

Effective AI implementation in insurance requires executive sponsorship for process change, cross-functional alignment between business, risk, legal, and IT, clear success metrics tied to business outcomes, and willingness to retire or simplify legacy processes. Without these conditions, AI initiatives remain pilots that never scale.

7. Claims: The Most Visible Example of AI Failure

Claims is often the first area where insurers deploy AI. It is also where failure becomes most visible. Common patterns include:

- AI triages claims, but adjuster capacity remains unchanged

- Low-risk claims are identified, but settlement rules still require manual approval

- Fraud scores are generated, but investigation backlogs grow

- Customer communication remains fragmented despite AI insights

These failures occur because claims workflows were designed around human sequencing, not intelligent orchestration. True operational workflow redesign in claims involves end-to-end claim journey mapping, clear segmentation of straight-through, assisted, and complex claims, dynamic routing based on AI confidence levels, and automated resolution for low-risk scenarios. Without this redesign, Insurance AI becomes a diagnostic tool rather than a productivity driver.

8. Underwriting: Intelligence Without Integration

Underwriting AI often delivers impressive predictive accuracy in isolation. However, its impact is limited when underwriting workflows remain unchanged. Common issues include:

- AI risk scores not aligned with pricing authority

- Manual underwriting guidelines overriding model insights

- Lack of transparency causing underwriter distrust

- Inconsistent application across channels

Here again, the failure lies in process integration. AI must be embedded into underwriting decision flows, pricing logic, and exception handling rules. Successful insurance process automation in underwriting ensures that:

- AI outputs directly influence pricing and acceptance decisions

- Human review focuses on edge cases, not standard risks

- Model explanations are aligned with regulatory expectations

- Learning loops are built into policy lifecycle management

9. From Tools to Transformation

Many insurers adopt AI tools without committing to enterprise AI transformation. This results in fragmented initiatives that never compound value.

Enterprise transformation requires:

- A shared vision for AI-driven operations

- Common architectural principles

- Consistent data standards

- Process ownership across functions

Without this foundation, AI remains a series of disconnected experiments. Transformation is not about deploying more models. It is about redesigning how the organization operates, decides, and learns.

10. Organizational Resistance Is a Process Problem

Resistance to Insurance AI is often framed as a cultural issue. In practice, it is usually a process issue. Employees resist AI when their roles are unclear, decision rights are ambiguous, accountability increases without support and AI adds steps instead of removing them. Well-designed processes reduce fear by making expectations explicit. They show how AI supports professionals rather than replacing them.

Effective operational workflow redesign:

- Redefines roles around judgment, not repetition

- Clarifies escalation and exception handling

- Reduces cognitive load through automation

- Aligns incentives with AI adoption

11. A Practical Path Forward

To avoid failure, insurers should approach AI adoption in the following sequence:

- Redesign core processes around desired outcomes

- Standardize and automate workflows where possible

- Embed AI into decision points with clear authority

- Build feedback loops for continuous learning

- Scale through governance, not ad-hoc controls

This approach aligns insurance process automation, AI implementation in insurance, operational workflow redesign, and enterprise AI transformation into a single coherent strategy.

Conclusion: AI Amplifies Design, Not Intent

Insurance AI does not fix broken processes. It amplifies them. When workflows are fragmented, slow, and ambiguous, AI accelerates confusion. When processes are clear, outcome-driven, and well-governed, AI becomes a force multiplier. The insurers that succeed with AI will not be those with the most advanced models, but those willing to redesign how work gets done. Process redesign is not a prerequisite to AI success. It is the foundation. Without it, Insurance AI will continue to promise transformation while delivering disappointment.