AI in insurance is no longer a futuristic promise but a present operational reality, particularly in claims management. For decades, insurance claims have been defined by paperwork, manual verification, fragmented data, and long settlement cycles that frustrate both insurers and policyholders. Today, advances in artificial intelligence are fundamentally reshaping this process, moving claims handling from labor intensive administration toward automated, data driven intelligence. This shift is not only about cost reduction, but also about accuracy, speed, trust, and the overall customer experience.

>> Which AI myths of AI in insurance? Click here to explore top 5 common myths!

This article explores how AI in insurance is transforming claims management end to end, why insurers are accelerating adoption, and what truly differentiates basic automation from intelligent, scalable claims ecosystems.

1. AI in Insurance Market

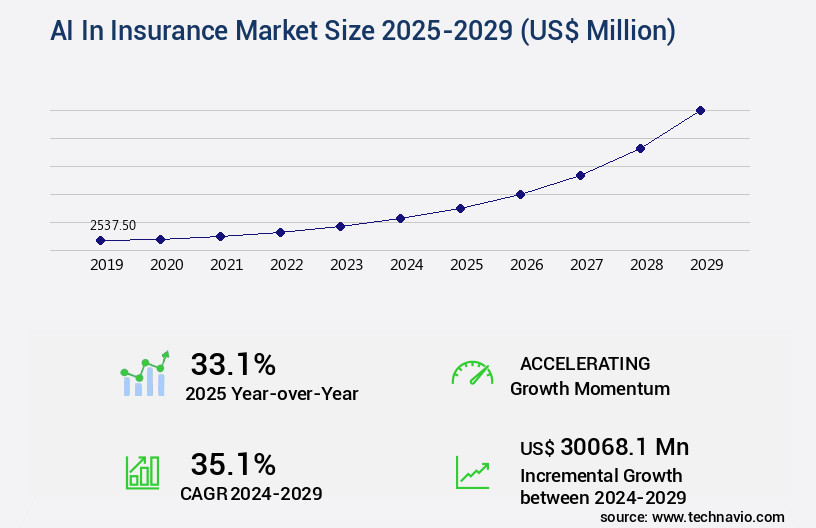

The AI in insurance market is projected to see significant growth, increasing by USD 30.07 billion and achieving a compound annual growth rate (CAGR) of 35.1% from 2024 to 2029, primarily driven by the need for operational efficiency and cost reduction. North America is expected to dominate the market, accounting for 45% of the growth during this period. In 2023, the cloud deployment segment was valued at USD 1.42 billion, while the machine learning technology segment held the largest revenue share. Looking forward, the market’s future opportunities are estimated at USD 30,068.10 million for 2024, highlighting its expansive potential.

2. The Traditional Claims Process: Why Manual No Longer Works

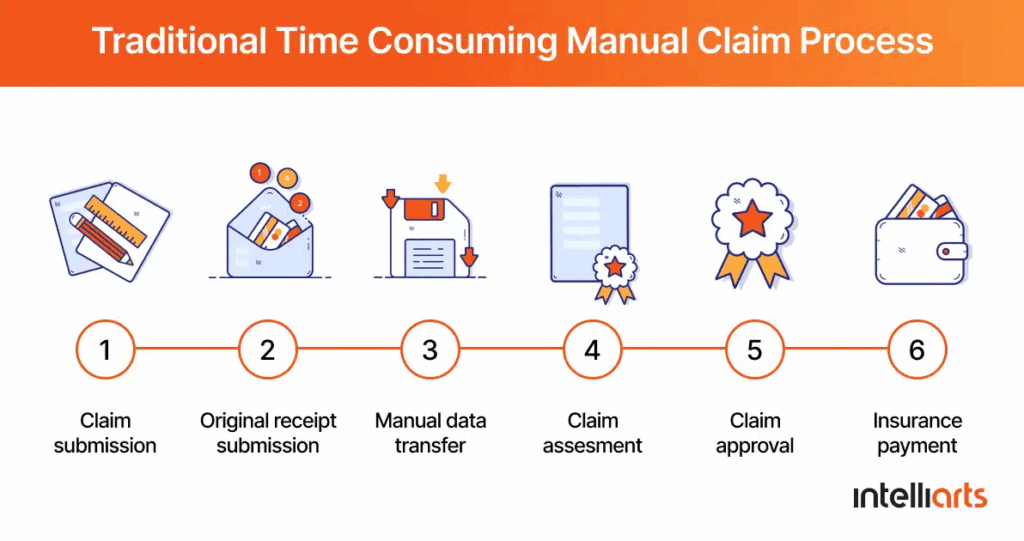

Historically, insurance claims followed a linear and manual workflow. A customer submits a claim, documents are collected, adjusters review evidence, assess damage, investigate potential fraud, and finally approve or reject the claim. Each step relies heavily on human judgment, repetitive data entry, and siloed systems. This model exhibits several structural limitations that hinder its efficiency and effectiveness. Long processing times are often attributed to manual reviews, leading to increased operational costs driven by labor-intensive tasks.

Additionally, inconsistent decision-making among adjusters can create disparities in outcomes, while limited cross-case visibility elevates the risk of fraud. These factors contribute to poor customer satisfaction, as clients face delays and a lack of transparency in the claims process, ultimately undermining trust in the system. As claim volumes increase and customer expectations shift toward real time digital experiences, these inefficiencies become unsustainable. This is the environment in which AI in insurance becomes not just valuable, but necessary.

3. From Automation to Intelligence: A Critical Distinction

Many insurers begin their transformation journey by introducing basic automation such as rule based workflows or robotic process automation. While these tools reduce manual effort, they do not fundamentally change how decisions are made. AI in insurance claims goes further by introducing learning, reasoning, and predictive capabilities. Intelligent systems do not simply follow predefined rules. They analyze patterns, adapt over time, and support nuanced decision making under uncertainty.

The evolution of processes typically follows three distinct stages: first, digitization, which involves converting paper-based procedures into digital workflows, streamlining accessibility and efficiency. Next is automation, where rules and scripts are employed to minimize repetitive tasks, further enhancing operational speed. The most profound transformation occurs in the intelligent automation stage, where technologies such as machine learning, natural language processing, and computer vision are leveraged to augment or even replace human judgment. It is at this third stage that AI becomes fully integrated across the entire claims lifecycle, driving significant improvements in decision-making and operational effectiveness.

4. Intelligent Claims Intake and Triage

The first point of impact for AI in insurance claims is intake and triage. Traditionally, claims intake requires manual form filling and call center interaction. AI enables a far more dynamic approach. Using natural language processing, insurers can accept claims through multiple channels including chatbots, mobile apps, email, and voice. These systems can extract key information such as policy numbers, incident descriptions, and supporting evidence automatically.

Machine learning models then classify and triage claims based on complexity, severity, and risk. Straightforward claims can be routed for instant or near instant settlement, while complex or suspicious cases are escalated to human adjusters. The result is faster response times, reduced backlogs, and a more personalized customer experience from the very first interaction.

5. Top Use Cases for AI in Insurance

5.1 Automated Damage Assessment With Computer Vision

One of the most prominent applications of AI in the insurance sector is automated damage assessment, particularly in motor, property, and travel insurance, where visual evidence is crucial for claims decisions. Computer vision models are utilized to analyze images and videos submitted by customers, allowing for efficient evaluation of damage severity, identification of affected components, and estimation of repair costs.

For instance, vehicle damage can be assessed through photos submitted via a mobile app, while property damage from floods or fires can be evaluated remotely. In travel insurance, claims related to baggage damage or loss can also be validated using visual evidence. These automated systems are trained on extensive datasets of historical claims and continuously improve their accuracy over time. Although human oversight is necessary for handling edge cases, automated assessment significantly accelerates processing times and reduces subjectivity in decision-making.

5.2 Fraud Detection and Risk Scoring

Fraud is one of the most costly challenges in insurance claims. Traditional fraud detection relies on manual investigation and static rules, which often identify issues only after losses occur. AI in insurance enables proactive and adaptive fraud detection. Machine learning models analyze patterns across claims, policies, customer behavior, and external data sources to generate dynamic risk scores.

Key capabilities of AI in fraud detection within insurance include the ability to identify anomalous claim patterns in real-time, detect inconsistencies across documents and narratives, and cross-reference claims against known fraud networks. Additionally, these systems continuously learn from confirmed fraud cases, enhancing their accuracy over time. Rather than treating fraud detection as a separate process, AI seamlessly integrates it into claims workflows, effectively balancing operational speed with risk control. This integration ensures that potential fraud is flagged swiftly without disrupting the overall efficiency of the claims process.

5.3 Decision Support for Claims Adjusters

Despite the advances in automation, human expertise continues to be vital in claims management. The role of AI in insurance is not to completely replace adjusters but to enhance their decision-making capabilities. AI-powered decision support tools equip adjusters with valuable resources, such as recommended settlement amounts derived from historical outcomes, assistance in policy interpretation through language models, and contextual insights based on similar past cases. Moreover, these tools provide alerts for potential compliance or fairness issues, ensuring that adjusters are well-informed as they navigate complex cases.

By alleviating cognitive load and presenting structured insights, AI enables adjusters to concentrate on the more nuanced aspects of their roles, including complex judgment calls, negotiations, and customer communication. This shift not only increases the efficiency of the claims process but also enhances the quality of interactions with clients, allowing adjusters to devote more time to resolving intricate issues rather than getting bogged down by administrative tasks. As a result, the integration of AI in insurance supports a more balanced approach to claims management, where human judgment and technological advancements work in tandem.

5.4 Data Integration and the Foundation of Intelligence

The effectiveness of AI in insurance claims is profoundly influenced by the quality and integration of data. Claims data frequently exists in silos, scattered across various policy systems, third-party providers, repair networks, and legacy platforms. To harness the full potential of AI, modern claims systems depend on unified data architectures that consolidate both structured and unstructured data. Additionally, they utilize real-time data ingestion pipelines and ensure secure integration with external sources, such as weather, geospatial, and repair cost databases.

Without this robust data foundation, AI in insurance models struggle to deliver consistent or explainable outcomes. Therefore, successful insurers recognize the importance of investing in data infrastructure alongside the development of algorithms. By prioritizing both aspects, they can effectively implement AI solutions that enhance decision-making, streamline processes, and ultimately improve the overall claims experience for customers.

5.5 Governance, Ethics, and Regulatory Considerations

Claims decisions directly impact customer livelihoods, making governance and fairness essential in the use of AI in insurance. To operate within strict regulatory and ethical boundaries, key considerations include model explainability to justify decisions, bias monitoring to ensure fair treatment across demographics, and human-in-the-loop controls for high-impact decisions. Auditability and traceability of automated actions are also crucial for maintaining transparency. Regulators increasingly expect insurers to demonstrate not only operational efficiency but also accountability in AI-driven claims processes, fostering trust and ensuring alignment with ethical standards and regulatory requirements.

6. The Future of Claims: From Reactive to Predictive

The future of claims in insurance is poised to evolve from a reactive approach to a predictive and preventative model, leveraging AI to anticipate risks before they manifest. Insurers are increasingly employing AI to predict the likelihood of claims based on various behavioral and environmental signals, enabling them to proactively address potential issues. For example, insurers can advise customers on steps to reduce loss exposure, such as implementing safety measures or adjusting coverage, ultimately fostering a more engaged relationship with policyholders. Additionally, the automation of micro claims settlements without customer initiation simplifies the process and enhances customer satisfaction.

As AI in insurance technologies mature, the role of claims management is set to transform from a traditional cost center into a strategic capability that simultaneously strengthens customer relationships and improves risk management. This shift allows insurers to not only respond to claims efficiently but also to cultivate proactive risk mitigation strategies, thereby enhancing overall customer trust and loyalty. By adopting a predictive lens, insurers can offer tailored solutions that align with individual customer needs and preferences, reinforcing their value proposition in an increasingly competitive market.

What we are look for ahead?

AI in insurance claims represents a fundamental transformation from manual processing to automated intelligence. This shift is not merely about efficiency, but about reimagining how insurers deliver trust, fairness, and value at scale. Organizations that invest thoughtfully in intelligent claims systems will be better positioned to meet rising expectations, manage risk effectively, and compete in an increasingly digital insurance landscape.

The journey requires more than technology. It demands strong data foundations, clear governance, and a commitment to augmenting human expertise rather than replacing it. When executed well, AI in insurance claims becomes a powerful enabler of both operational excellence and customer confidence. At Verysell AI, we build intelligent insurance claims solutions that transform manual, fragmented workflows into end-to-end AI-driven claims intelligence, enabling insurers to process claims faster, detect fraud earlier, and deliver transparent, customer-centric experiences at scale.