Multi-agent workflows represent a decisive shift in how banks, financial institutions, and insurance providers design, deploy, and scale automation. Rather than relying on a single monolithic system or a linear rules engine, this approach distributes intelligence across multiple specialized agents that collaborate toward shared objectives. For the BFSI sector, where complexity, regulation, and risk intersect daily, this architectural shift marks a fundamental step forward in achieving true autonomous operations. This article examines why multi-agent workflows are emerging as the next phase of automation in BFSI, how they differ from traditional automation and single-agent AI, and what strategic, operational, and governance implications they introduce.

>> Read post about 5 step-by-step impressive guide to implement!

1. Why BFSI Automation Has Reached a Structural Limit

For decades, BFSI automation has evolved incrementally. Institutions moved from manual processing to rule-based systems, then to robotic process automation, and later to machine learning models embedded within workflows. Each step improved efficiency, but each also exposed new constraints.

Traditional automation often struggles in environments characterized by interdependent decision-making across departments, where the context can shift dynamically in response to market trends, customer demands, or regulatory changes. In such settings, the frequency of exceptions complicates automation efforts, as they are no longer rare occurrences but rather a common aspect of operations. Additionally, the need for risk assessment in these environments presents a challenge, as organizations must find a balance between the speed of decision-making and the necessity for explainability, ensuring that automated processes remain transparent and comprehensible while still being adaptable to rapidly changing circumstances.

Single-agent AI systems, while powerful, still operate as centralized decision-makers. They analyze inputs, generate outputs, and trigger actions. However, BFSI processes rarely conform to a single perspective. A credit decision, for example, is simultaneously a financial, regulatory, fraud, and customer experience problem. Expecting one model or workflow to optimally resolve all dimensions introduces fragility and limits scalability. Multi-agent workflows address this limitation by design.

2. What Multi-Agent Workflows Actually Mean in BFSI Contexts

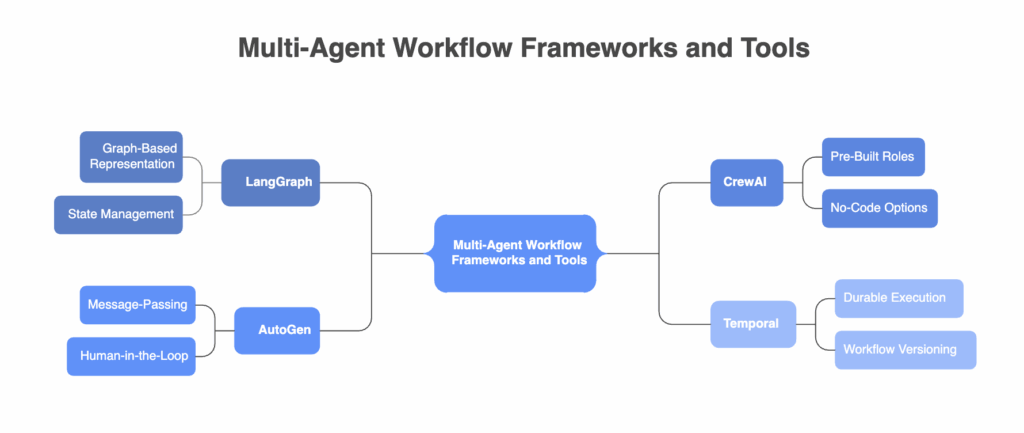

A multi-agent workflow consists of multiple autonomous or semi-autonomous agents, each with a defined role, objective, and scope of authority. These agents communicate, negotiate, validate, and coordinate actions to complete complex tasks. In a BFSI environment, agents can serve multiple essential functions, including risk assessment to identify and mitigate potential financial threats, and fraud detection mechanisms to uncover and prevent fraudulent activities. They also play a crucial role in compliance validation, ensuring that all operations adhere to regulatory standards.

Additionally, agents can enhance customer interaction and personalization by providing tailored services based on individual needs. They support operations and settlement logic to streamline transactions, and implement monitoring and escalation controls to address and escalate issues as they arise, ensuring smooth and efficient operations within the sector. Each agent operates with its own models, rules, and data access, while contributing to a shared workflow goal. Instead of a single linear process, the system behaves more like a coordinated organization of digital specialists. This mirrors how human financial institutions already operate, but with machine-speed execution and continuous learning.

3. From Linear Automation to Collaborative Intelligence

The critical distinction between legacy automation and multi-agent workflows lies in collaboration. Traditional automation workflows follow predefined paths. Even when AI is embedded, it typically serves as a decision node within a fixed sequence. If conditions deviate from expectations, human intervention is required.

Multi-agent workflows are adaptive. Agents can:

- Challenge or validate each other’s outputs

- Request additional data when confidence thresholds are not met

- Escalate decisions selectively rather than by default

- Re-route workflows based on real-time risk or policy changes

For example, in transaction monitoring, a fraud agent may flag an anomaly, while a compliance multi-agent workflows evaluate regulatory exposure, and a customer context agent assesses behavioral history. The final action emerges from consensus logic rather than a single score. This reduces false positives, improves resilience, and supports continuous optimization.

4. Core BFSI Use Cases Accelerated by Multi-Agent Workflows

Credit and Lending Decisions: Multi-agent workflows facilitate the parallel evaluation of various factors influencing creditworthiness, affordability, fraud risk, and regulatory compliance. Each agent independently assesses its specific domain, subsequently converging to reach a final decision supported by transparent justifications. This structure enhances the reliability of lending decisions, allowing institutions to better manage risk while ensuring clarity in the decision-making process.

Fraud Detection and Prevention: In the realm of fraud detection, multiple agents work collaboratively to monitor transaction patterns, device signals, geolocation data, and behavioral biometrics, moving beyond static thresholds. This coordinated approach enables faster and more nuanced detection of potential fraudulent activities without imposing excessive friction on the customer experience. By sharing insights, these agents facilitate quicker responses to anomalies, ensuring effective prevention strategies.

Customer Service and Advisory: Customer-facing agents adeptly handle inquiries while backend agents manage eligibility verification, policy constraints, and relevant historical context. This separation not only enhances the quality of customer responses but also helps reduce the volume of escalations to higher support tiers. By creating a streamlined flow of information between agents, organizations can provide timely and accurate service, improving overall customer satisfaction.

Claims and Insurance Processing: In claims processing, multi-agent systems can streamline tasks such as claims validation, document analysis, policy interpretation, and fraud screening, operating in an organized and coordinated manner. This collective effort significantly reduces settlement times while ensuring that all processes remain auditable and compliant. By integrating various functions into a multi-agent framework, insurers can enhance efficiency and responsiveness at critical junctions.

Regulatory Reporting and Monitoring: Compliance agents continuously interpret evolving regulations, ensuring organizations remain abreast of legal requirements. Meanwhile, data agents compile and prepare accurate reports, while operational agents enforce necessary policy changes without the need for extensive system rewrites. This dynamic structure allows institutions to adapt to regulatory shifts quickly, maintaining compliance with minimal disruption to everyday operations.

5. Governance and Control in Multi-Agent BFSI Systems

One of the primary concerns in BFSI automation is governance, as multi-agent systems must not introduce opacity or uncontrolled autonomy. Well-designed multi-agent workflows incorporate clearly bounded agent responsibilities, ensuring that each agent operates within defined parameters. They establish hierarchical decision rights for high-risk actions to maintain oversight and control. Additionally, these systems prioritize logging and traceability of agent interactions, allowing for a comprehensive audit trail.

Policy-driven overrides and human-in-the-loop checkpoints further enhance governance, ensuring that critical decisions involve human oversight. Rather than diminishing control, this architecture often increases it by decomposing decisions into explainable components, each traceable to a specific agent and rule set. This approach aligns closely with regulatory expectations regarding accountability and transparency, fostering trust and compliance in automated processes within the BFSI sector.

6. Risk Management and Resilience Benefits

From a risk perspective, multi-agent workflows provide significant structural advantages by mitigating the impacts of single-agent failures, which can rapidly propagate through centralized systems. In contrast, distributed agents create natural containment, where if one agent generates anomalous outputs, others can detect inconsistencies and halt execution effectively. This design supports crucial elements such as fault isolation, where the effects of a failure are contained, and redundancy in critical decisions, ensuring that alternative agents can step in as needed.

Moreover, it facilitates graceful degradation, allowing operations to continue functioning under reduced capacity rather than resulting in systemic failure. In volatile markets or during regulatory changes, the ability to update agents independently enables institutions to adapt swiftly without requiring full system downtime, thus enhancing both resilience and agility in response to shifting conditions.

7. Strategic Implications for BFSI Leaders

Adopting multi-agent workflows represents more than just a technical upgrade; it necessitates a fundamental shift in how BFSI leaders conceptualize automation strategy. Key strategic considerations involve moving from a focus on task automation to decision orchestration, which emphasizes the coordination of multiple agents to enhance decision-making. Additionally, investing in modular AI capabilities rather than relying on monolithic platforms allows organizations to remain agile and adaptable.

It is also crucial to align organizational governance models with the evolving roles of digital agents, ensuring that oversight frameworks can effectively manage automated processes. Preparing talent to manage, supervise, and audit AI-driven workflows is vital for fostering a culture of accountability. Institutions that treat multi-agent systems as isolated experiments risk fragmentation and inefficiencies, while those that integrate them into their core operating models stand to gain compounding advantages in speed, compliance, and customer trust, ultimately enhancing their competitive edge in the market.

8. Challenges and Realistic Adoption Pathways

Despite their potential, multi-agent workflows are not a universal solution and come with several challenges. These include increased architectural complexity, which can complicate system design and maintenance, alongside a higher upfront design and integration effort necessary to establish effective multi-agent systems. Additionally, a mature data foundation is critical, as accurate and consistent data is essential for agents to function optimally.

Cultural resistance to distributed decision-making can also pose significant hurdles, as organizations may struggle to shift from traditional automation and centralized decision-making processes. A pragmatic adoption path typically begins with bounded domains, such as fraud triage or customer service augmentation, before expanding into core financial decision-making. To ensure sustainable success, incremental deployment is key, paired with strong governance frameworks and close collaboration between business, risk, and technology teams, fostering a holistic approach to integration and operation.

9. The Future of BFSI Automation Is Coordinated, Not Centralized

As BFSI institutions face rising expectations around speed, personalization, and compliance, automation must evolve beyond isolated intelligence. Multi-agent workflows provide a structural answer to this challenge. By distributing intelligence, enabling collaboration, and embedding governance at the architectural level, they allow financial institutions to scale automation without sacrificing control or trust. The next generation of BFSI automation will not be defined by a single model or platform. It will be defined by how effectively multiple intelligent agents work together, much like the institutions they are designed to serve.