Artificial intelligence (AI) has become a defining force in reshaping industries across the globe, and finance is no exception. In particular, Generative AI is a subset of artificial intelligence that can create new content, insights, and predictions from existing data. It holds significant promise for finance professionals. By augmenting decision-making, automating complex tasks, and uncovering hidden patterns, generative AI has the potential to transform how financial institutions and professionals operate. This article explores how this technology is helping finance experts and why it is increasingly central to the future of financial services.

What is Generative AI?

Generative AI refers to models, such as large language models (LLMs) and generative adversarial networks (GANs), trained to produce new data outputs based on patterns in existing datasets. Unlike traditional AI tools that mainly classify or predict, generative AI creates new outputs ranging from financial reports to risk models based on its training.

For finance professionals, this capability translates into tools that can:

- Generate financial forecasts and scenarios.

- Automate the drafting of reports or client communications.

- Simulate market behaviors to assist with strategy development.

Key Areas Where Generative AI Supports Finance Professionals

1. Automating Financial Reporting

Financial reporting is a time-consuming process, often involving detailed analysis of vast datasets. Generative AI can automate much of this process by producing draft reports, summarizing earnings results, or explaining market trends in plain language. This not only saves time but also reduces the potential for human error.

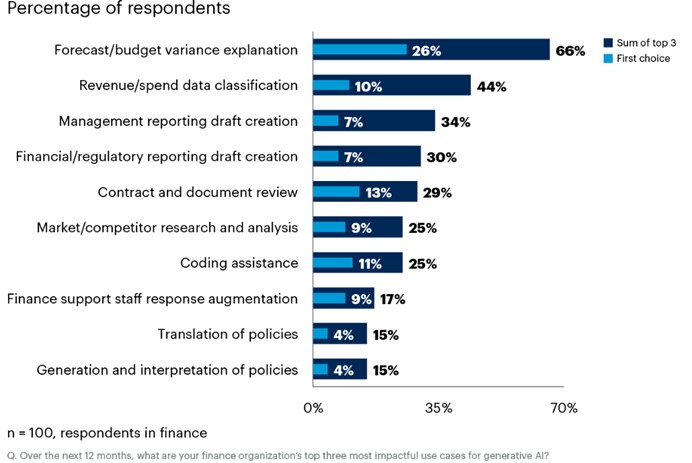

A Gartner survey in 2024 found that 66% of finance leaders believe generative AI will have the most immediate impact on explaining forecast and budget variances. This suggests automation of narrative and variance reporting is seen as very valuable.

For example, it can analyze quarterly earnings and automatically draft an executive summary for clients or regulators. Finance professionals can then review and refine the draft, ensuring efficiency without sacrificing accuracy.

2. Enhancing Risk Management

According to Haosen Xu (2024), AI‐powered credit risk models show about 20% increase in predictive accuracy compared to traditional methods; for market risk, anomaly detection improves in speed and precision by around 30%.

Risk management is at the heart of financial decision-making. Generative AI enables professionals to run advanced scenario simulations, stress tests, and predictive models. By generating potential outcomes based on historical and real-time data, these tools help financial institutions prepare for different risk scenarios.

This application is particularly important in areas such as credit risk assessment, fraud detection, and compliance. Generating synthetic datasets to simulate rare but impactful events allows firms to test resilience in ways that traditional models might miss.

3. Improving Customer Experience

Client relationships are central to finance, whether in wealth management, retail banking, or investment services. Generative AI can personalize customer interactions by producing tailored insights, portfolio updates, or responses to inquiries. This allows finance professionals to offer a higher level of service without being overwhelmed by repetitive tasks.

For instance, a wealth manager might use AI to create customized financial strategies for clients based on their goals, risk tolerance, and market conditions. This personalization improves trust and engagement, strengthening long-term client relationships.

4. Supporting Regulatory Compliance

Regulatory compliance requires strict adherence to reporting standards and evolving policies. Generative AI assists by generating accurate reports, highlighting compliance risks, and automating documentation. Finance professionals can leverage these tools to reduce the burden of manual compliance tasks while maintaining high levels of accuracy.

In addition, it can analyze new regulations and provide teams with summaries and action items, ensuring organizations remain aligned with the latest standards.

5. Driving Data-Driven Decision Making

Generative AI enhances decision-making by producing actionable insights from large, complex datasets. Instead of manually sifting through endless spreadsheets or market analyses, professionals can rely on AI to extract trends, identify anomalies, and even propose strategies.

This application is particularly powerful in investment research. Generative AI can generate investment theses by analyzing historical market data, news sentiment, and macroeconomic indicators. Professionals can then evaluate these insights against their expertise, improving both speed and accuracy.

6. Streamlining Client Advisory Services

Advisory services are becoming more complex as clients demand personalized and immediate solutions. Generative AI can power advisory platforms that provide real-time recommendations, create detailed financial plans, and deliver AI-powered decision-making support. This makes finance professionals more effective in guiding their clients with evidence-based insights.

While precise large-scale statistics specific to advisory services are less common, the general trend toward increasing investment in generative AI shows that 67% of leaders globally are increasing investment, citing productivity, cost reduction, and customer relationship enhancement among the top benefits (Deloitte). Also, firms using AI for customer experience tools (chatbots, virtual assistants) often find that personalization and quicker responses can lead to higher trust and client retention, which are key to advisory relationships.

7. Unlocking Innovation in Financial Products

Generative AI is driving innovation by helping financial institutions design new investment products and strategies. By simulating different market conditions and customer behaviors, AI-powered finance tools can test product viability and enhance competitiveness in rapidly changing markets. Evidence from Statista shows that generative AI in finance represents a “substantial economic opportunity,” with analysis indicating a total addressable opportunity equal to 10.6% of EBITDA and an opportunity in salary cost savings of 22.5% as AI adoption matures.

Benefits of Generative AI in Finance

The integration of this technology in finance offers several core benefits:

- Efficiency: Automates repetitive processes such as reporting, compliance checks, and client updates.

- Accuracy: Reduces human error in financial forecasting and analysis.

- Scalability: Enables professionals to manage more clients and more complex datasets without additional resources.

- Innovation: Supports new financial models, strategies, and investment scenarios.

- Resilience: Improves risk management through predictive modeling and synthetic data generation.

Challenges: Ethical Considerations

While the benefits are substantial, finance professionals must also navigate challenges:

- Data Quality: AI models are only as strong as the data they are trained on. Poor data quality can lead to misleading outputs.

- Transparency: Many systems act as “black boxes,” making it difficult to understand how specific conclusions are reached.

- Bias: Training data may contain biases that propagate into outputs, potentially influencing financial decisions unfairly.

- Regulatory Scrutiny: As AI becomes more integral in finance, regulators will likely impose stricter standards to ensure accountability and fairness.

Future Outlook: AI-Powered Finance

The future of AI-powered finance will likely involve deeper integration of generative models into daily workflows. Over time, we may see:

- Fully automated reporting pipelines.

- AI-driven investment advisory platforms.

- Real-time compliance monitoring powered by AI.

- Enhanced fraud detection using synthetic data simulations.

Generative AI is already reshaping the BFSI industry. From automating reporting and compliance to improving risk management and client engagement, its applications are wide-ranging and transformative. While challenges remain, particularly around transparency and ethics, the potential to empower finance professionals is clear.

As financial services continue to evolve, embracing these tools will be critical for professionals seeking to remain competitive and innovative. In the coming years, Generative AI in Finance and AI-powered decision-making will be central themes driving the growth and resilience of the sector.

At Verysell AI, we help finance professionals and organizations unlock smarter decision-making, streamline operations, and stay ahead of industry change with AI-driven solutions. Connect with us today and see how Generative AI can transform for business and the way you work.