Fintech and AI are transforming the financial landscape by merging technological innovation with data-driven intelligence. Artificial intelligence enhances financial technology through automation, predictive analytics, and personalized services, enabling faster decision-making, improved fraud detection, and more efficient customer engagement.

From algorithmic trading and credit scoring to digital banking and robo-advisory platforms, AI empowers fintech firms to deliver smarter, more secure, and accessible financial solutions. This synergy is not only reshaping how businesses operate but also redefining the customer experience in the digital economy. This blog post explores how AI is transforming FinTech, from wealth management to predictive analytics the market and from opportunities to threats.

>> Read more to identify 5 best transformative of AI Innovations in the financial services

1. Fintech and AI Market

The global fintech market is growing rapidly: in 2024 it was valued at around USD 218.8 billion, and it is projected to reach approximately USD 828.4 billion by 2033, implying a compound annual growth rate (CAGR) of about 15.8% from 2025 to 2033 (IMARC Group, 2024). Other estimates show the market reaching over USD 1 trillion by the early 2030s, underlining the major scope for technology-driven disruption in financial services (Digital Silk, 2025)

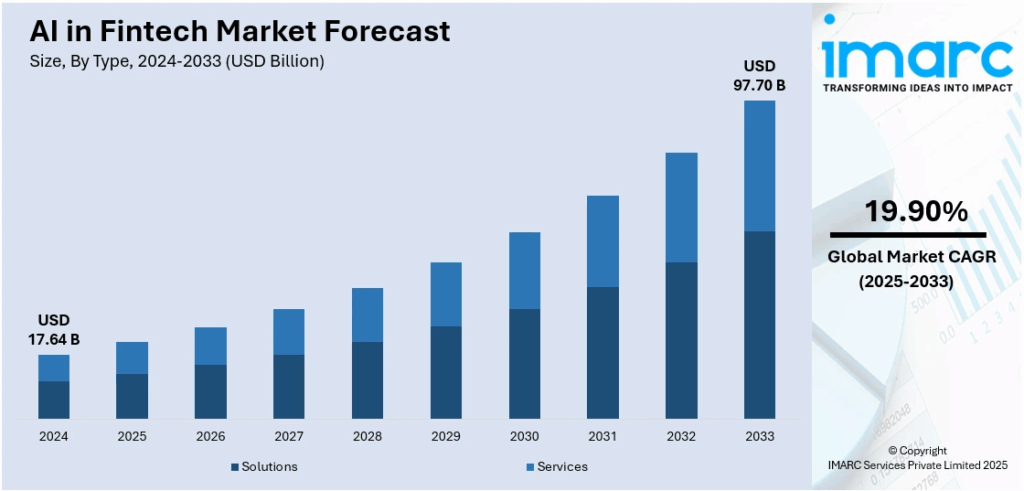

Within that broad fintech space, the sub-market of artificial intelligence in fintech is also showing strong growth. For example, one estimate places the AI-in-fintech market at about USD 17.6 billion in 2024, with projections to reach almost USD 97.7 billion by 2033, corresponding to a CAGR of about 19.9%. Another view estimates the market at around USD 22.5 billion in 2023 and forecast to be USD 79.4 billion by 2030, which gives a CAGR of roughly 19.8%.

2. Top Priority Use Cases

2.1 Credit Risk and Underwriting

AI-driven credit risk and underwriting models leverage machine learning and alternative data such as transaction patterns, utility payments, and behavioral signals to assess borrowers more accurately than traditional scorecards (Faheem, 2021). This allows lenders to extend credit to previously underserved customers while maintaining prudent risk levels. Automated underwriting systems reduce decision time from days to minutes, improving both customer experience and portfolio performance.

2.2 Fraud Detection and Transaction Monitoring

By applying real-time anomaly detection and graph-based analytics, AI enables early identification of suspicious activities across payment networks (SmartDev, 2024). Machine learning continuously refines detection thresholds to minimize false positives and maximize fraud detection and prevention efficiency. This capability significantly reduces financial losses and enhances consumer trust in digital payments.

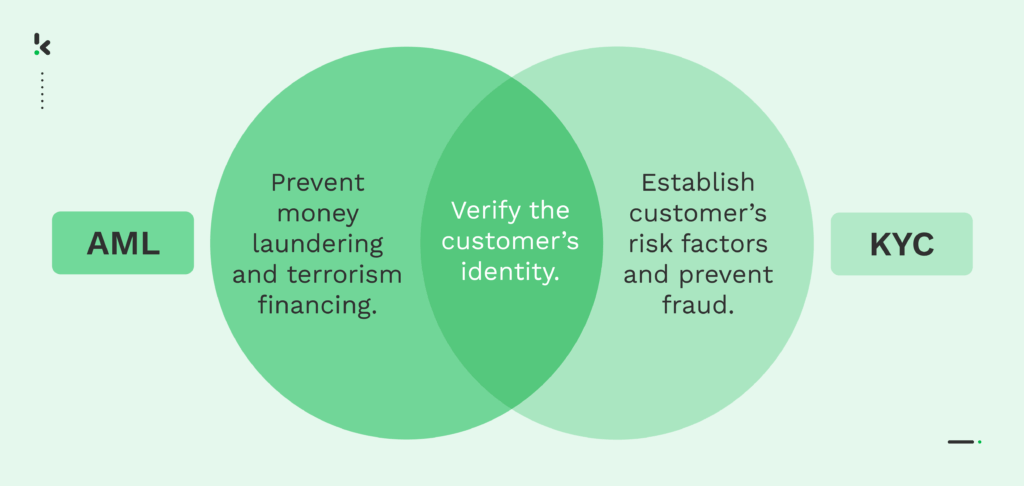

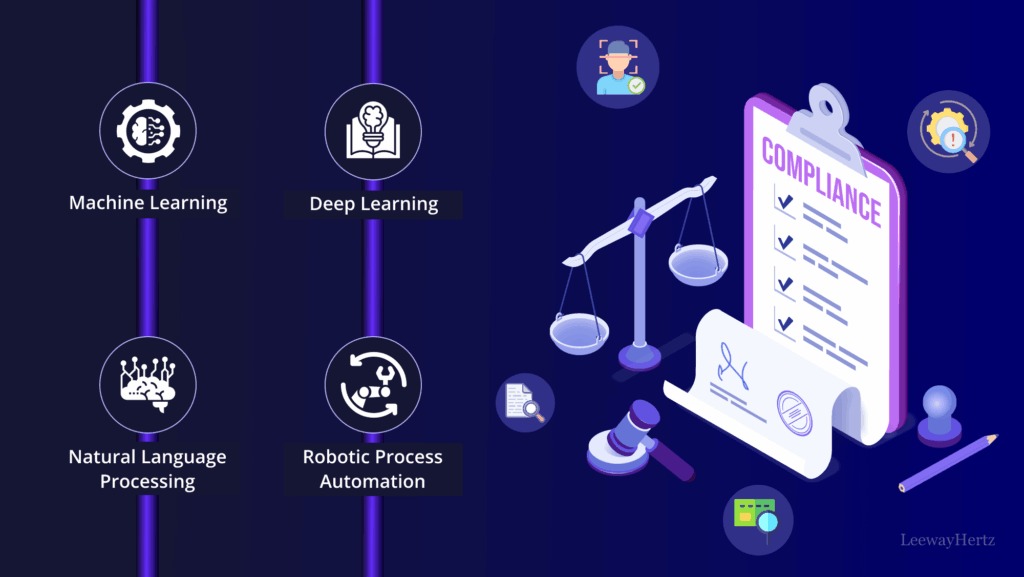

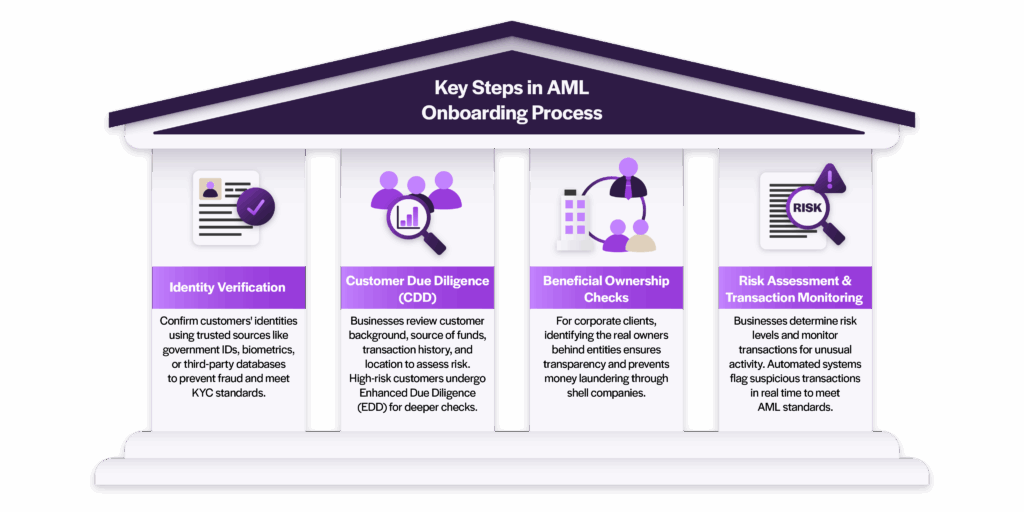

2.3 KYC, KYB, and AML Compliance

AI streamlines onboarding and compliance through intelligent document verification, natural language processing (NLP) for identity extraction, and network analytics for suspicious activity detection (Pingili, 2025). These tools accelerate Know-Your-Customer (KYC) and Anti-Money-Laundering (AML) processes, cutting manual review times and operational costs. Enhanced accuracy and automated reporting also ensure stronger regulatory compliance.

2.4 Personalized Services and Dynamic Pricing

AI models analyze spending behavior, income levels, and contextual data to deliver individualized product recommendations and adaptive pricing (Mattan, 2025). This data-driven personalization enhances customer engagement and lifetime value. Financial institutions benefit from improved conversion rates, reduced churn, and more targeted marketing campaigns (Olalekan, 2021).

3. AI and Fintech Benefits

An EY expert believed that AI adoption in fintech generates significant revenue and risk management advantages (Chlouverakis, 2024). By leveraging data-driven insights, financial institutions can approve more applications while maintaining prudent credit standards, resulting in higher conversion rates and portfolio growth. Advanced personalization engines enable hyper-targeted cross-selling, dynamic pricing, and predictive analytics offers that maximize customer lifetime value (Fiedler et al., 2025). At the same time, intelligent fraud detection and anomaly monitoring systems reduce losses, strengthen trust, and enhance regulatory compliance across digital transactions. Collectively, these capabilities elevate both top-line performance and operational security.

On the efficiency and scalability front, AI automates repetitive manual reviews and accelerates decision-making from hours to seconds, enabling organizations to process larger volumes without increasing costs (Kassa and Worku, 2025). Cloud-native models and continuous learning systems ensure resilience and adaptability as customer behaviors or market conditions evolve. Customers benefit from seamless onboarding, personalized services, and 24/7 intelligent support that boosts satisfaction and loyalty. The result is a financial ecosystem that is faster, smarter, and more responsive with the capable of scaling sustainably in a competitive, data-driven economy.

4. AI and Fintech Challenges

Fintech organizations adopting AI face multiple implementation and governance challenges, beginning with data quality and accessibility (Saiyed, 2025). Financial data often exists in silos and may carry biases that compromise model accuracy and fairness. To mitigate this, firms are investing in standardized data contracts, lineage tracking, and automated bias detection to ensure consistent, reliable training inputs. The development of centralized feature stores further enhances transparency and reusability across AI projects.

Another critical concern involves model explainability and regulatory compliance. Many AI systems operate as “black boxes,” making it difficult for financial institutions to justify automated decisions in highly regulated domains such as credit and lending (Anang, 2024). To address this, organizations are adopting interpretable models, post-hoc explanation techniques like SHAP, and robust model risk management frameworks. Simultaneously, compliance obligations around KYC, AML, and data privacy are managed through policy-as-code, privacy-enhancing technologies, and immutable audit trails.

Operational scalability and governance present additional hurdles, particularly as AI moves from pilots to production. Continuous monitoring is essential to detect model drift, the gradual loss of predictive analytics as data patterns evolve. MLOps pipelines, supported by CI/CD automation, model registries, and rollback mechanisms, enable stable deployment and ongoing supervision. Complementing these technical measures, fintechs must also reinforce security and talent readiness, adopting zero-trust architectures, red-teaming for LLMs, and comprehensive upskilling programs to foster responsible, organization-wide fintech and AI adoption.

5. Compared Traditional Fintech vs. AI-Powered Fintech

In traditional fintech systems, credit and fraud detection rely heavily on static scorecards and heuristic rule sets, which are updated periodically based on historical data and expert judgment (Dastidar et al., 2024). While this approach offers regulatory predictability, it lacks flexibility and cannot quickly adapt to emerging fraud schemes or behavioral shifts in borrower patterns. In contrast, AI-powered fintech leverages machine learning models that continuously learn from real-time data. These models detect complex anomalies, network-based fraud rings, and evolving risk signals, allowing institutions to make faster, more accurate decisions and reduce both credit losses and false positives.

When it comes to personalization, conventional fintech typically segments customers into broad groups and delivers standardized offers with limited contextual understanding (Barbu, 2021). Such approaches often miss nuances in individual needs and timing, resulting in lower engagement and conversion rates. AI-driven systems transform personalization into a dynamic, one-to-one experience, using predictive analytics models to forecast customer intent, spending behavior, and financial goals. By applying next-best-action logic and adaptive pricing, AI ensures every interaction feels timely, relevant, and value-enhancing for the user.

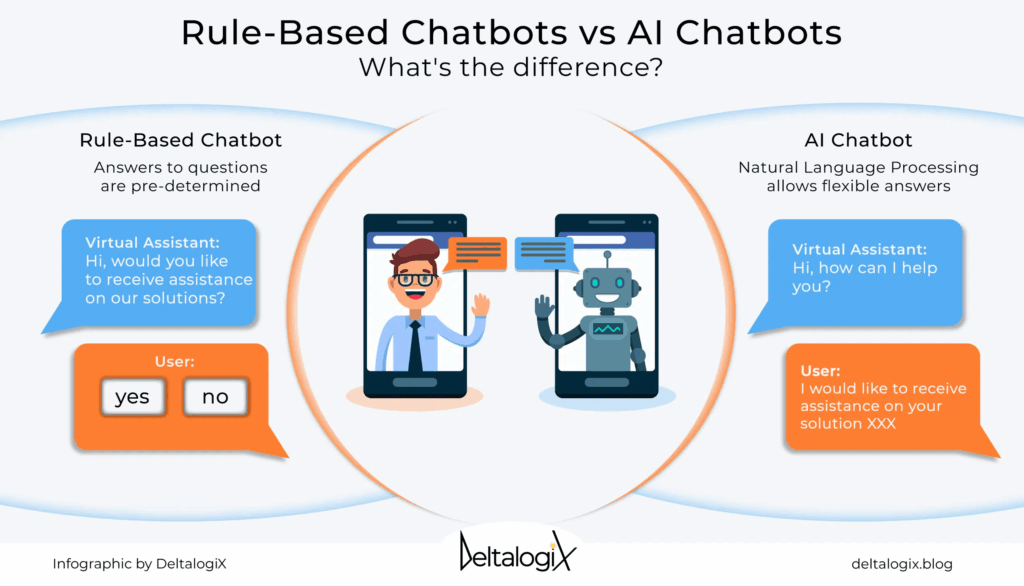

In the area of customer service, rule-based chatbots and IVR systems dominate traditional fintech, offering scripted and menu-driven interactions that often require human escalation for complex cases (Singh, 2022). This rigid structure limits service quality and responsiveness. Conversely, AI-powered fintech utilizes large language models (LLMs) enhanced with retrieval-augmented generation (RAG) to understand user intent, context, and sentiment (Chidipothu, 2025). The result is an intelligent assistant capable of providing instant, human-like support, improving first-contact resolution rates, and delivering a seamless 24/7 customer experience.

Finally, onboarding, compliance, and AML processes in traditional fintech remain highly manual, involving repetitive document verification and basic rule triggers for suspicious activity (Struk, 2025). These methods can be slow, error-prone, and burdened by excessive false positives. AI reshapes this workflow through document intelligence for automatic data extraction, entity resolution for accurate identity linkage, and graph machine learning for detecting intricate AML patterns. The outcome is a faster, more precise onboarding process, sharper compliance reporting, and a substantial reduction in operational risk.

Conclusion

In conclusion, the convergence of fintech and artificial intelligence marks a pivotal transformation in how financial services operate, shifting from rigid, rule-based systems to intelligent, adaptive, and data-driven ecosystems. Verysell AI stands at the forefront of this evolution, enabling enterprises to harness AI responsibly and effectively through scalable architectures, advanced machine learning pipelines, and explainable decision frameworks. With deep expertise in large language models, data engineering, and AI governance, Verysell AI helps fintech organizations transform complexity into clarity.