Customer experience is the new competitive advantage that has become the defining factor of success in the rapidly evolving world of banking, financial services, and insurance (BFSI) (KPMG 2025). As products and prices become increasingly commoditized, what truly differentiates leading financial institutions is how seamlessly, intelligently, and personally they engage their customers.

>> Read more to explore our case study about AI chatbot for banking and finance industry!

Artificial intelligence (AI) is now at the heart of this transformation, helping organizations move beyond traditional service models toward truly predictive, personalized, and proactive engagement. In this blog post, we will analyze the top five AI use cases for the future in BFSI that are revolutionizing customer experiences, enhancing operational efficiency, improving risk management, enabling fraud detection, and driving data-driven decision-making.

1. Customer Experience From Reactive to Predictive: How AI Redefines Service

Traditional BFSI customer service has been inherently reactive. A customer encounters a problem, reaches out, and receives assistance when often after delays and friction. This reactive model is now obsolete. AI shifts the paradigm from reactive to predictive service. By analyzing behavioral data, spending patterns, and previous interactions, AI can anticipate customer needs before they arise.

We can consider these applications:

- Predictive analytics in BFSI: AI systems can predict when a customer might need a mortgage refinance or new insurance coverage and proactively reach out with relevant offers (Joni and Graepel, 2024)

- Intelligent virtual assistants: Natural Language Processing (NLP)-powered bots, such as Bank of America’s Erica or DBS’s digibank assistant, provide 24/7 conversational support, resolving 80–90% of routine inquiries instantly (Omoleye, 2020).

- Proactive fraud alerts: Machine learning models detect anomalies in real-time, alerting customers immediately when suspicious transactions occur, enhancing trust and safety simultaneously.

This shift transforms the customer journey. Instead of waiting for help, customers receive timely, context-aware solutions when often before they even realize a problem exists.

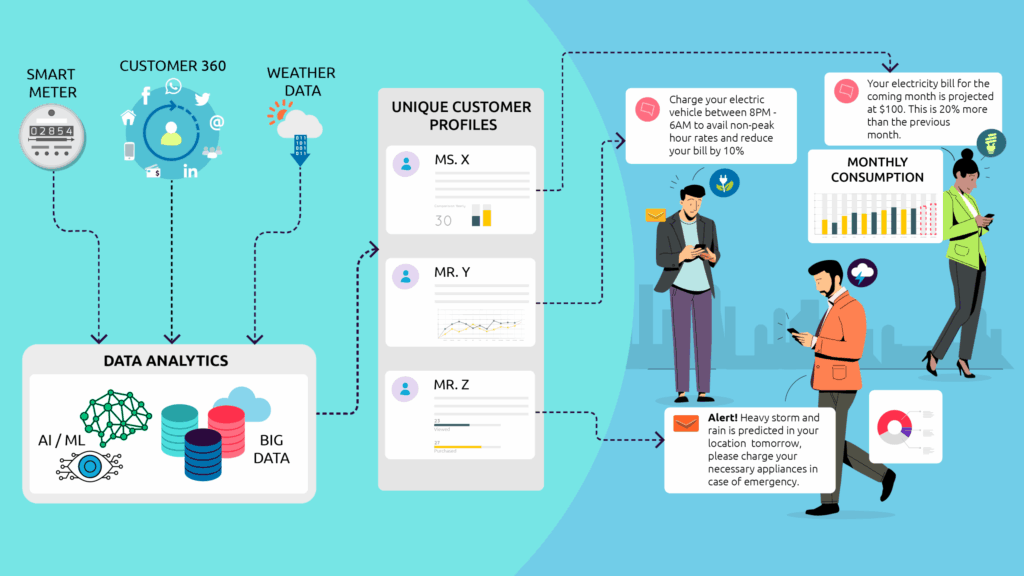

2. Hyper-Personalization at Scale: Turning Data into Insight

Personalization has always been a goal in BFSI, but AI turns it into a reality at scale. Financial institutions have access to massive datasets: transaction histories, location data, demographics, and even social sentiment. The challenge lies in transforming this raw data into actionable intelligence. AI algorithms can segment customers dynamically, predict future needs, and deliver personalized recommendations in real time.

For example:

- Banking: A customer regularly transferring funds abroad could receive personalized forex rate notifications or suggestions for an international account package.

- Insurance: AI can model life events such as the birth of a child or property purchase to recommend appropriate coverage adjustments.

- Wealth Management: AI-driven robo-advisors analyze market movements and personal risk tolerance to propose tailored investment strategies.

This level of personalization fosters deeper engagement and higher customer satisfaction. According to Renascence (2024), companies leveraging AI for personalized banking experiences have seen a 15–20% increase in customer retention and a 25% boost in cross-selling effectiveness.

3. Automation Meets Empathy: Reimagining the Service Experience

Automation often evokes concerns of impersonality, but modern AI enables what might be called “empathetic automation” (Sen, 2025). By combining automation with sentiment analysis and conversational intelligence, institutions can respond not only to what customers say, but how they feel. For instance, voice analytics can detect frustration in a customer’s tone during a support call, prompting an escalation to a human agent.

Chatbots can identify emotional cues and adjust their tone accordingly from formal precision for corporate clients to a more supportive tone for retail customers. AI doesn’t replace human empathy when it amplifies it. Routine interactions such as balance inquiries, transaction checks, or claim status updates can be automated, freeing human advisors to focus on high-value, emotional, or complex cases where human judgment matters most. This blend of speed, precision, and emotional intelligence defines the next evolution of customer service.

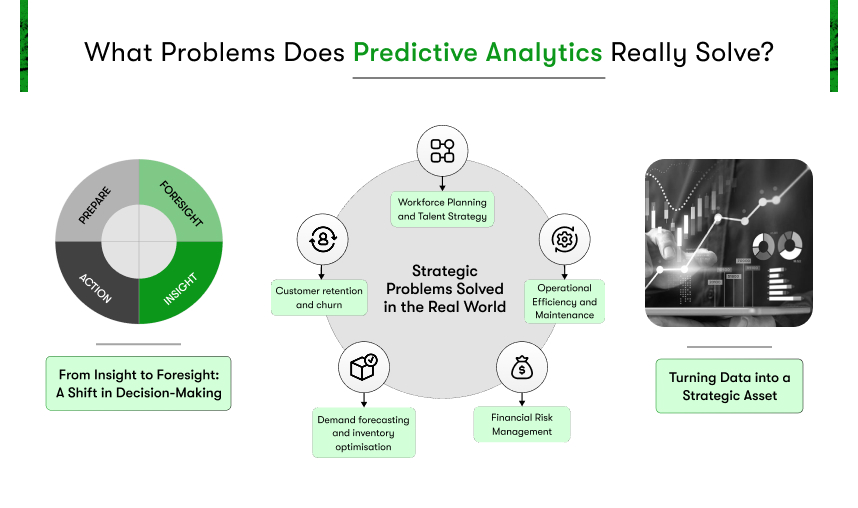

4. Predictive Analytics: From Insight to Foresight

The BFSI industry is built on managing risk and opportunity with both of which hinge on accurate forecasting. AI-powered predictive analytics revolutionizes this by enabling foresight across the customer lifecycle.

- Credit and lending: AI models assess repayment capacity not just through traditional credit scores, but by analyzing real-time income streams, transaction patterns, and behavioral signals (Nguyen and Pum, 2024).

- Customer churn prediction: By recognizing early warning signs such as declining engagement or reduced product usage when AI allows institutions to re-engage customers before they leave.

- Claims management: Insurers can use machine learning to detect fraudulent claims, streamline legitimate processing, and deliver faster settlements (Agilelab, 2025).

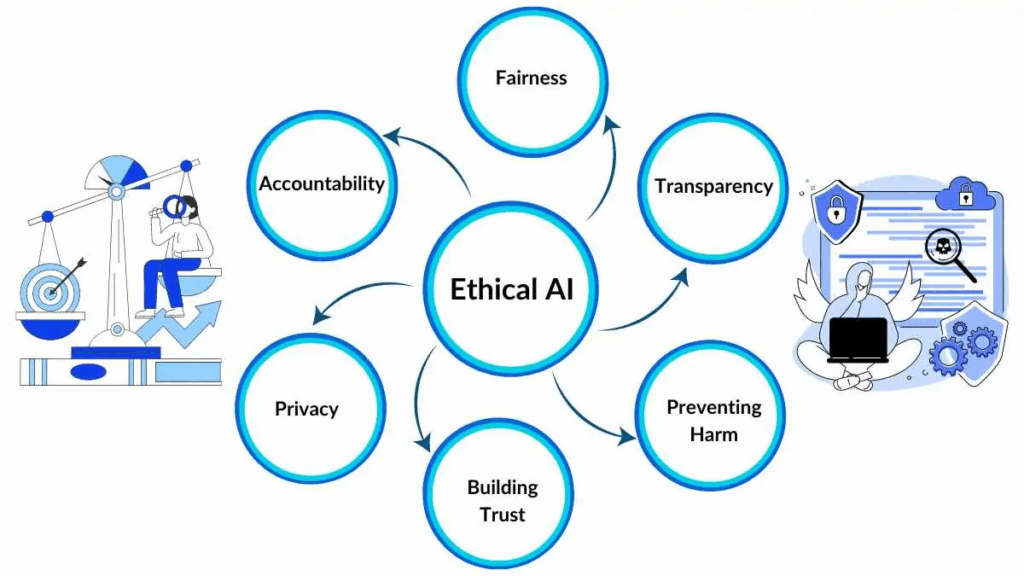

5. Security, Trust, and Transparency: The Ethical Core of AI

In BFSI, trust is the currency that underpins every transaction. Customers are rightfully concerned about how their data is used, shared, and interpreted. As AI becomes more deeply embedded in decision-making, transparency and accountability become non-negotiable.

Financial institutions must establish clear governance frameworks for AI adoption, ensuring:

- Data privacy and compliance: Adhering to frameworks like GDPR, ISO/IEC 42001, and emerging AI regulations to ensure lawful data use.

- Explainable AI (XAI): Making AI decisions interpretable. For instance, explaining why a loan was approved or denied based on quantifiable factors.

- Bias mitigation: Continuously auditing algorithms to prevent discriminatory outcomes in lending, insurance pricing, or hiring.

AI also strengthens security itself. Advanced fraud detection systems use deep learning to spot patterns invisible to traditional rule-based models, reducing false positives and protecting both institutions and customers. The balance between innovation and ethics will define which BFSI players emerge as true leaders in the AI era. Those who maintain trust through transparency will retain long-term customer loyalty.

6. The Human-AI Partnership: Complementary, Not Competitive

A common misconception is that AI will replace humans in BFSI operations. In reality, the future of customer experience depends on a synergistic partnership between AI and human expertise. Humans excel at empathy, judgment, and ethical decision-making, which areas where AI provides limited contextual understanding. Conversely, AI excels at data processing, pattern recognition, and automation.

The integration of these strengths creates a powerful dual engine:

- AI handles repetitive and data-intensive tasks, ensuring efficiency and consistency.

- Human professionals focus on advisory, relationship-building, and problem-solving with the emotional core of financial trust.

For instance, while an AI system can identify a customer at risk of financial distress, it is the human advisor who can provide reassurance, counseling, and tailored financial planning. Leaders in BFSI are already training employees to work alongside AI, developing augmented intelligence rather than replacement-driven automation.

>> Explore our exclusive AI solutions playbook for BFSI leaders here!

7. Conclusion: The AI-Driven Experience Era

The future of customer experience in BFSI is not about machines replacing humans when it is about machines empowering humans to serve customers better, faster, and more meaningfully. AI is transforming the industry from the inside out: enabling predictive insight, real-time personalization, and empathetic engagement at scale. Yet, the institutions that will truly lead this transformation are those that balance efficiency with empathy, innovation with ethics, and automation with authenticity.

In this new era, customer experience is not just a metric that is the defining strategy for differentiation, growth, and trust. The banks, insurers, and financial platforms that harness AI responsibly and humanely will not only win customer loyalty when they will define what trust in the digital age truly means. Contact us to resolve all of your business problems working by AI from today!