AI chatbots in banking are enduring a quick change. Today’s consumers expect frictionless experiences, hyper-personalized services, and quick gratification. Banks must use chatbots and financial automation to meet these rising demands. According to Kelly (2024), an overwhelming 92% of CEOs plan to increase their workforce with AI in the next three years. Moreover, generative AI has the potential to boost productivity in the banking sector by up to 5% and reduce global expenditures by as much as $300 billion (McKinsey & Company, 2023).

AI-powered banking chatbots in the financial industry are one of the latest of the technological revolution. The foundation of contemporary banking is quickly being formed by these sophisticated virtual assistants, which improve client experiences, streamline processes, and spur notable expansion.

What Are AI Chatbots in Banking?

Having a tireless personal assistant available 24/7 to handle all your banking needs, these chatbots are created to engage with customers through conversational text or voice interfaces. By utilizing AI, particularly natural language processing (NLP), these chatbots can comprehend customer inquiries, process information, and deliver intelligent responses (Giri et al., 2024). Instead of dealing with complicated menus or waiting for human support, customers can easily communicate with the chatbot to check account balances and transaction history, make payments and transfers money, reset passwords or schedule appointments with bank representatives.

10 Innovative Ways AI Chatbots in Banking Boost Customer Service

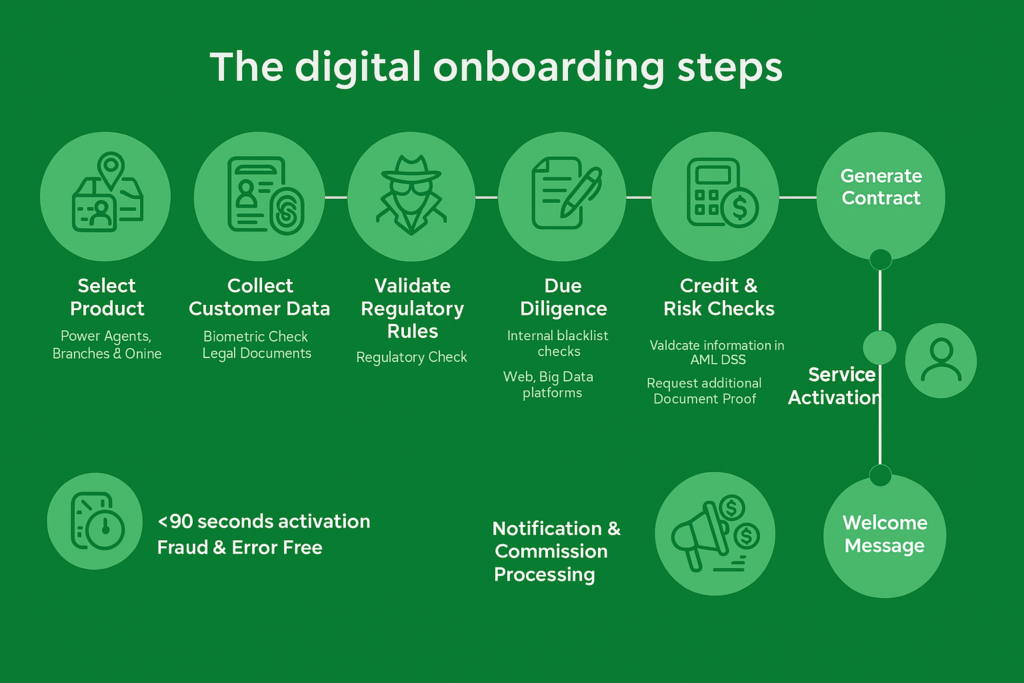

1. Streamlined Onboarding

Onboarding new customers is a critical process for banks, as it sets the tone for the entire banking relationship (Veritran, 2023). Traditional onboarding methods often involve cumbersome paperwork, lengthy forms, and time-consuming verification processes, which can lead to customer frustration and abandonment. However, AI chatbots are revolutionizing this experience by making it more efficient, engaging, and user-friendly (Uzoka et al., 2024).

- Real-time Assistance: The most significant advantage is their ability to provide immediate assistance. Customers often have questions during the onboarding process, such as clarifications on document requirements or the next steps. Chatbots respond in real-time, offering instant support and reducing the need for customers to wait for human representatives. This enhances user satisfaction and keeps the onboarding momentum going.

- Document Verification: AI chatbots facilitate the document submission and verification process. Customers upload necessary documents through the chatbot interface, which can then use AI to analyze and verify them. This automation speeds up the verification process, ensuring that customers don’t have to wait long for approval.

- Educational Support: AI chatbots in banking provide educational resources during the onboarding process. New customers might be unfamiliar with banking terms or services. Chatbots explain concepts, offer guidance on product features, and help customers understand their options.

>> Read more: Automating document verification by AI and ML

2. Personalized Banking Recommendations

Personalized banking recommendations are crucial for enhancing customer satisfaction and loyalty. AI chatbots in banking play a pivotal role in delivering tailored advice and product suggestions that align with individual customer needs and financial goals.

- Data-Driven Insights: AI chatbots in banking analyze vast amounts of customer data, including transaction histories, spending patterns, and demographic information. By leveraging this data, they can identify trends and preferences unique to each customer.

- Customized Product Recommendations: Chatbots recommend banking products that best fit the customer’s profile. For instance, if a customer frequently travels, the chatbot could suggest a travel rewards credit card. This level of customization not only enhances customer satisfaction but also increases the likelihood of product uptake.

>> Read more: Top Applications of AI in banking in 2025

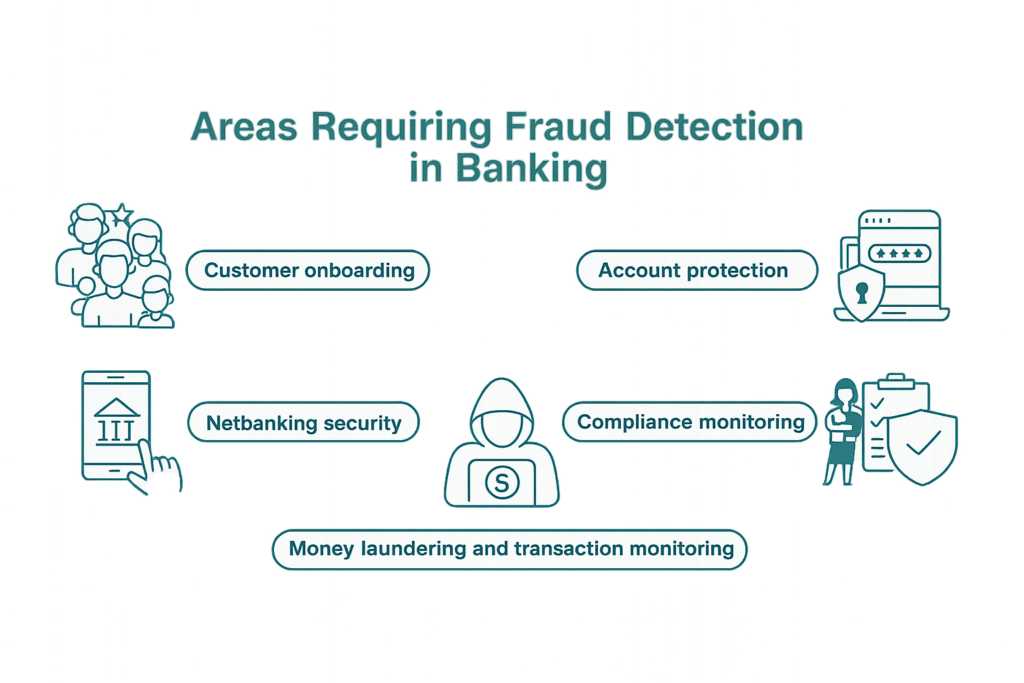

3. 24/7 Fraud Detection and Prevention

AI chatbots are transforming the way banks monitor transactions and detect fraudulent activities. By leveraging advanced technologies, these chatbots can provide real-time monitoring and alerting systems that enhance security measures. A business typically loses 5% of its annual income to fraud each year, with a median financial effect of $117,000 before the theft is discovered (Managed Pay, 2022). By using algorithms to identify anomalies and stop financial losses, artificial intelligence (AI) fraud detection is revolutionizing how businesses fight fraud. Here are some instances of cross-industry use cases: customer onboarding, networking security, account protection, compliance monitoring, and money laundering and transaction monitoring.

>> Read more: Strengthening role of AI cybersecurity for BFSI in 2025

- Behavioral Biometrics: It plays a crucial role in enhancing security. AI chatbots in banking analyze user behavior patterns, such as typing speed, mouse movements, and navigation habits. By establishing a baseline of normal behavior, the chatbot can detect anomalies.

- Machine Learning: ML algorithms enable chatbots to learn from historical transaction data and adapt to new fraud patterns. As fraudsters develop more sophisticated techniques, AI chatbots in banking can be trained to recognize these emerging threats.

4. Simpler Bill Payment Processes

AI chatbots are transforming the way customers manage their bill payments, making the process more seamless and convenient. By incorporating features like voice commands and one-click payments, these chatbots enhance the overall user experience.

- Voice commands for Hands-Free Convenience: Customers use voice commands to pay their bills, allowing for a hands-free experience. This is especially useful for users who are multitasking or prefer verbal interactions. The chatbot understand and process spoken requests, making it easy for customers to say things like, “Pay my electricity bill” or “Make my monthly payment.”

- One-click Payments: AI chatbots in banking offer a one-click payment option for frequently used bills, such as utilities or subscriptions. This feature simplifies the payment process and minimizes the time spent on each transaction. By remembering previously paid bills, chatbots provide a quick payment option, enhancing user convenience and encouraging timely bill payments.

- Secure Transactions: AI chatbots in banking ensure that all transactions are secure, utilizing encryption and authentication methods to protect customer data. This security builds trust and encourages users to utilize the payment features confidently.

5. AI-Powered Financial Literacy

AI-powered chatbots are revolutionizing the way customers access financial education and advice. By providing valuable information in an engaging manner, these chatbots empower users to make informed financial decisions.

- Gamification for Engagement: AI chatbots in banking can incorporate gamification elements. This approach turns learning into an interactive experience by adding game-like features such as: quizzes and challenges, progress tracking and interactive scenarios.

- Progress Tracking: Customers can track their learning progress and receive badges or incentives for completing educational modules, encouraging continued participation.

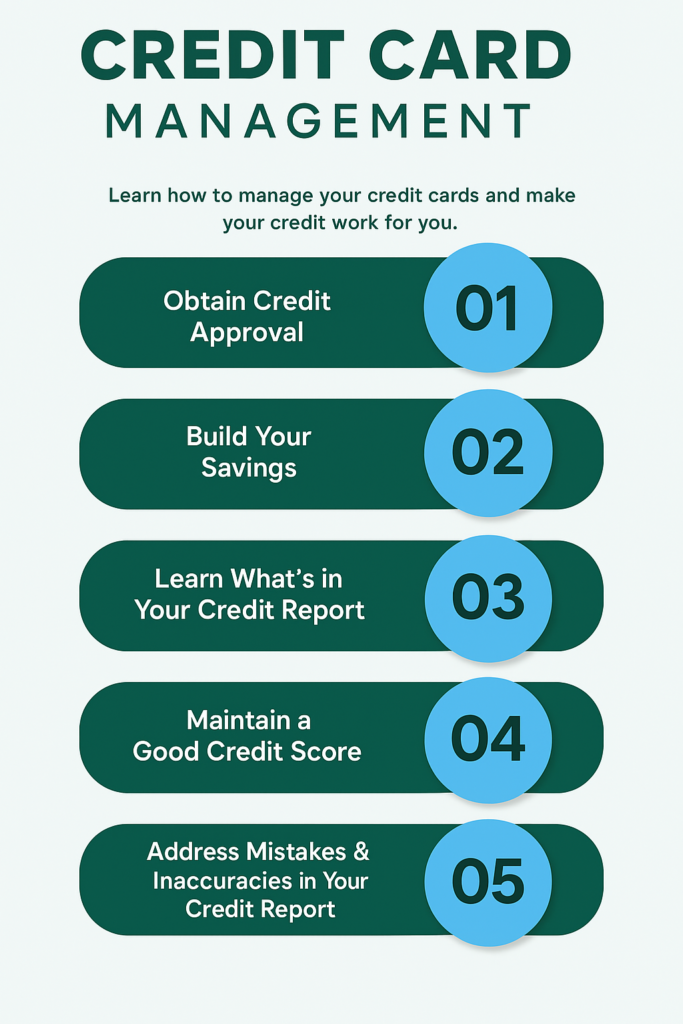

6. Simplified Credit Card Management

AI chatbots are increasingly becoming essential tools for customers managing their credit card accounts. By providing a range of functionalities, these chatbots enhance the overall customer experience, making it easier and safer to handle credit-related tasks.

- Account Management: Customers can easily initiate credit card payments through the chatbot, providing a quick and convenient way to stay on top of their bills. For example, the banks have rewards, chatbots can provide updates on reward points or cashback earned, helping customers stay informed about their benefits and encouraging them to use their cards strategically.

- Visual Cards to Enhance Security: Virtual cards provide a unique card number for online transactions, reducing the risk of fraud associated with using physical cards. If a virtual card number is compromised, it can easily be deactivated without affecting the primary account. For privacy protection, customers can use virtual cards for online purchases without revealing their actual credit card numbers, enhancing privacy during transactions.

7. Real-Time Customer Support

AI chatbots are revolutionizing customer support in the banking sector by offering instant assistance and resolving issues around the clock. Their ability to handle a wide range of inquiries efficiently enhances customer satisfaction and streamlines service operations.

- 24/7 Instant Support: AI chatbots are available 24/7 for banking automation, allowing customers to receive immediate assistance whenever they need it. This availability is crucial in the banking sector, where customers may have urgent questions or issues outside of regular business hours. Chatbots can handle common customer queries, such as: account balances, transaction histories, payment processing and lost or stolen cards.

- Omnichannel Support: AI chatbots provide consistent support across various channels, enhancing the overall customer experience. Customers can engage with chatbots through social media, email and phone calls.

8. Data-Driven Decision Making

AI chatbots are not only enhancing customer interactions but also playing a vital role in generating valuable insights that can inform business decisions. By analyzing customer interactions and preferences, these chatbots enable banks to better understand their clients and adapt strategies accordingly.

- Customer Interaction Analysis: AI chatbots in banking track and analyze interactions with customers across various channels. This analysis helps banks identify trends in customer behavior, preferences, and common inquiries.

- Predictive Analysis: By analyzing historical data, chatbots predict potential customer behaviors, such as spending patterns or product uptake, enabling banks to proactively adjust their services and marketing strategies. Moreover, predictive analytics helps identify customers at risk of defaulting on loans or credit obligations, allowing banks to take preventive measures, such as offering financial advice or restructuring options.

9. Personalized Investment Strategies

AI chatbots are revolutionizing investment management by providing personalized investment recommendations tailored to individual customer needs. By analyzing customer risk tolerance and financial goals, these chatbots enhance investment experience.

- Personalized Investment Recommendations: AI chatbots can analyze customer data to provide tailored investment suggestions. By considering factors such as financial goals, time horizon, and risk tolerance, chatbots help customers make informed investment decisions.

- Automated Portfolio Management: Chatbots can integrate advanced robo-advisor technology to manage investment portfolios automatically. This includes selecting investment options based on customer profiles and market conditions.

10. Enhanced Accessibility for Diverse Audiences:

AI chatbots are making banking services more accessible by providing support in multiple languages. This inclusivity allows banks to cater to a broader range of customers, enhancing user experience and satisfaction.

- Multilingual Support: AI chatbots can be programmed to support various languages, allowing customers to interact in their preferred language. This feature is essential for banks operating in diverse markets. Moreover, advanced natural language processing enables chatbots to understand and respond in multiple languages, ensuring smooth communication without language barriers.

- User-friendly Interfaces: Chatbots can offer intuitive interfaces that guide users through various banking services, regardless of the language used. This simplicity helps reduce confusion and enhances customer satisfaction. Incorporating visual elements can aid understanding, especially for users with limited language proficiency.

>> Read more: 4 AI in the Retail Industry Best Cost Reduction Suggestions

Top 3 Examples of Chatbots in Banking

1. Erica from Bank of America

Transactions like paying down debt and checking account balances. For instance, Erica might text a customer, “Michelle, I found a great opportunity for you to reduce your debt and save $300.” By clicking the message, Michelle can launch the app and receive Erica’s advice: “Based on your usual monthly spending, you can allocate an extra $150 towards your cash rewards Visa, potentially saving you up to $300 each year.” Additionally, Bank of America is leading the way in peer-to-peer payments by introducing Zelle, a new money transfer service that will compete with PayPal’s Venmo. This will allow customers to withdraw or deposit cash at ATMs using their mobile banking app.

2. Aida from SEB

SEB was awarded for its use of the AI agent Aida, who aids both in internal IT support as well as in answering chat questions on the website. Since 2016, Aida has been working at the IT Service Desk, helping out with unblocking accounts, fixing Wi-Fi problems, restoring passwords and granting network drive access. Today, it handles around 16 percent of the incoming Service Desk questions.

3. Nina from Swedbank

By using Nina, agents can focus on other types of calls, enhancing the bank’s overall value. Nina handles all service-related inquiries, allowing agents to dedicate more time to sales. According to the bank, while Nina saves agents time, they would prefer to initially roll her out to only 20% of the customer base. This approach would give the virtual assistant the opportunity to learn and expand its database effectively.

Conclusion

As AI technologies evolve, customer support automation in banking will become increasingly sophisticated, providing enhanced personalization, improved fraud detection, and quicker service delivery. Future AI chatbots in banking will seamlessly integrate with other technologies, enabling banks to offer a fully automated, end-to-end customer experience. AI will take on more complex financial processes, such as loan underwriting and investment management, allowing human agents to concentrate on delivering personalized, high-value support.