AI in insurance is the engine driving innovation across the insurance sector. Once viewed as a long-term transformation bet, AI adoption is now a mission-critical capability, redefining underwriting, accelerating claims, reducing fraud, and delivering the hyper-personalized customer experience today’s policyholders expect.

>> Click here to explore top AI Insurance use cases

According to McKinsey, AI could deliver up to $1.1 trillion in annual value to the global insurance industry by 2030, driven by smarter pricing, faster claims processing, and personalized services at scale. This blog post will explore top best challenges and promises of AI in Insurance in 2025.

1. What Is AI In Insurance?

AI in insurance refers to applying machine learning, natural language processing, computer vision, and other intelligent technologies to automate, optimize, and improve operations throughout the insurance transformation. From underwriting and pricing to digital claims management and fraud detection, AI enables insurers to make more accurate, personalized decisions at scale.

AI’s role goes beyond basic automation. It analyzes vast volumes of structured and unstructured data, including historical claims, customer behavior, and external risk indicators, to uncover patterns, generate insights, and inform predictive models. This shift transforms insurance from a reactive industry based on loss compensation to a proactive ecosystem focused on risk prevention and personalized protection.

2. Benefits of AI in Insurance

AI is rapidly becoming a core driver of innovation and efficiency in the insurance sector. Its value lies in its ability to transform operations, elevate the personalized customer experiences, and enable more strategic, data-informed decisions across the enterprise.

1. Increased operational efficiency

One of AI’s most immediate and measurable benefits for insurers is its ability to streamline day-to-day operations, reducing manual workload, increasing process speed, and improving overall efficiency:

- Process simplification through automation: AI streamlines laborious, manual activities including client queries, policy issuance, document verification, and claims management. As a result, there are fewer mistakes, quicker turnaround times, and more operational uniformity.

- Faster reaction times and lower operating costs: In certain insurance transformation lines, intelligent automation may save back-office expenses by as much as 30%. Insurers can handle large quantities of transactions with little human involvement thanks to AI-powered solutions like intelligent document processing and robotic process automation (RPA), which drastically save administrative costs and improve responsiveness.

2. Personalized customer experiences

Beyond efficiency, AI is revolutionizing how insurers connect with customers, enabling the delivery of hyper-personalized experiences that drive loyalty, satisfaction, and increased lifetime value.

- AI-driven personalization for customer interactions: By analyzing behavioral, demographic, and transactional data, AI enables the creation of real-time, personalized customer journeys. This includes tailored policy recommendations, proactive renewal notices, and adaptive coverage options.

- Tailored policy recommendations and improved customer satisfaction: Insurers like Lemonade and Progressive have used AI to dynamically match users with personalized coverage bundles, improving customer satisfaction and reducing churn. These experiences are designed to feel intuitive, transparent, and responsive to individual needs.

3. Enhanced predictive analytics

AI empowers insurers with enhanced predictive capabilities to anticipate risks, tailor offerings, and make more informed, data-driven decisions across the enterprise.

- Better forecasting and strategic decision-making: AI-powered predictive analytics models help insurers anticipate customer needs, forecast claims management volume, and optimize capital reserves. These tools enable scenario planning and support real-time adjustments to business strategy.

- Accurate risk assessments and pricing models: Advanced AI models increase underwriting accuracy by incorporating a wide range of risk signals, including IoT data and geospatial analytics. This enables insurers to price policies more competitively while minimizing exposure.

4. Reduction in claims costs

By automating key steps in the claims lifecycle and detecting fraud in real time, AI helps insurers lower costs, minimize losses, and improve claims accuracy.

- Efficient claims processing and reduced fraud instances: AI expedites digital claims management intake and triage, ensuring prompt resolutions and reducing operational friction. Insurers using computer vision and NLP can instantly assess damage via submitted photos or videos, while fraud detection models flag suspicious activity based on behavioral anomalies and historical trends.

- Improved resource allocation and claims accuracy: AI systems optimize adjuster assignment and case routing, freeing up human experts to focus on high-value or complex claims. The result is higher accuracy, reduced rework, and increased policyholder trust.

The benefits of AI in insurance are no longer theoretical when they are tangible and measurable and already reshaping operations across the industry. From streamlining processes and increasing customer satisfaction to refining risk analysis and reducing claims costs, AI enables insurers to operate more efficiently and deliver greater value to both policyholders and stakeholders.

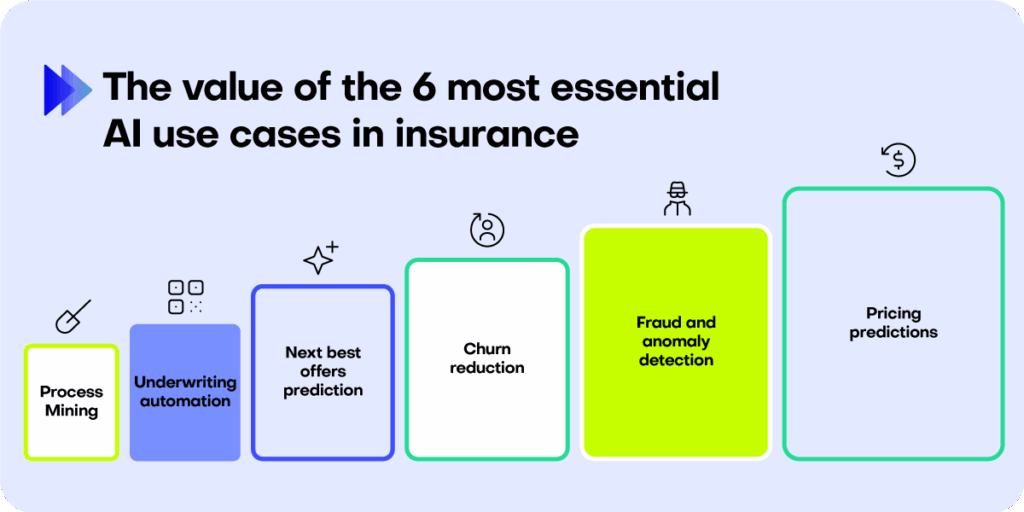

3. Examples & Use Cases of AI in Insurance

AI is moving from promise to practice across the insurance value chain. From claims automation to fraud detection, leading insurers are applying AI to streamline operations, enhance customer service, and improve risk assessment. Below are key use cases illustrating how AI is integrated into real-world insurance workflows.

1. AI-driven claims management

Automated claims processing is revolutionizing how insurers manage the claims lifecycle. By leveraging technologies such as computer vision, natural language processing (NLP), and machine learning, insurers can assess damages and approve payouts in minutes rather than days, reducing friction and enhancing customer satisfaction.

Allianz introduced the Insurance Copilot, an AI-powered solution developed by Allianz Technology, to transform claims management. Launched in 2024 for automotive claims in Austria, this solution leverages generative AI (GenAI) to streamline workflows and automate key tasks, enabling faster and more accurate claim settlements. Implementing AI-driven claims processing can significantly reduce settlement times, enhancing customer satisfaction and operational efficiency.

2. AI support chatbot for policyholder self-service

AI-powered virtual assistants now manage policy servicing, claims updates, and customer queries around the clock, reducing call volumes and enhancing CX at scale.

Allianz Benelux deployed an AI-powered chatbot using Landbot to simplify the insurance claims process. The chatbot processed over 92,000 unique search terms and achieved a 90% positive feedback rating from more than 18,000 customer interactions. Integrating AI chatbots can enhance customer engagement and streamline support processes, leading to higher customer satisfaction rates.

3. Legacy code modernization

Modernizing legacy systems is crucial for insurers aiming to enhance operational efficiency, reduce costs, and improve scalability. AI-driven tools facilitate this transformation by automating code analysis, refactoring, and migration processes.

Athora, a European insurer, partnered with Avanade to modernize its core insurance systems (developed initially in Unisys on Unisys Libra 690 mainframes). Utilizing Avanade’s Automated Migration Technology, Athora successfully migrated 15 applications—including customer information, individual life policies, and account receivables—totalling 5.3 million lines of code. This initiative led to a 70% reduction in infrastructure and operational costs.

Pro Tip: Implementing AI-assisted code migration tools can significantly accelerate the modernization process, reduce errors, and ensure consistency. By automating the transformation of legacy codebases, insurers can achieve faster time-to-market and better alignment with modern IT infrastructures.

4. Fraud detection and prevention

AI excels at identifying anomalous patterns and high-risk transactions in real time, aiding insurers in minimizing financial exposure while maintaining customer trust. These systems learn from historical data to detect suspicious claim behaviors, identify anomalies, and prevent payout errors.

Zurich Insurance employs AI-driven tools developed by its in-house team, Zurich Customer Active Management (ZCAM), to improve fraud detection across multiple lines of business. By utilizing machine learning and natural language processing, Zurich’s system assigns a fraud risk score to claims, prompting further investigation when necessary. This approach has resulted in a substantial increase in the detection of fraudulent activities. Build layered fraud defenses by combining supervised models (trained on historical fraud) with unsupervised learning to detect new fraud tactics. Align AI tools with experienced human investigators for maximum accuracy and responsiveness.

5. Risk assessment and management

AI enables insurers to assess risk more precisely by ingesting and analyzing structured and unstructured data at scale. These models consider diverse signals from IoT sensors, satellite imagery, and behavioral trends to deliver dynamic, real-time risk profiles.

Progressive’s Snapshot program uses telematics data to personalize auto insurance pricing based on actual driving behavior. The AI engine evaluates factors like speed, braking, and time of day to assess individual risk levels, enabling more equitable and predictive underwriting. Utilize AI-driven risk models to transition from static underwriting to dynamic, behavior-based assessments. Integrate external data sources (such as IoT, wearables, and environmental feeds) to refine segmentation and deliver hyper-personalized premiums.

6. AI-powered new product development

AI helps insurers uncover unmet customer needs, identify emerging market opportunities, and rapidly iterate on new offerings. By analyzing consumer behavior, sentiment, and usage data, AI enables the creation of personalized, modular insurance products that align with how people live and work today.

Metromile, a pioneer in usage-based insurance (UBI), leverages AI to power its pay-per-mile auto insurance model. The company uses machine learning to analyze driving patterns, mileage, and claims history, enabling it to tailor pricing dynamically. This model appeals to low-mileage drivers and has reshaped traditional premium structures. Utilize AI not only for optimization, but also for driving product innovation. Apply behavioral analytics and customer segmentation to co-create insurance offerings that are modular, embedded, and contextual, meeting policyholders where they are, in their own context.

4. Advanced AI Technologies Transforming Insurance

As insurers scale their AI capabilities, several enabling technologies are becoming foundational to their transformation strategies. These tools power AI initiatives and ensure scalability, interoperability, and compliance across complex IT environments.

Through the smooth integration of third-party data sources, AI engines, and core insurance platforms, APIs and microservices design provide flexible, scalable solutions. Insurance companies may include AI capabilities with this architecture without having to completely revamp their existing systems. Business Process Automation (BPA) reduces processing time and human error by automating repetitive operations including document classification, policy issuing, and claims handling. This frees up trained workers for higher-value duties.

Applications of GenAI: Enable customer-facing experiences such as intelligent document production, tailored policy explanations, and dynamic content creation. By creating answers, reports, or claims summaries, generative models also assist internal processes. Moreover, intelligent automation automates both organized and unstructured processes by fusing AI-driven decision-making with conventional RPA. Workflows that need to read scanned documents, prioritize exceptions, or route approvals according to context are best suited for this hybrid paradigm.

Machine learning: Offers predictive insights and pattern detection in the areas of fraud, pricing, underwriting, and claims. Machine learning is used by insurers to estimate risk, improve loss ratios, and customize products based on past and behavioral data. Besides, chatbots, sentiment analysis, and intelligent search across internal knowledge bases are all improved by natural language processing, or NLP. NLP also facilitates customer email triage, regulatory compliance, and automated document inspection.