AI + SME (small and medium-sized enterprises) face a growing array of financial risks from cash-flow problems and credit defaults to fraud, compliance lapses, or sudden market shifts. Yet many SMEs lack the resources dedicated risk officers, sophisticated analytics teams, or deep credit histories that large corporations use to manage those risks. Once the province of big banks and hedge funds, AI-based risk tools are becoming increasingly accessible to SMEs.

New AI-powered financial platforms allow even small companies to forecast cash flow, assess creditworthiness, detect anomalies, and continuously monitor risk often at a fraction of the cost of traditional systems. For SME finance departments, this can be a game-changer: shifting from reactive, manual firefighting to proactive, data-driven risk management. In this post, we’ll explore how AI is transforming SME finance with the concrete capabilities it brings, how it helps guard against risk, the challenges and caveats SMEs should watch out for, and best practices for implementation.

1. AI + SME Finance: Risk Management New Trend in 2026

In 2026, AI has become the new frontier of risk management for SMEs as intelligent financial tools shift from optional add-ons to essential components of everyday operations. With AI-powered platforms offering real-time cash-flow monitoring, automated anomaly detection, smarter credit assessments, and predictive forecasting, SME finance are moving from reactive financial management to proactive, data-driven decision-making.

This trend is driven by the growing affordability of AI solutions, deeper fintech integrations, and the need for small businesses to strengthen resilience in an unpredictable economic landscape. As a result, SME finance teams are leveraging AI not just to reduce risks, but to uncover opportunities, optimize working capital, and plan with greater confidence, making AI adoption a critical competitive edge in 2026.

2. What Kinds of Risk Do SMEs Face and Why Traditional Approaches Struggle

Before seeing how AI helps, it’s useful to understand the kinds of risk that commonly confront SMEs, and why conventional methods often fall short.

- Cash-flow volatility and liquidity risk: SME finance often operate on tight margins and depend on regular payments from customers. Delays or spikes in expenses can quickly lead to cash flow shortages. Without accurate forecasting tools, businesses may miss warning signs until it’s too late.

- Credit risk and bad debts: SME finance may extend credit to customers or buy from suppliers on credit terms. But assessing who is reliable especially for smaller or newer clients with limited track record is difficult. Traditional credit checks rely on historical credit history or financial statements that may not exist or be incomplete.

- Fraud and operational anomalies: Smaller organizations frequently lack rigorous internal control systems. A single fraudulent transaction or undetected bookkeeping error can have outsized impact.

- Regulatory and compliance risk: As regulation increases for taxes, reporting, anti-money laundering, data privacy that SMEs may struggle to keep up. Manual compliance processes are error-prone and resource-intensive.

- Strategic risk from market changes: Economic fluctuations, shifts in consumer behavior, supply chain disruptions for SMEs need to anticipate and adapt, but traditional analysis (e.g. using past spreadsheets) often fails to account for dynamic external factors.

Given limited staff, resources, and data, SMEs’ finance departments often resort to simple heuristics, periodic reviews, or static forecasts all of which can miss early warning signs.

3. How AI Changes the Game for SME Finance

3.1 Automating manual financial processes freeing up time and reducing errors

Many SMEs waste valuable time on bookkeeping, invoicing, reconciliation, and reporting, tasks prone to human error if done manually. AI-powered systems can automate these routine accounting tasks with minimal human intervention.

For example:

- AI-driven invoice processing tools use techniques like OCR (Optical Character Recognition) and Natural Language Processing (NLP) to extract data from invoices and receipts. They can match invoices with purchase orders, flag anomalies (e.g. unusual charges), and even automatically schedule payments when due.

- Automated reconciliation ensures that bank statements, payments, and accounting books match, reducing mistakes that might otherwise slip through if staff are juggling many tasks.

By eliminating much of the repetitive “admin” load, SMEs’ finance teams can focus on more strategic tasks like analyzing trends, forecasting, or planning. As one recent overview puts it, AI frees accounting teams from manual tasks and lets finance become a “value-creator.” This shift from manual bookkeeping to automated, real-time accounting not only reduces clerical errors, but ensures financial data is timely and reliable, a crucial foundation for any risk-management effort.

3.2 Better cash-flow forecasting and financial planning

One of the most transformative applications of AI for SMEs is predictive analytics. Instead of relying on simple, static forecasts (e.g. “based on last year’s numbers”), AI-driven tools analyze historical financial data together with external signals such as sales trends, customer behavior, market conditions, seasonality to forecast cash flows, liquidity needs, and financial health. According to happay (2024), cash flow forecasting process is going through 7 steps:

- Step 1: Set your business objectives (goals)

- Step 2: Set forecast period to work on

- Step 3: Opt for the suitable forecasting method

- Step 4: Forecast your cash inflows

- Step 5: Estimate your cash outflows

- Step 6: Compile the data for the cash flow forecast

- Step 7: Review and revisit the forecast report

Concretely, this means:

- SMEs can get early warning if cash inflows are projected to dip, giving them time to adjust. For example, by postponing discretionary spending, renegotiating payment terms with vendors/customers, or arranging bridging finance.

- Finance teams can run “what-if” simulations: what happens if sales drop 20% next quarter? What if a major customer delays payment? AI makes these scenarios easy to generate so companies can plan contingencies.

- Investment decisions, hiring, expansion that all can be better timed. With reliable forecasting, SMEs can avoid over-extending themselves and get a stronger sense of when they have capacity to grow.

By making cash flow and liquidity more predictable, AI reduces one of the biggest existential risks for SMEs: running out of cash.

3.3 Smarter credit risk assessment & underwriting

Credit decisions whether about extending credit to a customer, buying on account from a supplier, or applying for a loan, have always carried risk. Traditional credit scoring and underwriting often depend on limited data (historic credit history, financial statements) and qualitative judgments. For many SMEs, especially new ones, or those in underserved markets that data may be incomplete or misleading.

AI changes this through:

- Broader data sources: AI-based credit-risk models can incorporate non-traditional data — transaction history, payment behavior, social or market signals, even alternative data like online reputation or sector performance. This produces a more holistic, up-to-date view of a borrower’s (or partner’s) health.

- Machine learning and predictive modeling: Rather than static credit scores, AI models continuously learn and adapt, making predictions about the likelihood of default or delay.

- Faster, more inclusive underwriting: For SMEs with limited credit history or irregular records, AI-based underwriting can open doors, enabling access to loans or trade credit that might have been denied under traditional criteria.

This has a two-fold benefit: SMEs can make safer decisions when extending credit or entering partnerships; and when SMEs themselves need financing, they stand a better chance of being assessed fairly and gaining access to funds.

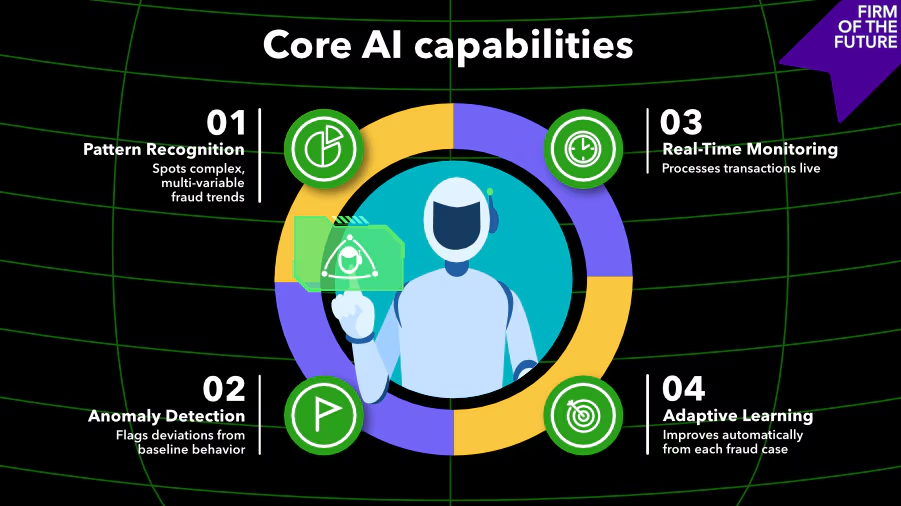

4. Real-time Risk Monitoring & Fraud/Anomaly Detection

One of the chronic problems for SMEs is that financial risks may emerge unexpectedly with a fraudulent invoice, a payment gone missing, a suspicious transaction, or irregular spending and sometimes remain undetected until it’s too late. Traditional periodic reviews or manual audits often catch issues only after the fact. AI helps by enabling continuous, real-time monitoring. Machine learning models and anomaly detection algorithms can analyze transactional data as it flows in flagging unusual patterns, duplicate invoices, unexpected large expenses, or suspicious behaviour.

For example, AI-based fraud detection systems have proven effective in detecting potentially fraudulent or anomalous activities that manual processes would miss. By issuing alerts as soon as anomalies appear, e.g. a vendor invoice that doesn’t match approved purchase orders, payment to a new/unverified account, or an unusual sequence of transactions that SMEs can respond quickly, investigate and contain damage before it escalates. This real-time oversight dramatically reduces operational risk, helps prevent financial losses, and improves overall control, even for SMEs with limited staff or no dedicated internal audit team.

5. Enhanced Strategic Planning and Scenario-Based Decision Making

Beyond day-to-day operations, AI enables finance departments in SMEs to think strategically and anticipate future risks proactively. AI-driven predictive analytics, when combined with external data (market trends, macroeconomic indicators, industry-specific signals), allows SMEs to anticipate changes in demand, seasonal fluctuations, or potential downturns — and adjust budgets, investment, staffing, or inventory accordingly.

Moreover, newer AI models support simulation of multiple scenarios (“what-if” analysis): what if raw material costs rise? What if a major client pulls out? What if currency exchange rates shift? With such simulations, SMEs can build contingency plans, stress-test their budgets, and improve their resilience against uncertainty. In short, AI helps SMEs transition from reactive firefighting to proactive, strategic financial planning, reducing risk of unpleasant surprises and enabling growth with more assurance.

6. Real-World Trends: AI is No Longer Just for Big Firms

While AI in finance once seemed like a luxury for large institutions, recent trends show democratization: affordable and accessible AI-powered financial management tools are now increasingly available to SMEs. A recent industry article argues that AI gives SMEs capabilities “that rival those of major corporations, but at a fraction of the cost and complexity.” Some fintech players especially those focused on SME banking or supply-chain finance, using AI-driven Business Financial Management (BFM) platforms to deliver value: real-time cash flow dashboards, payment scheduling, anomaly detection, and transaction forecasting all through apps or cloud interfaces.

Research confirms that even for smaller companies, AI-based models (machine learning regressors, neural networks, Bayesian models) yield more accurate predictions of financial performance and risk than traditional ratio-based analysis. This shift means that SMEs are no longer forced to choose between expensive enterprise-level software or rudimentary spreadsheets. With AI, they can now access powerful risk-management tools that scale with their needs.

7. Challenges & Considerations: What SMEs Need to Watch Out For

Despite the many advantages, adopting AI for risk management isn’t a magic bullet. SMEs should carefully consider several potential challenges and pitfalls.

7.1 Data quality and data governance

AI’s effectiveness depends heavily on the quality and completeness of data. If a company’s historical financial data is messy, incomplete, or inconsistent, common for many SME finance then AI predictions and risk assessments may be inaccurate or misleading. As one analysis notes, firms should invest in data governance and management to ensure the data feeding AI systems is accurate and up-to-date. Moreover, SMEs need to be mindful of data privacy, security, and regulatory compliance especially if using external/cloud-based AI platforms.

7.2 Integration with Existing Systems and Processes

Many SMEs already use accounting software, ERPs, or legacy systems, integrating AI tools into existing workflows can be challenging. Compatibility issues, data migration, and user training often become bottlenecks. As one article points out, ensuring compatibility between AI tools and legacy systems is “very crucial” for seamless operation.

7.3 Costs and ROI: Balancing Benefits and Investment

While AI tools are becoming more affordable, there is still upfront cost (software subscription, consulting, data storage) and ongoing maintenance (updates, monitoring). For small businesses, the payback period may not be immediate. Moreover, some SMEs may lack in-house expertise (data scientists, analysts) to interpret AI outputs effectively or to tune models appropriately. Without adequate human oversight and financial literacy, AI outputs may be misunderstood or misused.

7.4 Risk of over-reliance and “black-box” decisions

Especially when using complex machine-learning or generative-AI models, there is a risk that decisions become opaque which “the AI says this customer is high risk but we don’t know exactly why.” That can make it harder to justify decisions, especially with lenders, auditors, or regulators. However, the emerging trend of “explainable AI” (XAI) is helping counter this: by providing transparent reasoning for decisions, AI becomes more trustworthy and defensible.

8. Best Practices for SMEs: How to Implement AI-Based Risk Management Successfully

Here are some guidelines for SMEs looking to harness AI for risk management in finance departments:

- Start small — automate low-hanging tasks first

Begin with automating routine processes like invoicing, reconciliation, or basic cash-flow dashboards. These yield quick wins (time savings, error reduction) and build organizational confidence with AI. - Clean and standardize your data

Before applying AI, invest time in data cleaning, standardization, and proper bookkeeping. Good data is the backbone of any reliable AI output. - Use AI for forecasting + scenario planning, not just reporting

Prioritize tools that offer predictive analytics and what-if simulations. These add strategic value, helping you anticipate problems rather than react to them. - Combine AI insights with human judgment

Treat AI as an assistant, not an oracle. Use AI to surface risks, highlight anomalies, and suggest trends — but human oversight remains critical, especially for decisions with major financial or reputational consequences. - Pick tools / vendors that support transparency (XAI)

Prefer solutions that offer explainable insights — so you, auditors, lenders, or regulators can understand how risk scores or forecasts were derived. - Ensure data security and compliance

If using cloud-based or third-party AI tools, vet their data privacy and security standards. Implement data governance procedures to protect sensitive financial data. - Create a culture of data-driven finance

Encourage finance staff to learn basic data analytics / AI literacy. When the finance team understands what the AI does (and doesn’t do), adoption will be smoother and more effective.

9. The Future: What’s Next for AI + SME Risk Management

Looking ahead, there are several exciting trends and potential developments on the horizon — many of which stand to make AI-based risk management even more powerful and accessible for SMEs.

- Generative and large-language-model (LLM) tools for risk analysis: Emerging research (for example RiskLabs) shows that LLM-based frameworks can integrate different types of data — textual reports, earnings calls, news, time-series data to generate comprehensive risk assessments. This could help SMEs incorporate qualitative signals (market sentiment, regulatory news) into their risk models, beyond just numbers.

- Supply-chain and supply-chain-finance risk modeling: For SMEs embedded in supply chains — e.g. manufacturing, retail where AI models are being developed to assess credit risk, supplier reliability, demand volatility, and loan eligibility based on supply-chain data. One recent study proposes generative modeling for credit risk in supply-chain finance, potentially helping SMEs who rely on inventory or receivables as collateral.

- Simpler, modular AI risk tools and fintech integrations: As fintech platforms increasingly target SMEs, we can expect more plug-and-play AI-based risk tools — e.g. for real-time cash-flow monitoring, dynamic credit scoring, fraud detection — built as modular add-ons to existing accounting or ERP software.

- Regulation & compliance-aware AI for SMEs: As regulatory pressures increase (data privacy, anti-money laundering, tax compliance), AI tools that embed compliance-checking and risk alerts may become standard, lowering legal and regulatory risk for SMEs.

Conclusion

For SMEs, managing financial risk has always been a challenge: limited resources, unpredictable cash flows, incomplete data, and manual processes make it hard to stay ahead. But with AI-powered tools, even small finance departments can now access advanced capabilities — real-time monitoring, predictive forecasting, smarter credit evaluation, fraud detection, and scenario planning.

AI doesn’t just make processes faster or easier. It transforms what is possible: empowering SMEs to shift from reactive firefighting to strategic, data-driven decision-making. Of course, success depends on clean data, sound implementation, human oversight, and appropriate tools. But for SMEs willing to invest in people, in data, in systems when the payoff can be substantial: greater financial stability, more informed decisions, and a stronger foundation for growth. As AI becomes more accessible and affordable, the barrier between “enterprise-grade” finance and “SME-grade” finance is shrinking. Connect with us to explore more about our industries working on!