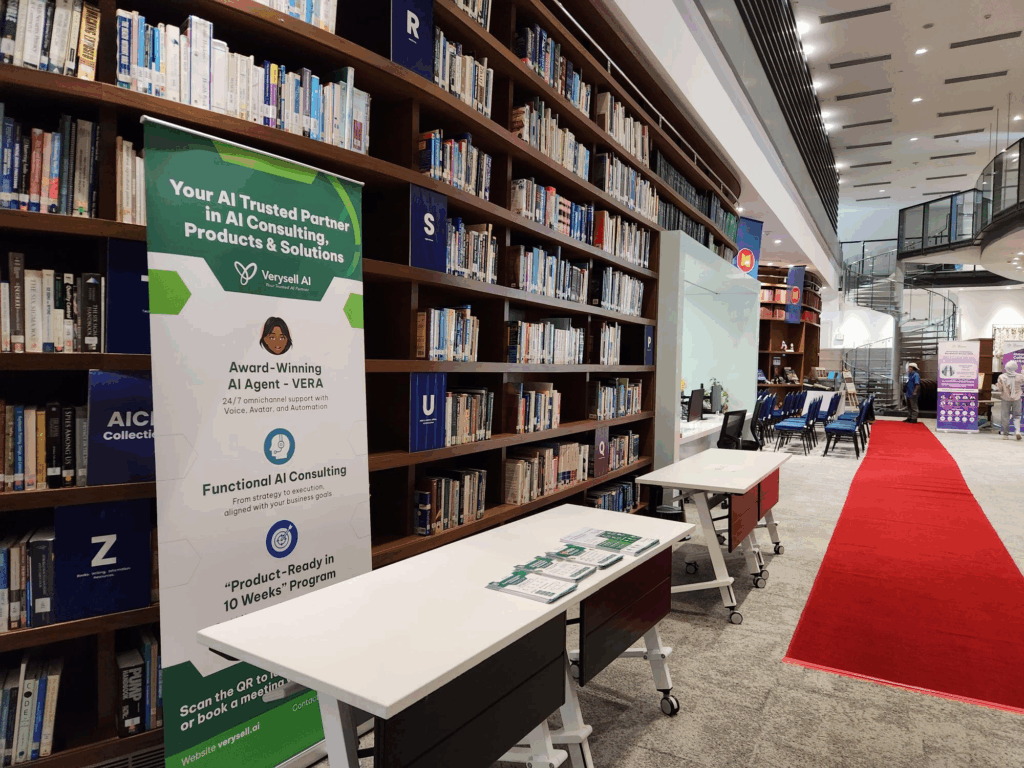

The Insurance Collective Roadshow 2025 was held on 22nd May 2025 with the participation of Verysell AI in Kuala Lumpur, Malaysia. This event included around 100 industry leaders, technology innovators, and regulators gathered at the Financial Services Library, AICB in Kuala Lumpur, Malaysia, for the highly anticipated Insurance Collective Roadshow 2025. Organized by Bank Negara Malaysia and The Insurance Collective, the event provided a forward-looking platform to exchange ideas, explore digital transformation solutions, and shape the future of Malaysia’s insurance ecosystem.

>> Explore more about event summary: The Insurance Collective X ITC Asia Roadshow Series 2025

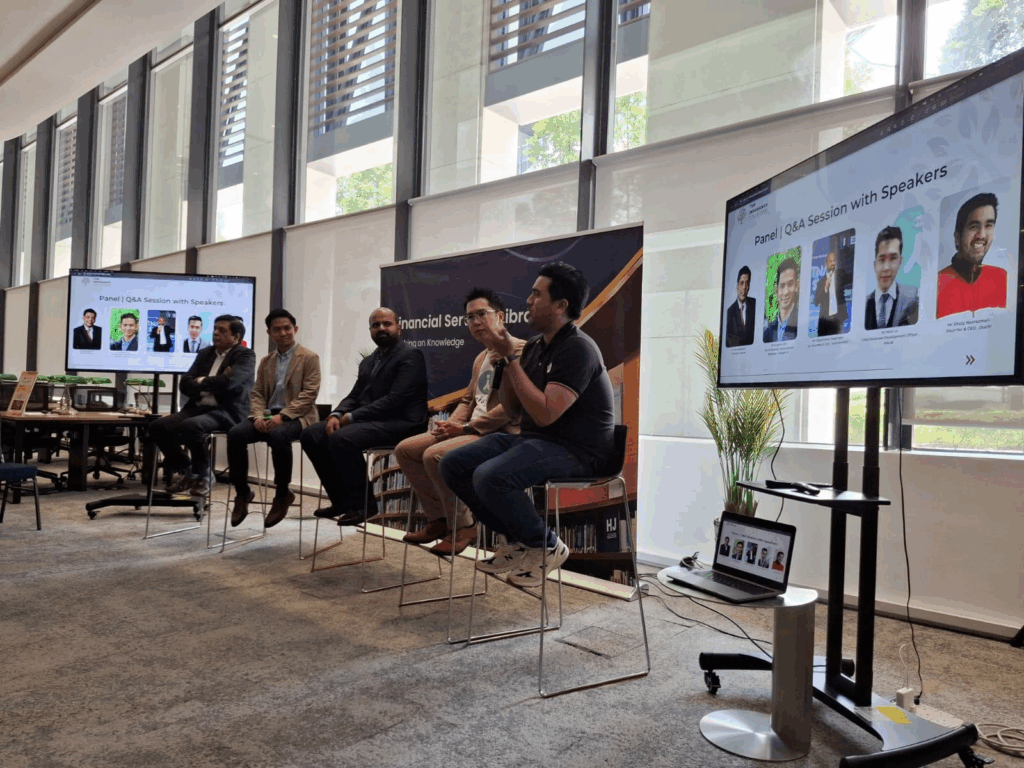

We are proud to share that Eugene Mugen Goh, Business Development Manager from Singapore at Verysell AI, is representing our team at this pivotal industry event. His presence reflects our deep commitment to helping financial institutions and insurance providers embrace AI-powered solutions that drive measurable business outcomes.

Why Verysell AI join this event?

In the rapidly evolving insurance landscape of APAC, strategic initiatives are essential for growth and innovation. We believe the Insurance Collective Roadshow event brings various opportunities for us, as well as having a chance to share our stories to the world. At Verysell AI, we are committed to harnessing opportunities that not only enhance our offerings but also foster meaningful partnerships within the industry.

1. Explore Strategic Partnerships

The Insurance Collective (TIC) stands out as a pivotal player in the APAC ecosystem, providing access to a vast network of partners, many of whom could become end customers. We aim to strengthen our relationship with TIC to connect with potential clients whose business needs align with our AI-driven solutions.

Our offerings, including Verychat and Vera, are designed to integrate seamlessly into insurance workflows, making them ideal for co-development and ecosystem integration. By exploring co-innovation and proof-of-concept opportunities with partners and regional InsurTechs, we can accelerate product adoption and establish strong commercial traction.

2. Generate Qualified Leads

Recent events have attracted major insurers and influential associations, presenting a wealth of qualified lead opportunities. The closed-door, by-invitation-only format ensured high-caliber attendance, fostering deeper conversations and higher-quality engagement. Our speaking and panel opportunities provided a credible platform to present our value proposition, sparking interest and follow-up potential from key decision-makers.

3. Increase Brand Visibility and Positioning in APAC

The insurance sector in APAC is on the brink of significant digital transformation, particularly with regulatory shifts like Malaysia’s DITO (Directory Information and Technology Organization) framework paving the way for modernisation. Our invitation to speak on topics such as financial inclusion, innovation, and efficiency showcased Verysell AI’s leadership in AI-driven insurance solutions, including Verypay, Vera, and Verychat.

The Theme of Insurance Collective Roadshow: Inclusion, Competition, and Efficiency

This year’s roadshow centers on the core themes that define the evolution of the financial services sector in Malaysia and beyond:

- Inclusion: Ensuring that all segments of society have access to insurance and financial products through innovative digital channels.

- Competition: Encouraging market dynamism and technology-driven disruption to elevate service delivery and customer satisfaction.

- Efficiency: Harnessing automation, artificial intelligence, and streamlined processes to reduce operational costs and improve responsiveness.

These themes are particularly relevant in the current regulatory landscape shaped by the Digital Insurers and Takaful Operators (DITO) Framework. The DITO initiative encourages new entrants and digital-native players to innovate and expand their impact within Malaysia’s insurance space.

Key Takeaways

After joining the Insurance Collective Roadshow event, Eugene summarized top three takeaways that made its become outstanding to join.

The Importance of Insurance Sector for Digital Transformation: The insurance sector is on the brink of a digital revolution. Our research for this conference highlights a remarkable surge in insurance innovation globally, especially in the United States and other Western economies. This transformation is fueled by advancements in technology, such as AI and data analytics, which are reshaping how insurers operate and interact with customers. As the industry embraces digital solutions, it not only enhances efficiency but also improves customer experiences, making insurance more accessible and responsive to market needs.

Insurtech Adoption in Asia – A Golden Opportunity: While Western markets are racing ahead, Asia’s insurtech adoption is still catching up. This gap presents a fantastic opportunity for tech pioneers like Verysell AI to step in, educate the market, and provide AI-driven solutions tailored to local needs. Through the Insurance Collective Roadshow event, we can bridge this gap and empower insurers in Asia to harness the full potential of technology. As we introduce innovative solutions, we aim to create a more dynamic and competitive landscape that ultimately benefits consumers with better products and services.

Malaysia’s DITO Framework – A Catalyst for Change: Malaysia’s DITO framework is not just a regulatory initiative; it’s a powerful engine driving digital transformation across the insurance landscape. This regulatory momentum is pushing insurers to weave technologies like digital distribution into their core strategies, setting the stage for similar shifts across other APAC markets. As more insurers adapt to this framework, we can expect a wave of modernization that enhances operational efficiency and customer engagement. This regulatory push not only fosters innovation within the industry but also positions Malaysia as a leader in the region’s digital insurance evolution.

Verysell AI’s Role: Enabling Intelligent Transformation

At Verysell AI, we recognize that insurance providers are not merely seeking technology. They are looking for transformation partners who understand industry nuances, regulatory priorities, and the need for agile execution. Eugene’s participation in the Insurance Collective Roadshow 2025 emphasizes three core solution areas we deliver to our partners. These three pillars reflect our holistic approach to supporting insurers as they evolve into digital-first organizations:

1. Data Management & Analytics

Robust data strategy is foundational for success in digital insurance. We assist organizations in building modern data pipelines that unify customer data, policy records, and claims history. Through advanced analytics, insurers gain actionable insights into customer behavior, risk segmentation, fraud detection, and cross-selling opportunities.

2. AI/ML Implementation

AI is no longer a buzzword—it’s a practical tool for automating underwriting, detecting anomalies, forecasting claims, and personalizing policy recommendations. Our AI solutions have helped insurance clients reduce processing time, increase fraud detection accuracy, and deliver superior customer experiences.

3. Digitalization of Operations

From mobile apps for policyholders to backend workflow automation, Verysell AI empowers insurers to digitize customer journeys end-to-end. We integrate advanced software applications that streamline onboarding, enable real-time policy management, and simplify claims processing.

In his speech, Eugene emphasized the urgency for insurers to adopt a forward-thinking digital mindset and act decisively on AI-driven opportunities. He highlighted how data-centric strategies, scalable AI implementations, and agile digital infrastructure can unlock both operational efficiencies and customer value. Drawing on recent case studies, he illustrated how Verysell AI’s solutions have accelerated transformation for insurers in the insurance industry. His message was clear: innovation must be intentional, measurable, and human-centered to create lasting competitive advantage.

A Platform for Collaboration and Co-Creation

Events like the Insurance Collective Roadshow are essential for fostering open dialogue between solution providers and financial institutions. Eugene’s role at the event is not just to showcase our capabilities but to listen, exchange insights, and identify co-creation opportunities that meet emerging industry needs.

Our team went with full excitement to engage with insurers who are:

- Exploring cloud-native architecture for AI deployment

- Rethinking customer engagement strategies

- Enhancing fraud detection through predictive modeling

- Complying with evolving digital regulations while scaling innovation

The Momentum Toward Digital Insurance

Malaysia is rapidly becoming a leader in Southeast Asia’s digital insurance movement. With regulatory support, high smartphone penetration, and growing demand for seamless digital services, insurers must now act swiftly to remain competitive. The DITO Framework is a clear signal that the future of insurance is digital, intelligent, and customer-centric.

Verysell AI is proud to be part of this momentum. Our mission is to help insurers transition from legacy systems to intelligent ecosystems where data, AI, and digital applications work together to deliver measurable value.

Looking Ahead

As the Insurance Collective Roadshow 2025 unfolds, we look forward to exchanging knowledge, identifying collaboration opportunities, and building partnerships that accelerate digital transformation across the insurance landscape. To connect with Eugene or to learn more about how Verysell AI is supporting digital insurers, feel free to reach out via our website or drop by our booth during the event.

Let’s turn bold ideas into AI-powered impact. At Verysell AI, we believe the future of insurance lies in agility and intelligence. By continuously learning from the evolving needs of our partners, we are committed to delivering solutions that not only solve today’s challenges but also anticipate tomorrow’s demands—ensuring long-term value creation and sustainable growth.