AI Auto-Ticketing is revolutionizing the way banks manage customer service by automating the ticket generation and routing process. This innovative technology leverages Artificial Intelligence (AI), machine learning, and Natural Language Processing (NLP) to classify, prioritize, and assign customer inquiries to the appropriate department or team for resolution. By doing so, AI auto-ticketing helps to reduce response times, enhance customer experience, and improve operational efficiency in the banking industry.

In the competitive world of banking, customer service plays a pivotal role in maintaining customer loyalty and satisfaction. However, as customer expectations rise, so does the pressure on financial institutions to streamline their operations and provide faster, more efficient services. In this blog post, we will explore how AI auto-ticketing works, how it reduces service time, the benefits it offers, challenges banks may face, and the future potential of this technology in the banking industry.

What Is AI Auto-Ticketing?

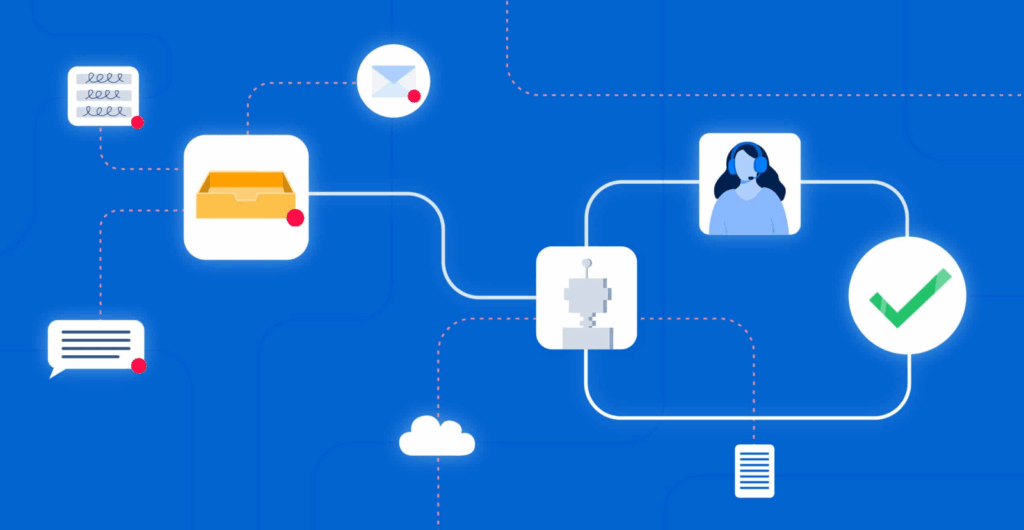

AI auto-ticketing refers to an AI-driven system that automatically generates and routes customer service tickets based on the nature of customer inquiries. It works by analyzing incoming customer communications, such as emails, live chat messages, social media interactions, or phone calls. Once the system identifies the issue, it creates a ticket, categorizes it, and assigns it to the appropriate department or team for resolution.

The integration of machine learning and NLP allows the AI system to understand the content and context of each inquiry, ensuring that tickets are directed to the right professionals. This automation reduces human errors, speeds up the ticket creation process, and ultimately leads to faster response times and improved service efficiency.

How AI-Auto Ticketing Reduces Service Time

1. Faster Issue Classification and Resolution

In traditional customer service workflows, agents spend a significant amount of time manually classifying and routing customer issues. This process can be slow and error prone. AI auto-ticketing eliminates this bottleneck by automatically categorizing issues based on keywords and context in real-time.

For example, if a customer reaches out about a billing issue, the AI system can instantly identify the topic and create a ticket under the “billing” category, routing it directly to the billing department (Bijlsma et al., 2011). This immediate sorting ensures that the right team handles the issue from the outset, reducing the time it would take to manually classify and assign the ticket.

According to McKinsey & Company (2023), AI-driven automation in customer service workflows, such as ticketing, can reduce response times by as much as 50%, allowing banks to resolve customer issues much faster.

2. 24/7 Availability

One of the most notable advantages of AI auto-ticketing systems is their ability to operate 24/7. Unlike human agents, who have fixed working hours, AI systems are always available to respond to customer inquiries. This round-the-clock availability ensures that customer issues are addressed at any time, regardless of time zone differences or peak hours. By providing continuous support, AI auto-ticketing helps reduce the backlog of pending inquiries and ensures that customers receive timely responses, even outside of regular banking hours.

Read more: 10 Innovative Ways AI Chatbots in Banking Boost Customer Service

3. Streamlined Ticketing Routing

AI auto-ticketing systems excel at routing customer issues to the appropriate department without human intervention. Traditional systems often rely on human agents to determine the right team to handle each issue, which can lead to delays or errors. AI systems, on the other hand, can quickly analyze customer requests and direct them to the correct team or department based on pre-established categories and priorities. This streamlined routing process reduces the time spent transferring tickets between teams, ensuring that customer issues are addressed more quickly and efficiently.

The Streamlined Ticket Management Systems goes through seven stages; each stage has a specific function. It is essential for optimizing customer service processes, especially in environments where high volumes of inquiries are handled, such as in banking.

- Centralized Ticket Repository helps to send the ticket from customers to the AI agent (chatbot), to work other stages in the process

- Automated ticket routing ensures that each customer issue is quickly directed to the appropriate team or department based on the nature of the inquiry, reducing delays and ensuring faster resolutions.

- Prioritization and SLAs (Service Level Agreements) help set clear expectations for response times, ensuring that critical issues are handled first.

- With a centralized ticket repository, all customer interactions are stored in one place, making it easier for support teams to access historical data and provide consistent service.

- Integration with CRM systems further enhances the system by allowing seamless access to customer profiles, ensuring a personalized service experience.

- Additionally, self-service options and collaboration tools empower both customers and agents, reducing dependency on direct human intervention.

- Finally, the feedback loop and continuous improvement mechanism ensures that the system evolves based on performance data, optimizing the service process over time.

4. Automated Follow-Ups and Updates

AI auto-ticketing systems can also automate follow-ups and status updates, reducing the need for customer agents to manually track and update each ticket. This can ensure that customers are kept informed of the status of their inquiry, improving satisfaction and reducing the need for customers to initiate follow-up calls.

For instance, once a ticket is generated, the AI system can automatically notify the customer of the ticket status, provide an estimated resolution time, and even send reminders if the issue has not been resolved within the expected time frame. This level of automation not only speeds up response times but also helps manage customer expectations more effectively.

Benefits of AI Auto-Ticketing in Banking

1. Cost Reduction

One of the most significant benefits of AI auto-ticketing is cost reduction. With AI handling routine customer service tasks such as ticket generation and routing, banks can significantly reduce the number of human agents required to manage customer queries. This leads to cost savings in terms of staffing, training, and operational overheads. According to a recent Statista industry research, 43% of contact centers have already used AI technology, which has resulted in a 30% decrease in operating expenses.

2. Improve Customer Experience

AI auto-ticketing improves the customer experience by providing faster, more efficient service. With quicker response times and accurate ticket routing, customers are more likely to have their issues resolved on the first contact, leading to higher satisfaction rates. Additionally, AI’s ability to offer 24/7 support ensures that customers receive timely assistance no matter when they need it.

Improved customer experience can lead to increased loyalty and retention. In fact, research from Deloitte (2022) indicates that companies that provide excellent customer service are 60% more likely to see a boost in customer retention, which directly impacts long-term revenue growth.

3. Data-Driven Insights

AI auto-ticketing systems collect and analyze large amounts of data from customer interactions, providing valuable insights into common issues, customer preferences, and service bottlenecks. Banks can use this data to identify areas of improvement in their services and make data-driven decisions to enhance their customer service offerings.

For example, if a particular issue (such as a failed transaction) is frequently raised by customers, the bank can take proactive measures to address it, reducing the number of similar inquiries in the future. Furthermore, these insights can help banks identify trends in customer behavior, enabling them to offer more personalized services.

Challenges and Considerations

While AI auto-ticketing offers many benefits, there are also challenges that need to be addressed for successful implementation:

1. Data Privacy and Security

As AI systems handle sensitive customer data, ensuring robust data privacy and security is paramount. Banks must ensure that AI auto-ticketing systems comply with regulatory requirements such as GDPR and other data protection laws. Implementing strong encryption and secure data storage protocols is essential to protect customer information from cyber threats.

2. Integration with Existing Systems

Banks often use legacy systems that may not be fully compatible with new AI technologies. Integrating AI auto-ticketing systems with existing customer service infrastructure may require significant investment in technology and resources. However, this integration is crucial for maximizing the benefits of AI automation.

3. Maintaining Human Touch

While AI can automate many tasks, it is important to maintain a human touch for complex or sensitive issues. AI should complement human agents rather than replace them. Banks must strike a balance between automation and human intervention to ensure customers receive personalized service when needed.

Future of AI-Auto Ticketing in Banking

As AI technology continues to evolve, so will its applications in banking. Future AI auto-ticketing systems are likely to become even more sophisticated, offering features such as:

- Predictive Analytics: AI systems may be able to predict customer issues before they arise, allowing banks to address potential problems proactively.

- Advanced Sentiment Analysis: AI will be able to analyze the tone and sentiment of customer inquiries, helping to prioritize tickets based on urgency or emotional tone.

- AI Chatbots Integration: AI auto-ticketing systems may integrate more deeply with chatbots, enabling customers to resolve issues entirely through AI interactions, further reducing service times.

As these advancements take shape, AI auto-ticketing will become an even more integral part of customer service in the banking sector, driving efficiency, cost savings, and customer satisfaction. Contact us to streamline your operation and reduce service times significantly with AI!