AI agents for loan processing is expected to grow, leading to more innovative solutions and improved financial services. Due to the growth of AI revolutionization, AI in loan processing is transforming traditional methods, making them more efficient, accurate, and customer-friendly. Loan processing systems are using technologies such as: machine learning and natural language processing that help automate repetitious processes, decrease human error, and speed-up the decision-making process. In this blog post, we will identify the significant advantage of AI agents for both lenders and borrowers, ultimately resulting in a higher return on investment (ROI) for financial organizations.

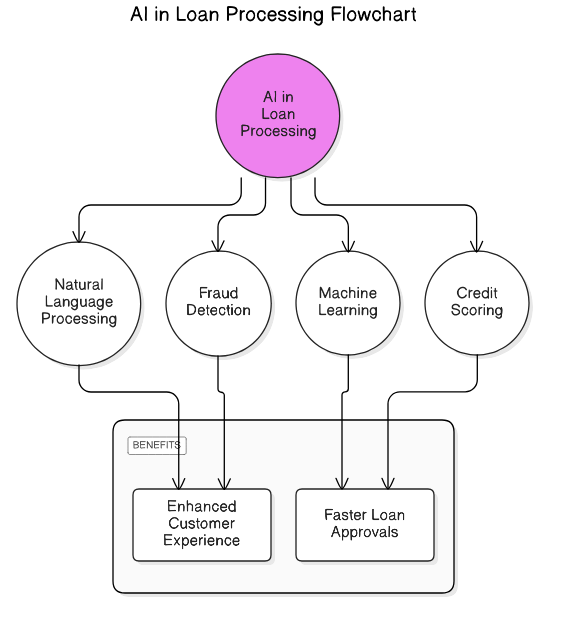

AI in Loan Processing Flowchart.

1. Evolution of AI agents for loan processing

The evolution of loan processing systems has been a notable journey, showcasing technological advancements and shifting consumer demands. Initially, loan processing was manual, requiring extensive paperwork and in-person interactions. The introduction of computers in the 1980s began to streamline these processes, enabling quicker data entry and retrieval. In the 1990s, the internet facilitated online applications, allowing borrowers to apply for loans from virtually anywhere. The 2000s introduced automated underwriting systems, such as automated mortgage underwriting and automated loan origination systems, which utilized algorithms to evaluate creditworthiness, significantly reducing approval times. Currently, loan processing systems, including automated and digital loan processing systems, increasingly incorporate AI autoamtion and machine learning, enabling real-time data analysis and enhanced decision-making.

2. The need for AI automation

The need for AI automation in loan processing is developed by various factors to highlight limitations of traditional methods:

2.1 Increased volume of loan applications

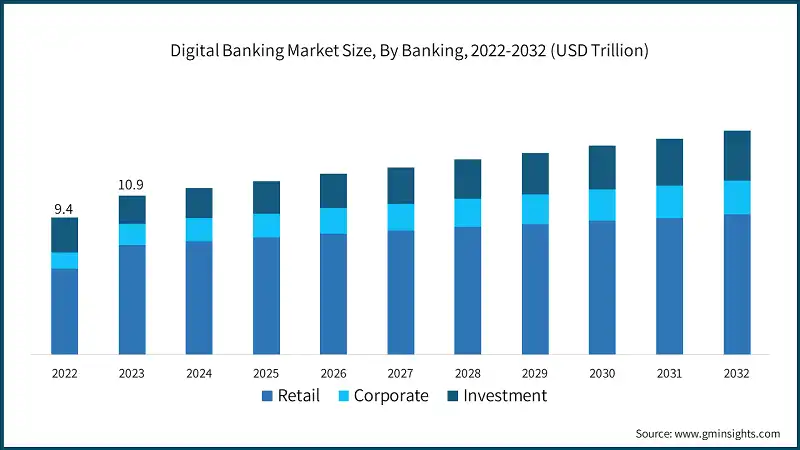

With the rise of digital banking, lenders face a surge in loan applications. To keep up with this increased demand, lenders must implement efficient technologies and processes that facilitate quick decision-making, ensuring they can meet borrower expectations without sacrificing accuracy or compliance. Embracing automation and data analytics becomes essential in streamlining workflows and enhancing the overall efficiency of the loan approval process. Therefore, it is necessary for having faster processing times.

Digital banking market size, by banking from 2022 to 2032.

2.2 Enhanced data accuracy

With the growth of AI, it can analyze vast amounts of data quickly, reducing human error in credit assessments and risk evaluations, which is crucial for systems like automated loan approval system and automated underwriting mortgage. By leveraging AI’s analytical capabilities, lenders can make more accurate and informed decisions, ultimately leading to improved loan approval rates and better risk management in their automated systems.

2.3 Enhance customer experience

Advanced AI-driven tools can handle a variety of inquiries, from answering questions about loan products to guiding users through the application process, ensuring borrowers receive timely assistance. From that, these AI chatbots and virtual assistants can provide instant support to borrowers, enhancing satisfaction and engagement.

2.4 Cutting cost and boosting efficiency

This cost reduction enables lenders to invest in technology, improve customer service, and develop innovative financial products, ultimately enhancing their competitive edge in the market. By streamlining operations, lenders can also focus on strategic growth initiatives rather than being bogged down by mundane tasks.

3. Current industry challenges

3.1 Data security

With the increasing digitization of loan applications, protecting sensitive customer information from cyber threats is a top priority for lenders. Lenders must implement robust cybersecurity measures, including encryption and multi-factor authentication, to safeguard personal data and maintain customer trust. Additionally, ongoing employee training and awareness programs are essential to mitigate risks associated with human error and ensure that all staff are vigilant against potential cyber threats.

3.2 Regulatory compliance

The financial industry is heavily regulated, and staying compliant with changing laws can be a daunting task for lenders. Navigating the complex landscape of financial regulations requires lenders to invest significant resources in compliance management and monitoring. Failure to adhere to these regulations not only risks substantial penalties but can also damage a lender’s reputation and erode customer confidence.

3.3 Customer trust

Building and maintaining trust with borrowers is crucial, especially in an era where data breaches and fraud are prevalent. By fostering this trust by being transparent about their data protection practices, promptly addressing any security incidents, and providing clear communication regarding how customer information is used and safeguarded.

As a result, addressing these challenges such as data security, regulatory compliance and customer trust are essential for the continued evolution of loan processing systems and the successful implementation of AI automation in the financial industry. From that, financial institutions can harness the full potential of AI automation, ensuring they remain competitive in a rapidly evolving landscape while delivering enhanced value to their customers.

4. Core AI technologies

AI technologies are revolutionizing loan processing by enhancing efficiency, accuracy, and customer experience with some key technologies like Machine Learning (ML), Nature Language Processing (NLP) and Robotic Process Automation (RPA). These core AI technologies not only improve the efficiency of loan processing but also enhance the overall customer experience, making the lending process faster and more reliable.

4.1 Machine learning (ML)

ML algorithms analyze historical data to predict borrower behavior and assess creditworthiness. This technology helps in automating the underwriting process.

4.2 Natural language processing (NLP)

NLP enables systems to understand and interpret human language, allowing for better customer interactions through chatbots and automated responses by allowing them to do so in the natural human language they use every day. This offers benefits across many industries and applications: content generation, automation of repetitive tasks, improved data analysis and insights and enhanced search.

4.3 Robotic process automation

RPA automates routine tasks such as data entry and document verification, streamlining the loan application process. This automation not only reduces processing times but also minimizes human error, allowing staff to focus on more complex tasks that require critical thinking and customer interaction.

5. Application intake and verification

Application intake and verification is a critical process in various sectors, including finance, healthcare, and education. This stage ensures that all submitted applications are complete, accurate, and meet the necessary criteria for further processing. The efficiency of this process can significantly impact the overall workflow and customer satisfaction. Streamlined processes help reduce the time taken for application approval, while effective verification minimizes the risk of fraud and errors.

5.1 Document authentication

Document authentication is a vital step in the application intake verification process. It involves verifying the legitimacy of the documents submitted by applicants, which is crucial to ensure that the information provided is accurate and trustworthy. Top documents that require authentication include identification cards (e.g., passports, driver’s licenses), financial statements (e.g., bank statements, tax returns), and educational certificates (e.g., diplomas, transcripts).

5.2 Fraud detection

Fraud detection is a critical component of financial services, retail, and online transactions. It involves identifying and preventing fraudulent activities that can lead to significant financial losses. With the rise of digital transactions, the need for robust fraud detection mechanisms, such as insurance fraud detection software and ai fraud detection, has become more pronounced. By understanding these components of fraud detection, credit assessment, and credit scoring models, businesses can enhance their risk management strategies and improve their lending processes.

5.3 Loan servicing and monitoring

Loan servicing and monitoring are essential components of the loan lifecycle, ensuring that loans are managed effectively after approval. This stage involves ongoing communication with borrowers and the management of loan repayments. Predictive analytics can identify borrowers who may be at risk of default, allowing lenders to intervene early. Moreover, having chatbots and virtual assistants provide 24/7 support to borrowers, answering queries and assisting with payment processes to support financial institutions.

6. Conclusion

At Verysell Group Applided AI Lab, we leverage our expertise in AI services to help clients implement these transformative technologies effectively. As well as, we also provide expert consulting to help our clients to ensuring they can leverage AI and blockchain technologies effectively to enhance their loan processing capabilities. By partnering with us, financial institutions can harness the power of AI to enhance their loan processing capabilities, improve customer satisfaction, and achieve greater operational efficiency.