AI in banking is undergoing a profound transformation that shows banks are no longer just relying on traditional systems to manage operations and provide services. AI has become the driving force in reimagining how banking enterprises operate, interact with customers, and make critical business decisions.

As AI continues to evolve, the possibilities for improving efficiency, enhancing customer experience, and gaining a competitive edge are limitless. In this blog post, we’ll explore the top five values AI brings to the banking sector, each of which plays a crucial role in rewiring the enterprise.

>> Read more about AI use cases in banking

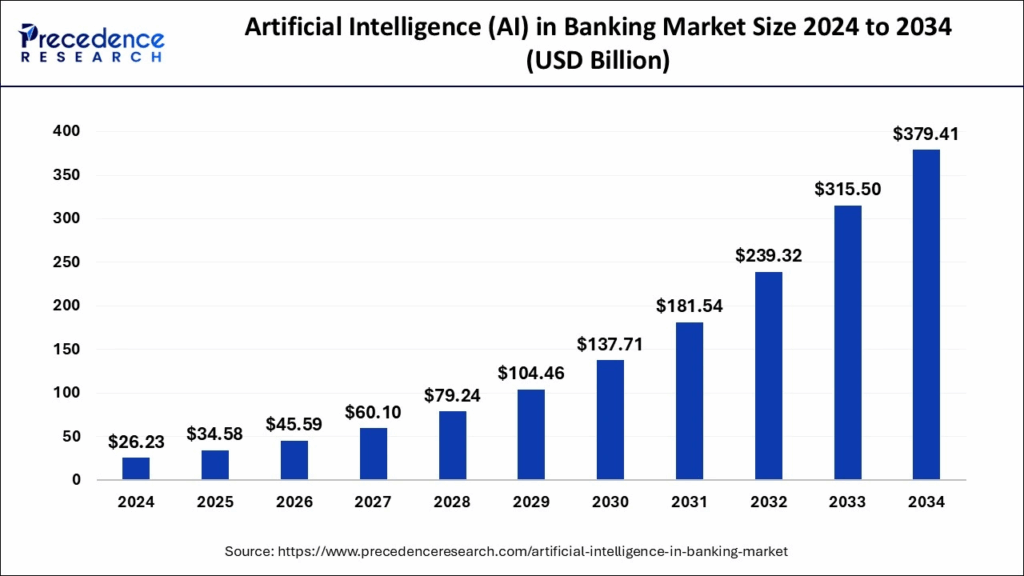

1. AI in Banking Market Analysis

According to Precedence Research (2025), the global artificial intelligence (AI) in banking market size was estimated at USD 26.23 billion in 2024 and is predicted to increase from USD 34.58 billion in 2025 to approximately USD 379.41 billion by 2034, expanding at a CAGR of 30.63% from 2025 to 2034. The digitization and modernisation of banking and financial institutes are driving the growth of the market.

2. Operational Efficiency

AI is dramatically improving operational efficiency within banks by automating repetitive and time-consuming tasks. Robotic process automation (RPA) is a prime example of how AI is streamlining back-office functions such as transaction processing, data entry, and regulatory compliance. By automating these tasks, banks reduce the risk of human error, speed up service delivery, and free up employees to focus on more strategic and value-added tasks.

AI also plays a key role in optimizing the internal workings of a bank. Machine learning algorithms can be used to analyze large datasets and identify inefficiencies, allowing for more accurate resource allocation and better decision-making. With AI handling mundane tasks, banks can reallocate human resources to higher-value functions, resulting in a more agile, cost-effective, and responsive organization.

3. Data-Driven Decision-Making

Data is the lifeblood of any financial institution, and AI is enabling banks to make smarter, data-driven decisions. Advanced AI models can process vast quantities of structured and unstructured data from various sources, including transaction histories, market trends, customer feedback, and even social media. This capability provides banks with a 360-degree view of their customers and operations, enabling them to identify emerging trends, spot potential risks, and make informed decisions quickly.

>> Identify churn prediction use cases to data-driven decision-making, informing strategic decisions, driving efficiency and profitability.

AI-driven analytics tools also help banks assess their performance and make predictions about future trends. For example, by analyzing customer behavior patterns, banks can predict loan defaults, identify at-risk customers, and implement proactive measures to mitigate these risks. This data-driven approach allows banks to be more proactive in their decision-making, minimize operational risks, and maintain a competitive edge in the market.

4. Improve Risk Management

Effective risk management is essential for the stability and success of any financial institution. AI is revolutionizing the way banks assess and manage risks, using advanced machine learning models to predict and mitigate financial risks in real time (Cossato, 2024). By analyzing historical data and continuously monitoring market conditions, AI can identify potential threats such as credit defaults, fraud, and market volatility.

AI is particularly powerful in the detection of fraudulent activities. Machine learning algorithms can sift through massive datasets and flag unusual patterns or transactions that may indicate fraudulent behavior. These systems learn from past data to continuously improve their accuracy, ensuring that banks can detect fraud before it becomes a major issue. This not only protects the bank’s assets but also helps build trust with customers, who can feel confident that their financial information is secure.

>> Click here to know more about risk mitigation in BFSI by 5 powerful ways

Moreover, AI can help banks manage regulatory compliance risks by ensuring that they adhere to constantly changing financial regulations. AI systems can automatically monitor and report on compliance, reducing the need for manual oversight and ensuring that banks stay on the right side of the law.

5. Innovative Product Development

AI has unlocked new possibilities for innovation in banking. With its ability to process and analyze vast amounts of data, AI is helping banks create innovative products and services that better meet the evolving needs of customers (Abdulsalam and Tajudeen, 2024). For instance, AI is driving the development of digital banking platforms and mobile apps that offer customers seamless access to their accounts, personalized financial advice, and easy payment solutions.

Additionally, AI is enabling banks to develop new products that were previously difficult or impossible to create. For example, AI-powered robo-advisors are revolutionizing the wealth management industry by providing affordable, automated investment advice to individuals with limited financial resources (Liu et al., 2024). These robo-advisors can analyze a customer’s risk tolerance, financial goals, and market trends to provide personalized investment strategies, making investment opportunities accessible to a broader audience.

AI is also playing a crucial role in the development of more secure and efficient payment systems. By using AI to analyze transaction data in real time, banks can offer faster, more secure payment options that reduce the risk of fraud and enhance the overall customer experience. As a result, AI is driving the evolution of the payment landscape, enabling banks to offer new and improved services to their customers.

6. Enhance Customer Experiences

In the modern banking landscape, customers demand convenience, speed, and personalized service. AI has enabled banks to meet these needs by delivering seamless, intelligent, and tailored customer experiences. AI-powered chatbots, for instance, are helping banks provide round-the-clock support, answer customer queries, and even assist with complex banking tasks like loan applications and account inquiries (Uzoka et al., 2024). These bots are designed to simulate human-like interactions, ensuring a smooth and efficient customer journey.

Additionally, AI enhances personalization by analyzing vast amounts of customer data to predict preferences and behaviors. Banks can now offer tailored recommendations for loans, credit cards, and investment products, ensuring customers receive services that match their financial goals. This level of personalization fosters loyalty, boosts satisfaction, and helps banks stand out in a competitive market.

Conclusion

AI is undoubtedly reshaping the banking sector by enhancing customer experiences, improving operational efficiency, enabling data-driven decision-making, boosting risk management, and fostering innovation. These five values highlight the immense potential AI has in transforming the way banks operate, interact with customers, and create new financial products. As AI continues to evolve, the financial services industry will be at the forefront of technological innovation, delivering smarter, more efficient, and more personalized services to customers worldwide.

By embracing AI and leveraging its capabilities, banks can not only stay ahead of the competition but also build stronger, more resilient organizations that are better equipped to navigate the challenges of the future. As AI technology continues to advance, the possibilities for the banking sector are boundless, and those who are early adopters will reap the rewards of a transformed enterprise.