Customer support has always been the cornerstone of business success. Whether in retail, tech, or banking, providing exceptional customer service builds trust, strengthens relationships, and drives customer retention. In the Banking, Financial Services, and Insurance (BFSI) sector, where speed, accuracy, and personalized assistance are paramount, the demand for advanced solutions has never been higher.

As the digital landscape evolves, BFSI organizations are increasingly turning to Artificial Intelligence (AI) to enhance their operations. Among these innovations, Conversational AI has emerged as a game-changer, with solutions like VERA leading the charge. This blog will explore how VERA is revolutionising customer support within the BFSI sector, highlighting five key benefits it brings to organisations and customers alike.

>> Click here to explore our VERA – customer support operations!

1. What is Conversational AI?

Before diving into VERA’s impact, let’s understand what Conversational AI is and why it’s such a transformative tool, which is a type of artificial intelligence that enables machines to understand, process, and respond to human language in a natural, conversational manner (Google, 2025). It combines natural language processing (NLP), machine learning, and speech recognition to facilitate human-like interactions (SmartDev, 2025). In this use case, Conversational AI can be deployed through chatbots, virtual assistants, or voice-activated solutions to help customers find answers, complete transactions and resolve issues without requiring human intervention.

2. How VERA is Changing Customer Support in BFSI

VERA, a Conversational AI solution, is specifically designed to cater to the needs of the BFSI industry. With the ability to understand and respond to customer inquiries with contextual awareness, VERA enhances the support experience by offering real-time assistance, 24/7 availability, and reduced response times. Here are some of the key ways VERA is transforming customer support in BFSI:

2.1 24/7 Availability and Instant Response

Traditional customer support channels in BFSI, such as phone lines or email support, often struggle to meet customer expectations for rapid response times, particularly during high-demand periods (Le, 2025). With VERA, however, customers can receive immediate responses to their queries, regardless of the time of day. Since VERA operates round the clock, customers in different time zones or those requiring assistance outside regular business hours no longer have to wait for office hours. This flexibility not only increases customer satisfaction but also significantly reduces waiting times, providing a seamless experience.

2. Personalised Customer Interactions

Personalisation is at the heart of exceptional customer service. VERA takes customer interaction to the next level by providing personalised assistance based on the customer’s previous interactions, preferences and transaction history (SuperOffice, 2025). This level of personalisation creates a more tailored experience for each individual. For example, if a customer calls in with a query regarding their recent loan application, VERA can pull up their application history, previous inquiries, and even relevant documents to offer a more informed and efficient solution. By learning from each interaction, VERA becomes smarter over time, continuously improving the customer experience.

Top 9 ways to create a customer experience strategy:

- Create a clear customer experience vision

- Understand who your customers are

- Create an emotional connection with your customers

- Capture customer feedback in real time

- Use a quality framework for development of your team

- Act upon regular employee feedback

- Measure the ROI from delivering great customer experience

- Personalise the experience

- Create a seamless omnichannel experience

3. Cost Efficiency and Operational Savings

One of the most significant advantages of Conversational AI, especially in customer support, is its cost-efficiency (Gumbo et al., 2024). In the BFSI sector, where customer queries can range from simple FAQs to complex financial transactions, managing a large team of customer service representatives can be resource-intensive (Jain et al., 2023).

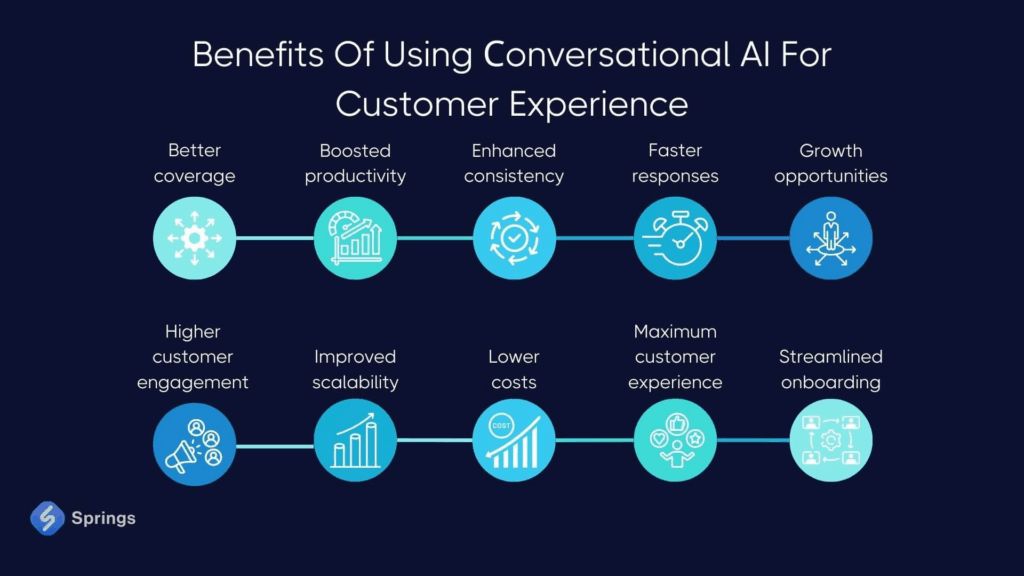

Top benefits of using conversational AI for customer are better coverage, boosted productivity, enhanced consistency, faster responses, growth opportunities and so on (Springs, 2025). With VERA, BFSI organizations can automate routine inquiries and transactions, freeing up human agents to focus on more complex cases. This not only reduces the operational costs associated with staffing but also increases overall efficiency. Furthermore, automation ensures fewer human errors, improving accuracy in resolving customer queries.

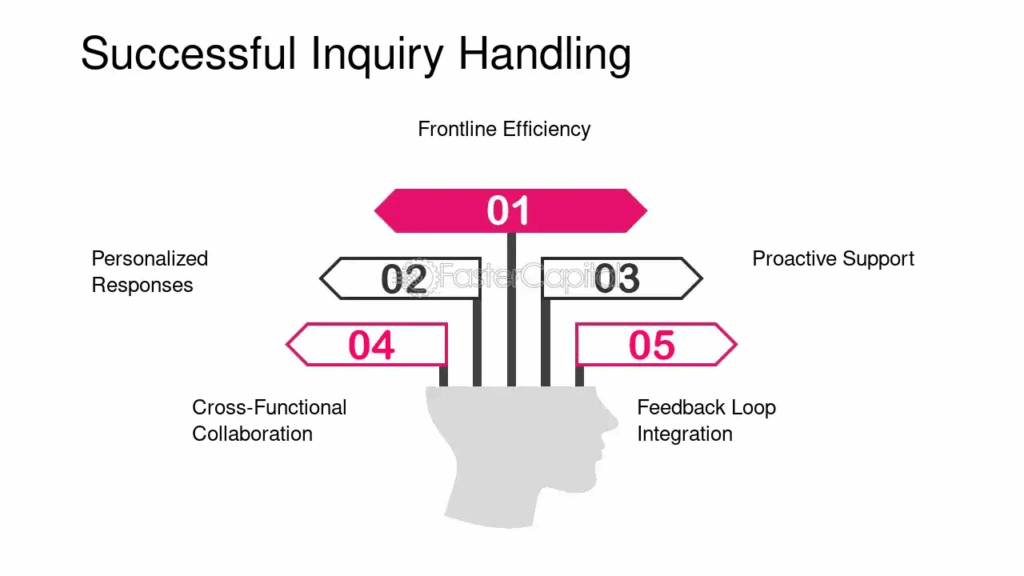

4. Handling Complex Inquiries with Ease

While many chatbots and virtual assistants can handle simple FAQs, VERA excels at managing more complex and nuanced inquiries typical in the BFSI sector. Whether it’s helping customers with loan applications, insurance claims, or investment portfolios, VERA uses advanced machine learning algorithms to understand intricate customer needs and provide accurate responses (Durant et al., 2022 and Chang et al., 2024). For instance, VERA can guide customers through investment options based on their financial goals, risk tolerance, and current portfolio, offering insights and recommendations that would typically require an expert advisor.

5. Boosting Customer Satisfaction

In the fast-paced BFSI environment, customer satisfaction is paramount. Customers expect fast, accurate, and convenient solutions to their problems. VERA’s quick response times, 24/7 availability and contextual understanding significantly enhance the customer experience, ensuring that customers are not left waiting or frustrated with slow or inaccurate responses. Moreover, VERA’s ability to engage in natural, human-like conversations helps create a more satisfying interaction. Whether through text or voice, customers feel that they are being heard, understood, and assisted in a way that feels personal and relevant.

6. Scalability and Flexibility

VERA is designed to scale with the growing demands of the BFSI industry. As customer interaction volumes increase whether due to seasonal surges, product launches, or unforeseen events like economic crises, VERA can handle a high volume of inquiries without compromising service quality. Unlike traditional customer support teams, which need to hire additional staff to handle spikes in demand, VERA can be scaled up or down to suit the organization’s needs. This flexibility is particularly valuable in the BFSI sector, where fluctuations in customer queries are common.

>> Read more about GenAI-Driven Software Testing – Maximising Synergy

The Future of Customer Support in BFSI

As Artificial Intelligence continues to evolve, so too will the capabilities of Conversational AI solutions like VERA. In the future, we can expect even more sophisticated AI systems capable of offering increasingly personalized, intuitive, and proactive customer support. It is not just a tool for automating customer support when it is a comprehensive solution that enhances customer interactions, improves efficiency, and drives operational savings for BFSI organizations. With its ability to offer personalized, 24/7 support, handle complex inquiries, and scale with business needs, VERA is poised to be a pivotal part of the BFSI sector’s digital transformation journey.

Furthermore, the integration of AI with other emerging technologies like blockchain and big data could further enhance VERA’s ability to provide even more seamless, secure, and intelligent support. For instance, blockchain could be used to verify identity, ensuring that every transaction or inquiry VERA handles is secure and accurate. Additionally, as AI systems become even more proficient at understanding and anticipating customer needs, VERA could proactively suggest solutions or financial products before customers even ask. This proactive approach will be essential in creating an even more dynamic customer service experience, where customers feel valued and understood.