Predictive Analytics in Claims Management

Predictive analytics in claims management is rapidly reshaping the insurance industry’s approach to risk assessment, fraud detection, and operational efficiency. This blog post proves the importance of AI-powered models trained on historical and real‑time data help users forecast claim outcomes, prioritize high‑risk cases, enhance operational efficiency, improve and personalize customer experiences in the insurance sector.

>> Click here to know best methods AI in insurance revolutionise claims!

1. What Is Predictive Analytics & Why Is It Crucial?

Predictive analytics refers to using statistical algorithms, machine learning, and data mining to identify the likelihood of future outcomes based on historical patterns (Božić, 2023). In insurance, models generate predictive scores that guide decision‑making across large volumes of claims data, enabling proactive, data‑driven operations. This capability is transformative: insurers shift from processing claims reactively to predicting and preventing risk, improving profitability and customer trust (Eling et al., 2021).

2. How AI-Driven Predictive Analytics Enhances Claims Management

2.1 Rapid Claim Triage and Case Prioritisation

AI models assess claims based on complexity and potential cost. High‑risk or litigation‑likely claims are flagged for senior adjusters, while routine low‑risk claims proceed through faster automated workflows (Brati et al., 2025). This proactive approach helps mitigate potential losses and enhances decision-making.

Routine low-risk claims benefit from automated workflows that expedite processing (Agapow, 2025). By utilising machine learning algorithms, these models can quickly verify information and make preliminary assessments, allowing claims to move through the system more efficiently. This dual approach not only improves operational efficiency but also enhances customer satisfaction by reducing wait times for policyholders. The integration of AI in claims management not only optimizes resource allocation but also strengthens the overall claims handling process, promoting a balance between thoroughness and speed (Sudabathula, 2025).

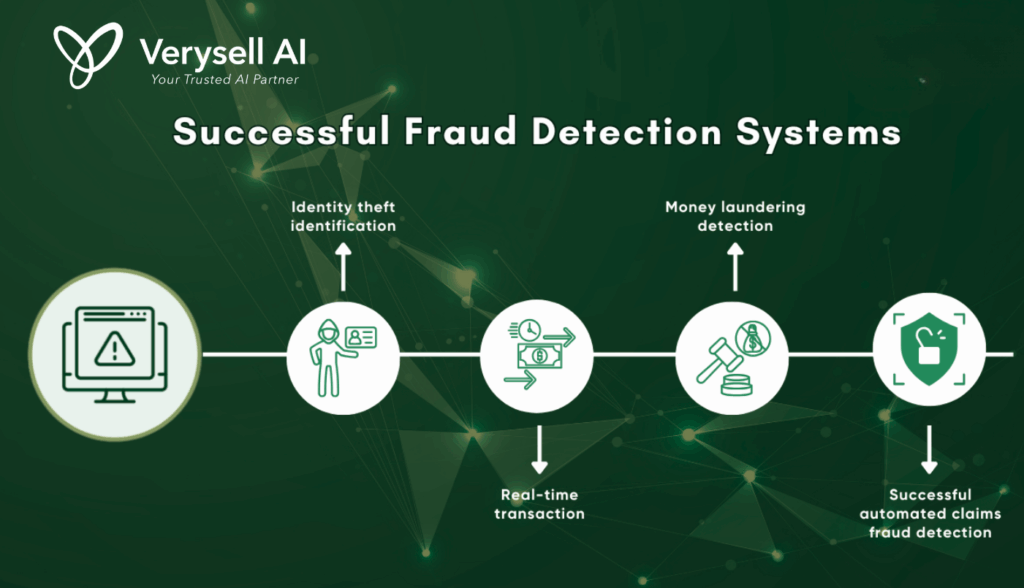

2.2 Fraud Detection and Anomaly Identification

Machine learning models identify suspicious patterns, such as multiple claims linked by device or location (Bello and Olufemi, 2024). Advanced graph‑based analytics detect organized fraud rings with high precision. Additionally, advanced graph-based analytics play a crucial role in uncovering organized fraud rings with remarkable precision.

By mapping relationships between various entities such as claimants, devices, and locations, these analytics reveal intricate networks of fraud that would be challenging to identify through traditional methods. This sophisticated approach not only enhances fraud detection but also empowers insurance companies to take proactive measures against potential threats, ultimately protecting their bottom line and maintaining trust with legitimate policyholders (Peter, 2023).

>> Explore now the best future of AI fraud detection and prevention in BFSI 2025!

2.3 Efficient Document and Image Processing

Modern tools leverage image recognition and explainable AI predictive analytics in claims management to automate damage estimation from submitted photos, cutting turnaround time while maintaining accuracy and trust. By quickly analyzing images with high accuracy, these technologies significantly reduce turnaround times for claims processing.

This automation not only streamlines workflows but also ensures precise damage assessments, which helps maintain trust with policyholders (SmartDev, 2025). The incorporation of explainable AI allows users to understand the rationale behind each estimate, fostering transparency in the decision-making process. As a result, insurance companies can enhance operational efficiency while delivering a more seamless and reliable experience for customers, ultimately leading to increased satisfaction and loyalty.

2.4 Actionable Insights and Decision Support

Predictive tools recommend the optimal next steps such as directing claimants to specialist physicians or suggesting settlement thresholds, maximizing positive outcomes based on similar cases (Caddick et al., 2023). Insurers can make informed decisions that align with best practices, thereby optimizing the claims process while reducing costs associated with prolonged negotiations or unresolved claims.

This proactive approach not only improves the efficiency of the claims handling process but also enhances the overall experience for policyholders. By ensuring that claimants receive timely access to the right resources and guidance, insurance companies can foster trust and satisfaction, ultimately leading to better resolution rates and improved relationships with clients.

2.5 Enhanced Customer Experience

By automating routine tasks and offering personalized updates across channels, insurers deliver faster and more transparent service to boost satisfaction and retention. Automation streamlines processes such as claims filing and status updates, reducing the time policyholders spend waiting for information (Ramamoorthy, 2024). Moreover, personalized communication whether through email, SMS, or mobile apps ensures that clients receive relevant updates tailored to their specific needs and preferences (Darvidou, 2024). This level of engagement fosters a sense of trust and connection between insurers and their clients.

3. Real-World Use Cases of Predictive Analytics in Insurance

3.1 Large P&C Insurer

One insurer deployed predictive models to estimate claims costs more accurately. They experienced faster resolution times, fewer human errors, and improved adjuster productivity thanks to automation of document review and risk scoring. Additionally, the insurer experienced a significant reduction in human errors, thanks to the automation of document review and risk scoring. By minimizing manual intervention, adjusters could focus on more complex tasks, thereby improving overall productivity.

3.2 Fraud Detection at Scale

A global insurer implemented graph‑based modeling to detect groups of organized fraudsters, boosting detection precision by over 80% and uncovering many more suspicious claims than legacy rule systems. By mapping relationships and interactions among various entities involved in claims such as claimants, devices, and locations-graph based on modeling provided deeper insights into fraudulent activities. This sophisticated analysis enabled the insurer to quickly identify patterns and connections that might otherwise go unnoticed.e

3.3 Claims Triage Optimisation

An insurer in Australia used predictive analytics to score claims and route the highest-risk ones to expert adjusters. This led to more efficient resource allocation and better outcomes for complex cases. By leveraging data-driven insights, the insurer could identify potential issues early in the claims process, allowing expert adjusters to address them proactively. As a result, this method not only improved the handling of intricate cases but also led to better outcomes for policyholders.

4. Getting Started: A 5-Step Implementation Framework

Assess Current Capabilities

To enhance operational efficiency, it is essential to conduct a thorough review of existing claims workflows, data systems, and technology readiness. This assessment will help identify gaps in current processes and infrastructure that may hinder performance. Once gaps are identified, it’s important to prioritize use cases that can deliver the most significant impact. For instance, focusing on fraud detection can help mitigate losses and protect the integrity of the claims process. Therefore, insurers can develop targeted strategies that address key challenges, streamline operations and enhance overall effectiveness in claims management.

Select Targeted Use Cases

Choose areas where predictive analytics can deliver measurable ROI and operational impact e.g., high-volume claims, fraud-prone segments, or customer experience improvements.

- High-volume claims: By applying predictive analytics to high-volume claims, insurers can streamline processing, reduce handling times, and improve accuracy. This can lead to substantial cost savings and enhanced customer satisfaction.

- Fraud-prone segments: Identifying and targeting fraud-prone segments with predictive models enables insurers to proactively mitigate risks. By detecting fraudulent claims earlier in the process, companies can prevent losses and allocate resources more effectively.

- Customer experience improvements: Leveraging predictive analytics to personalize customer interactions can enhance overall experience. By anticipating customer needs and preferences, insurers can tailor communications and services, leading to increased engagement and loyalty.

Pilot and Iterate

Predictive analytics in claims management helps to launch small-scale pilots to validate model performance and integration. Use metrics like denial accuracy, claim cycle time, and satisfaction scores. By focusing on these metrics, insurers can iteratively refine their predictive models, ensuring they deliver tangible benefits and align with organizational goals before broader implementation.

Scale and Monitor

Deploy proven models across teams, integrate with core systems, and establish real-time dashboards to flag performance drift or unexpected outcomes. To facilitate ongoing monitoring and improvement, establishing real-time dashboards is crucial. By implementing these strategies, insurers can ensure that predictive models remain effective, adapt to changing conditions, and continuously contribute to operational excellence.

- Flag performance drift: By tracking key performance indicators (KPIs) in real-time, teams can quickly identify any deviations from expected results, allowing for timely interventions.

- Monitor unexpected outcomes: Real-time analytics can help detect anomalies or unexpected trends in claims processing, enabling teams to investigate and address issues proactively.

Govern and Evolve

AI in predictive analytics in claims management set up data governance protocols, privacy safeguards, and regular model audits. Train staff on AI outputs and refine systems continuously:

- Data governance protocols: Establishing clear governance frameworks is essential for managing data integrity, access, and usage. This includes defining roles, responsibilities, and standards for data quality to ensure that the information feeding into predictive models is accurate and reliable.

- Privacy safeguards: Implementing robust privacy measures is critical to protect sensitive customer information. This involves using techniques such as data anonymization, encryption, and adhering to regulations like GDPR or CCPA. Ensuring compliance builds trust with customers and mitigates legal risks.

Regular Model Audits: Conduct periodic audits of predictive models to assess their performance, accuracy, and fairness. This helps identify any biases or discrepancies that may arise over time and ensures models remain effective.

- Performance assessment: Regularly evaluating the effectiveness of predictive models allows organizations to measure how well they are achieving their intended outcomes. This involves analyzing key performance indicators (KPIs) and comparing actual results against expectations.

- Accuracy verification: By examining model predictions against real-world outcomes, auditors can identify any discrepancies or areas where the model may not be performing as expected. This step is vital for maintaining trust in the model’s outputs.

Training Staff on AI Outputs

Provide comprehensive training for staff on interpreting AI-generated insights and integrating them into decision-making processes. This will empower teams to leverage AI effectively and understand its implications.

By equipping staff with the necessary skills and knowledge, organizations can empower their teams to leverage AI effectively, ensuring that predictive insights are integrated into decision-making processes and contribute to improved outcomes in claims management.

7. Benefits of Predictive Analytics in Claims Management

- Data governance protocols: Establish clear guidelines for data management, including data quality, access controls, and usage policies. This ensures that data used in predictive models is accurate, consistent, and compliant with relevant regulations.

- Privacy safeguards: Implement measures to protect sensitive information, such as anonymization techniques and encryption. Ensuring compliance with data protection laws, such as GDPR or CCPA, is critical for maintaining customer trust.

Predictive analytics represents a powerful advancement in claims management, enabling insurers to pivot from reactive processing to proactive risk prediction and optimized decision-making. By identifying high-risk claims early, detecting fraud more accurately, and automating routine tasks, insurers unlock meaningful gains in efficiency, cost savings, and customer loyalty.Implementing predictive analytics in claims management requires thoughtful planning, especially regarding integration, data governance, transparency, and change management. However, with a structured stepped approach and the right partner, such as Verysell AI, insurers can successfully harness AI-driven predictive solutions to transform their claims operations.