AI in BFSI (Banking, Financial Services, and Insurance) has rapidly evolved from a futuristic concept to an indispensable catalyst of change. In a sector traditionally governed by manual processes, legacy systems, and regulatory complexities, the integration of Artificial Intelligence (AI) has initiated an unprecedented wave of innovation and efficiency. Financial institutions today are actively embedding it into their operational, risk management, and customer engagement strategies.

This article explores five critical areas where AI in BFSI is delivering transformative automation, significantly reshaping the industry’s global landscape. Alongside each benefit, it presents a balanced view through a comparative analysis of opportunities and challenges.

1. Customer Service and Personalized Banking

One of the earliest and most visible impacts of AI in BFSI has been on customer service. Chatbots, virtual assistants, and AI-driven personalized recommendations have dramatically improved the customer experience. These solutions automate routine inquiries, provide instant support, and tailor banking advice to individual behaviors and preferences. For example, bank of America’s AI-driven assistant (Erica) has served millions of users, helping with transactions, budgeting advice, and credit score updates.

The integration of AI in this domain offers substantial opportunities, such as delivering 24/7 personalized service, ensuring faster response times, and improving overall customer satisfaction (Robert, 2025). It also enhances operational efficiency by reducing reliance on traditional call centers and cutting operational costs. Nevertheless, challenges persist. Customers may experience frustration if AI responses are perceived as generic or inaccurate, and significant investment is required to train and maintain AI systems to ensure ongoing effectiveness and relevance.

2. Fraud Detection and Risk Management

Financial fraud has become increasingly sophisticated but so have the tools to detect it. AI in BFSI now analyzes vast datasets in real time to identify anomalous patterns that might signal fraudulent activity. Machine learning systems continuously learn from new threats, adapting more quickly than traditional static rule-based systems. Take Mastercard as an example, it uses Decision Intelligence, an AI platform, to assess transaction risk based on contextual data, improving fraud detection accuracy without increasing false declines (Fintech Futures, 2016).

Both fraud detection and risk management have both opportunities and challenges. AI in BFSI has also brought transformative improvements in fraud detection and regulatory compliance. In fraud prevention, AI enables proactive detection by analyzing large datasets in real time to identify suspicious activities, significantly reducing financial losses.

However, one of the main challenges remains the high rate of false positives, which can inconvenience legitimate customers and affect trust. In terms of regulatory compliance, AI tools help financial institutions meet stringent requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) standards more efficiently by automating data verification and anomaly detection processes (Adejumo and Ogburie, 2025).

Despite these advantages, transparency remains a concern, as AI models often operate as “black boxes,” making it difficult for institutions to fully understand and explain how decisions are made, which can create regulatory and ethical challenges.

3. Underwriting and Credit Risk Assessment

Before AI in BFSI, traditional underwriting often relies on limited data points and manual assessment, leading to slower decisions and potential biases. AI revolutionizes this by analyzing broader datasets, including non-traditional indicators like utility payments, rental history, and even social media behavior, to produce a more holistic view of a borrower’s creditworthiness. Zest AI offers lenders AI-powered underwriting models that claim to increase approval rates while reducing default risks.

AI in BFSI is also redefining risk profiling and process optimization within credit assessment and underwriting. Through AI-driven analysis of both traditional and non-traditional data sources, financial institutions can now deliver faster and fairer credit decisions, thereby promoting greater financial inclusion for underserved populations. Risk profiling becomes more nuanced, allowing for a broader and more accurate understanding of borrower creditworthiness (Adams, 2024). Additionally, AI automates tedious manual assessments, enabling organizations to scale their underwriting processes efficiently without proportional increases in staffing.

However, these advancements bring significant challenges. Ethical concerns regarding data privacy and potential discrimination persist, especially when AI models incorporate unconventional data points. Furthermore, complex AI systems require rigorous validation and continuous monitoring to avoid systemic risk and ensure that biases or inaccuracies do not become embedded at scale.

Read our newsletters: AI That Acts, Not Reacts: What’s Next for the BFSI Sector?

4. Process Automation and Back-office Operations

Robotic Process Automation (RPA), when combined with AI (sometimes called Intelligent Automation) transforms back-office functions such as compliance reporting, data entry, reconciliation, and claims processing. Tasks that once took hours or days are now completed automatically with minimal human oversight.

AI in BFSI is significantly enhancing productivity gains and operational accuracy, particularly through the automation of back-office processes. By eliminating repetitive and time-consuming tasks, AI empowers staff to redirect their efforts toward more strategic, value-adding activities. This shift not only boosts overall productivity but also promotes a more dynamic and skilled workforce. Furthermore, AI improves accuracy in data-intensive operations, dramatically reducing the likelihood of human errors in critical financial processes.

Nevertheless, these advancements are not without challenges. Automation raises legitimate concerns regarding job displacement and may encounter resistance from employees apprehensive about changing roles or losing employment. Additionally, if AI systems are not carefully monitored and updated, errors embedded within AI logic can propagate rapidly, potentially leading to significant operational and financial risks.

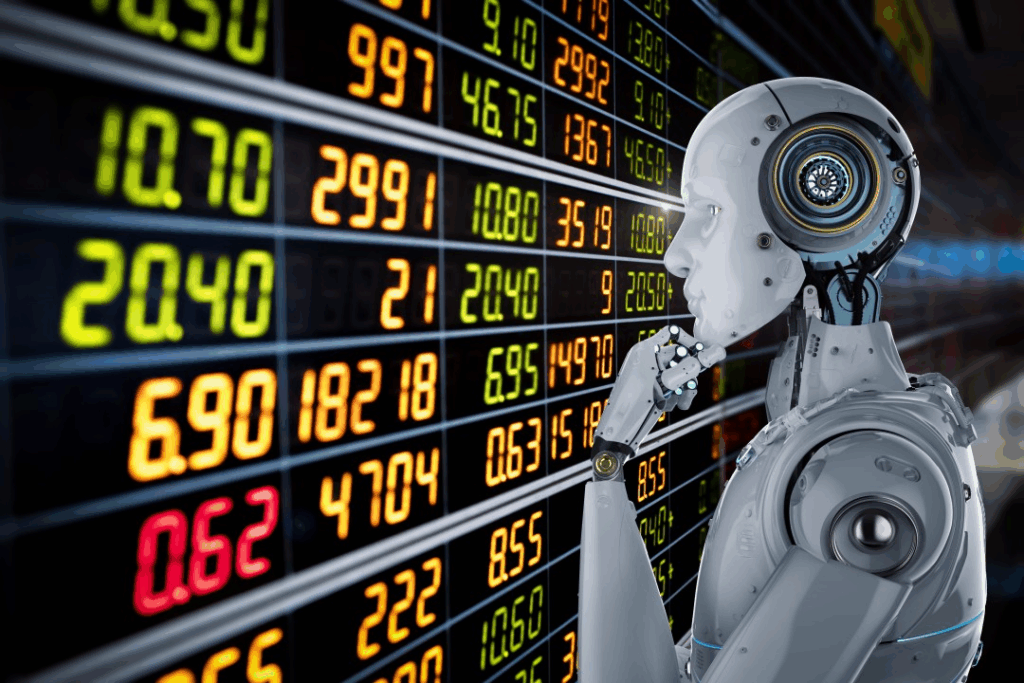

5. Investment Advisory and Wealth Management

AI in BFSI is demonstrated by AI-powered robot-advisors that democratize access to investment advice by providing affordable, algorithm-driven portfolio management services. They assess client goals, risk tolerance, and market conditions to offer personalized investment strategies without the need for human financial advisors. Betterment and Wealthfront are prominent robo-advisory firms that have amassed billions in assets under management using AI algorithms.

AI in BFSI has also revolutionized accessibility and scalability within investment advisory and wealth management. By offering low-cost, AI-powered financial advice, institutions are able to open investment opportunities to underserved populations who previously lacked access to traditional wealth management services (Vuković, Dekpo-Adza, and Matović, 2025). Furthermore, AI enables scalability by allowing advisory services to expand to millions of customers without requiring proportional increases in human staffing, thereby improving efficiency and outreach.

Nonetheless, challenges accompany these benefits. Limited human interaction in AI-driven advisory models may deter high-net-worth individuals who value personalized relationship management. Additionally, AI systems remain vulnerable to algorithmic bias and market shocks, particularly when there is insufficient human oversight to adjust strategies in response to rapidly changing financial conditions.

Conclusion

AI in BFSI is no longer a futuristic ambition, it is a present-day imperative. Across customer service, fraud detection, underwriting, back-office operations, and investment advisory, AI-driven automation is reshaping traditional financial paradigms. Institutions that embrace AI thoughtfully, balancing innovation with ethical considerations, will not only survive but thrive in this transformative era.

The financial services firms of tomorrow are those that recognize AI not simply as a tool for cost savings, but as a strategic asset for delivering superior customer value, achieving operational excellence, and fostering sustainable growth. As technology matures and regulations evolve, the full potential of AI in BFSI will unfold transforming not just businesses, but the very fabric of global financial ecosystems. Contact us if you need further discussion about AI.