Risk Mitigation in BFSI

Risk mitigation in BFSI (Banking, Financial Services, and Insurance) has always been a balancing act between innovation, security, and compliance (KPMG, 2023). In today’s hyper-digital economy, financial institutions are confronted with growing risks ranging from cyberattacks to complex regulatory demands. Traditional systems, while dependable, often lack the agility and intelligence needed to deal with fast-evolving threats. Artificial Intelligence (AI) has emerged as a game-changer in addressing these challenges (Mohamed, 2025).

By enabling advanced fraud detection, predictive analytics, and regulatory compliance automation, AI is not only reshaping how risks are managed but also unlocking new opportunities for efficiency and growth in the BFSI sector. In this blog post, we will briefly identify the 5 powerful ways AI reshapes risk mitigation in BFSI.

>> Read more about the VERA blog post – Our Customer Support for BFSI with Conversational AI

1. The Rising Need for Advanced Risk Mitigation in BFSI

The BFSI industry operates in an environment of high stakes. A single security breach, compliance failure, or operational disruption can result in multi-million-dollar losses and reputational damage. Key drivers intensifying the need for smarter solutions include:

- Sophisticated fraud tactics: Criminals are adopting AI themselves, making legacy systems less effective.

- Increased digital transactions: The surge in online and mobile banking has widened the attack surface for fraudsters.

- Regulatory pressure: Regulators worldwide demand greater transparency, stronger compliance mechanisms, and faster reporting.

- Customer expectations: Clients now expect seamless, secure, and real-time services.

2. Fraud Detection with AI: From Reactive to Proactive

Fraud detection with AI is one of the most impactful applications in BFSI (Adhikari, None Prashamsa Hamal and Baidoo, 2024). Traditional rule-based systems often fail to capture complex fraud patterns, especially when malicious actors exploit subtle loopholes. AI-powered systems, by contrast, use machine learning algorithms to analyze millions of transactions in real time. How AI improves fraud detection:

- Pattern recognition: AI identifies unusual behaviors such as atypical logins, spending anomalies, or account takeoversfaster than humans.

- Adaptive learning: Unlike static rules, AI models evolve as fraud tactics change, reducing false positives.

- Multi-factor analysis: AI combines user behavior, geolocation, device data, and transaction context for a 360° fraud risk profile.

For example, a bank can detect a suspicious transaction in milliseconds and block it before it clears, significantly reducing financial losses and protecting customer trust.

>> Read more to deeply understand best future of AI fraud detection and prevention in BFSI 2025

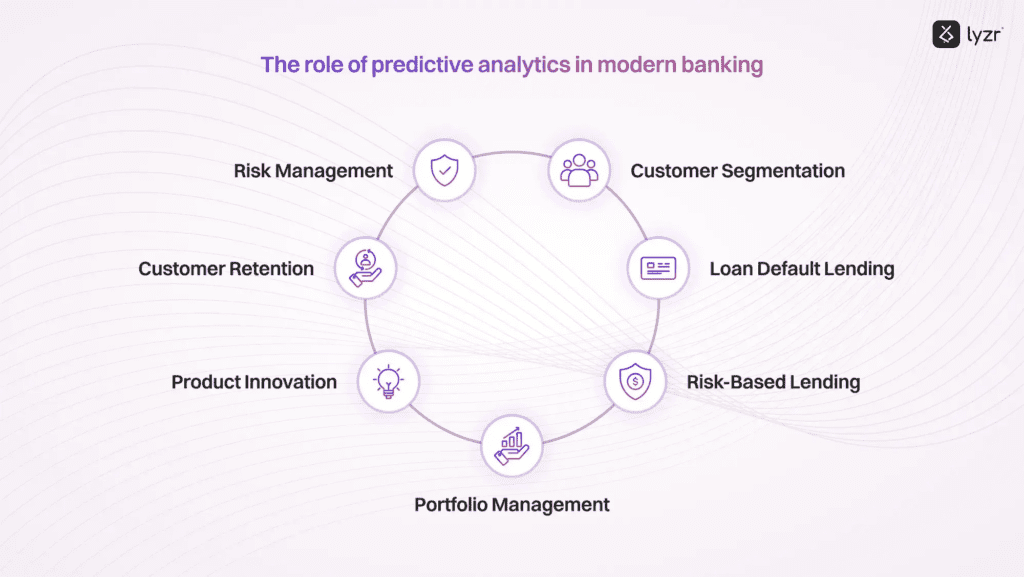

3. Predictive Analytics in Banking: Anticipating Risks Before They Happen

Risk mitigation is not just about responding to threats but anticipating them before they escalate (Majka, 2024). Predictive analytics in banking has various significant roles, such as risk management, customer retention, product innovation, portfolio management, customer segmentation, loan default lending and risk-based lending (Lyzr, 2025).

Key applications are given:

- Credit Risk Assessment: AI-driven models assess borrowers’ repayment ability by factoring in alternative data such as social behavior, online activities, and transaction trends.

- Operational Risk Forecasting: AI helps predict system outages, human errors, or third-party vendor risks.

- Market Risk Analysis: By analyzing global economic trends, AI enables banks to prepare for currency fluctuations, interest rate changes, or sudden market shocks.

The proactive nature of predictive analytics strengthens overall financial stability and helps institutions make better, data-driven decisions.

4. Regulatory Compliance Automation: Meeting Standards with Precision

The BFSI industry is one of the most heavily regulated sectors in the world. Non-compliance can result in hefty fines, reputational harm, and legal consequences. AI’s ability to streamline regulatory compliance automation is transforming how institutions approach this challenge (Kothandapani, 2025). There are some benefits of AI in compliance:

- Automated monitoring: AI scans millions of transactions for suspicious activities in line with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

- Real-time reporting: Instead of manual compliance reports that take days, AI delivers insights instantly.

- Reduced human error: Automated checks reduce mistakes caused by manual data entry and oversight.

- Dynamic adaptation: AI updates compliance protocols as regulations evolve, ensuring institutions stay ahead of the curve.

How to automate your compliance processes in 7 steps from gathering the requirements, integrating systems, creating a tactical plan, policy training, internal audit, certification and surveillance and monitoring.

4.1 Gather Requirements

The foundation of compliance automation starts with a comprehensive requirements analysis.

- Document data sources, workflows, and reporting obligations.

- Identify relevant laws, regulations, and standards (e.g., GDPR, ISO, SOC2, HIPAA).

- Map requirements to specific business processes and functions.

4.2 Integrate Systems

- Connect core systems (ERP, HRMS, CRM, ticketing, and cloud platforms).

- Use APIs, middleware, or robotic process automation (RPA) to unify data flow.

- Enable centralized dashboards for real-time visibility.

4.3 Create a Tactical Plan

- Define key compliance objectives (audit readiness, risk reduction, reporting accuracy).

- Prioritize areas for automation (high-frequency tasks such as access control, incident reporting).

- Assign responsibilities and allocate resources for implementation.

4.4 Policy Training

Deliver digital training, track completion, and send automated reminders.

- Digitize training programs and track completion automatically.

- Use e-learning platforms with interactive modules and quizzes.

- Send automated reminders for retraining or policy updates.

4.5 Internal Audit

Automate control checks, generate real-time audit trails, and flag anomalies.

- Set up automated control checks (e.g., password policies, vendor screening).

- Generate audit trails and reports instantly instead of manual preparation.

- Use anomaly detection to flag deviations in real time.

4.6 Certification

Streamline evidence collection, share controlled access with auditors, and track renewal deadlines.

- Automate documentation gathering (policies, logs, test results).

- Provide auditors with controlled access to compliance platforms.

- Track certification timelines and renewal deadlines automatically.

4.7 Surveillance & Monitoring

- Deploy AI-driven monitoring tools, automate alerts, and maintain real-time compliance visibility.

- Deploy automated monitoring tools for cybersecurity, financial transactions, and HR compliance.

- Use AI to detect suspicious activity, anomalies, or non-compliance risks.

Set up alerts, dashboards, and escalation workflows.

5. Case Studies: AI Success in BFSI Risk Mitigation

5.1 Fraud Detection in Retail Banking

A global retail bank deployed AI to detect fraudulent credit card transactions. Within the first year, false positives dropped by 25%, while the fraud detection rate increased by 40%. This improved customer satisfaction and reduced losses significantly.

5.2 Predictive Analytics for Loan Approvals

An Asian microfinance company adopted AI-driven predictive analytics to evaluate small business loan applicants. By analyzing unconventional datasets (like supplier payments and mobile wallet usage), they expanded financial inclusion while maintaining low default rates.

5.3 Compliance Automation in Insurance

A European insurance provider integrated AI into its compliance operations, automating claims audits and regulatory reporting. The solution reduced audit costs by 30% and cut reporting times from weeks to hours.

Challenges and Considerations

Despite its promise, AI in BFSI comes with challenges:

- Data Privacy Concerns: AI relies on massive amounts of sensitive data, raising questions about privacy and security.

- Bias in Algorithms: Poorly trained models can inadvertently discriminate against certain customer groups.

- Implementation Costs: Smaller institutions may struggle with the initial investment in AI systems.

- Regulatory Uncertainty: As AI adoption grows, new regulatory frameworks may emerge, requiring constant adaptation.

Addressing these issues with ethical AI practices, robust governance, and strong cybersecurity frameworks is crucial.

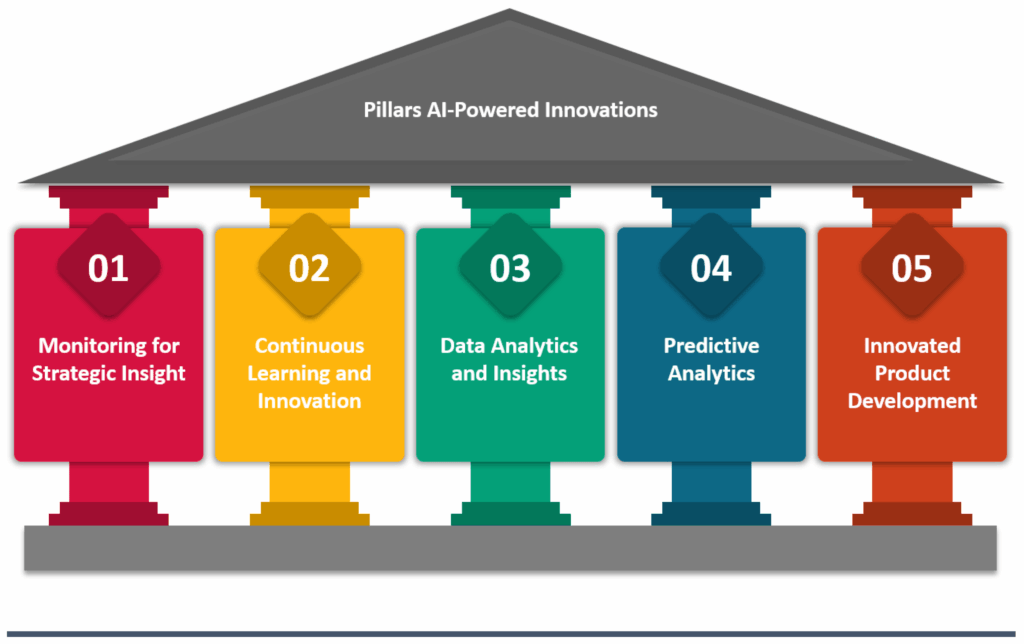

Future Outlook: AI as a Pillar of Financial Safety

Looking ahead, AI will become even more integral to risk mitigation strategies in BFSI. Emerging technologies such as explainable AI (XAI) will enhance transparency, while AI-driven cyber defense will become more sophisticated in countering advanced threats. Moreover, integration with blockchain, IoT, and quantum computing could further elevate the industry’s ability to predict, prevent, and manage risks. Institutions that invest early in AI innovation will not only secure themselves against threats but also position as leaders in trust and resilience.

Conclusion

Risk mitigation in BFSI is undergoing a profound transformation with AI at its core. From fraud detection with AI to predictive analytics in banking and regulatory compliance automation, financial institutions now have powerful tools to safeguard their operations, protect customers, and meet evolving demands.

As risks continue to evolve, embracing AI is not simply a competitive advantage—it is a necessity. The future of BFSI lies in building a resilient ecosystem where technology and human expertise work hand in hand to create safer, smarter, and more reliable financial services.