In the highly regulated world of banking and financial services, compliance remains a critical challenge. Financial institutions must navigate a complex and ever-evolving regulatory landscape, balancing stringent compliance requirements with operational efficiency. This is where AI for BFSI compliance is making a game-changing impact. Agentic AI, with its capabilities in autonomous decision making, workflow optimization, and credit risk assessment, is revolutionizing how financial institutions ensure regulatory compliance with greater accuracy and efficiency.

>> Read more: Best Future of AI Fraud Detection and Prevention in BFSI 2025

1. Understanding Challenges to be Solved by AI for BFSI Compliance:

Regulatory compliance in financial services requires continuous monitoring, promptly autonomous decision making, real-time credit risk assessment, and workflow optimization. Traditional compliance processes, which rely on manual checks and rule-based automation, often struggle to keep up with evolving regulations.

Regulatory non-compliance can lead to severe consequences, including hefty fines, reputational damage, and operational setbacks. According to BBC News (2021), the banking giant HSBC has been fined £63.9m by the UK’s financial regulator for “unacceptable failings” of its anti-money laundering systems, disregarding AML regulations. The case highlights the importance of having robust compliance mechanisms that can adapt to dynamic regulatory changes.

Agentic AI is prompt to transforming this landscape, due to its capabilities of proactively analyzing transactions, identifying potential risks, and automating compliance reporting. By that way, it ensures greater accuracy, efficiency, and adaptability in an ever-evolving regulatory environment.

2. Top 05 Use Cases of AI for BFSI Compliance:

Agentic AI is transforming regulatory compliance in the BFSI sector by introducing unparalleled efficiency, accuracy, and adaptability. By leveraging autonomous transaction monitoring, real-time risk analysis, and intelligent decision making, AI ensures financial institutions remain compliant with evolving regulations. Agentic AI not only detects anomalies and potential risks with greater precision but also optimizes compliance workflows, reducing operational bottlenecks. By proactively identifying regulatory breaches before they escalate, AI-driven compliance solutions enable financial institutions to mitigate risks, streamline reporting, and uphold industry standards with minimal human intervention. Here are how Agentic AI simplifies regulatory compliance:

2.1. Automated Regulatory Monitoring and Adaptation:

Financial institutions operate in a rapidly evolving landscape, where regulatory compliance requirements are frequently updated. Failing to adapt to these changes in a timely manner can result in severe penalties, reputational damage, and operational disruptions. Agentic AI transforms regulatory compliance by continuously scanning, interpreting, and integrating regulatory updates in real time. Through natural language processing (NLP) and machine learning, AI systems can analyze legal texts, regulatory announcements, and policy changes across multiple jurisdictions. These insights are then automatically translated into actionable compliance updates, ensuring that policies, risk models, and operational procedures remain aligned with the latest regulatory standards.

2.2. Intelligent Transaction Monitoring and Fraud Prevention:

In the dynamic landscape of financial transactions, the sophistication and frequency of fraudulent activities have escalated, necessitating advanced monitoring systems. Agentic AI, with its autonomous decision making capabilities, offers a robust solution by monitoring financial transactions in real time and flagging suspicious activities indicative of fraud or money laundering. Unlike traditional rule-based systems, Agentic AI leverages adaptive learning, enabling it to detect complex fraud patterns and generate actionable alerts. This adaptability ensures that institutions not only comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations but also enhance their overall security posture.

2.3. Enhanced Credit Risk Assessment:

Traditional credit risk assessment methods often rely on static models and periodic evaluations, which may overlook emerging risks and fail to capture the dynamic nature of borrowers’ financial behaviors. Agentic AI addresses these limitations by continuously monitoring borrower behavior, market conditions, and financial health, providing a dynamic and real-time risk assessment approach. This continuous analysis enables financial institutions to adjust risk evaluations promptly, improving the accuracy of risk pricing and reducing exposure to defaults, all while maintaining compliance with lending regulations.

2.4. Workflow Optimization for Compliance Reporting:

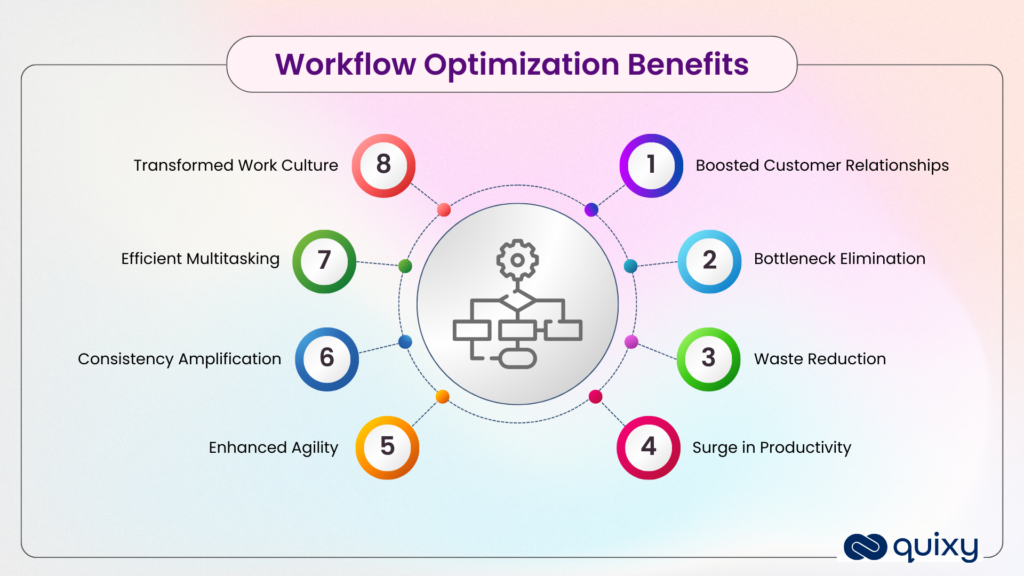

Regulatory reporting is a labor-intensive task that demands precision and timeliness. Agentic AI streamlines workflow optimization by automating data collection, validation, and report generation, ensuring timely and error-free submissions. AI-powered compliance engines can extract relevant information from disparate systems, reducing the manual burden and improving reporting accuracy. By optimizing the workflow in compliance reporting, organizations can enhance efficiency, reduce errors, and ensure timely submissions, thereby maintaining compliance with regulatory requirements and freeing up resources for strategic initiatives.

2.5. Proactive Risk Mitigation & Decision Support:

In the rapidly evolving financial landscape, institutions face increasing pressure to anticipate and mitigate risks before they materialize. Agentic AI empowers financial institutions to transition from reactive to proactive risk management by analyzing vast datasets to identify potential compliance breaches and provide actionable recommendations before issues escalate. By that way, financial institutions can enhance their ability to anticipate potential compliance issues, implement corrective measures promptly, and maintain continuous adherence to regulatory standards.

3. Challenges and Considerations in AI-Driven Compliance:

While AI-driven compliance solutions offer significant advantages, their implementation comes with notable challenges that financial institutions must navigate carefully:

- Regulatory Uncertainty: As AI adoption accelerates, regulatory bodies are still in the process of defining governance frameworks for its use in compliance. Financial institutions must work closely with regulators to ensure their AI solutions align with evolving standards and legal requirements. Failure to do so could result in compliance gaps, legal penalties, or reputational damage.

- AI Explainability: Compliance teams must be able to understand and audit AI-driven decisions to ensure regulatory adherence and accountability. Traditional machine learning models, particularly deep learning algorithms, often operate as “black boxes,” making it difficult to trace how conclusions are reached. Organizations must prioritize the use of explainable AI (XAI) techniques that provide transparent decision-making rationales, ensuring regulatory approval and stakeholder trust.

- Integration with Legacy Systems: Many financial institutions operate on outdated infrastructure, making it challenging to implement AI-driven compliance tools without disrupting existing workflows. Seamless integration with current compliance frameworks is crucial to maximize efficiency and avoid operational bottlenecks. This often requires significant investment in IT infrastructure and cross-functional collaboration between compliance, technology, and risk management teams.

4. Conclusion:

Agentic AI is poised to transform regulatory compliance in financial services by making it more efficient, proactive, and accurate. By leveraging AI-powered automation, financial institutions can navigate compliance challenges with confidence, reduce operational costs, and mitigate regulatory risks. With its ability to continuously learn, adapt, and optimize processes, autonomous decision making AI is not just simplifying compliance—it’s reshaping the future of financial services.

Ready to explore how AI can enhance your compliance strategy? Contact us today to learn how Agentic AI can help your organization stay ahead of regulatory challenges.