What is AI Data Analytics?

AI Data Analytics refers to the application of artificial intelligence to process and analyze data. It leverages techniques such as machine learning and natural language processing to extract insights from large datasets. In the Banking, Financial Services, and Insurance (BFSI), this technology is revolutionizing decision-making, risk management, and customer engagement.

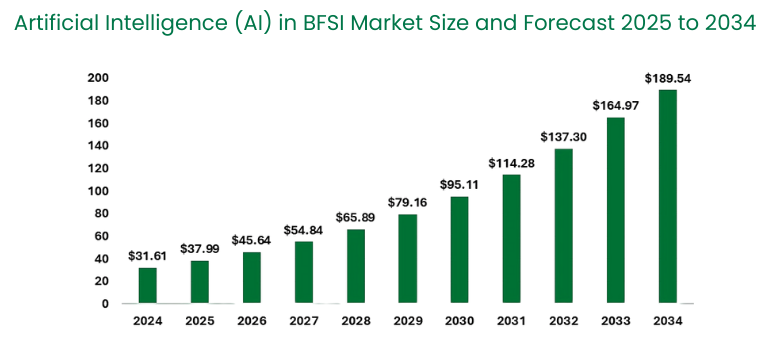

According to Precedence Research (2025), the global market for artificial intelligence (AI) in the BFSI sector is estimated to be valued at USD 37.99 billion in 2025 and is projected to grow to approximately USD 189.54 billion by 2034, with a compound annual growth rate (CAGR) of 19.62% from 2025 to 2034. This blog post will explore how AI Data Analytics is transforming, highlighting key benefits and challenges in the BFSI sector.

Source: Precedence Research (2025).

AI in BFSI Market Growth Factors

The BFSI sector has increasingly adopted AI-powered technologies to enhance daily operations and offer online assistance through chatbots for consumers. To deliver personalized services and improve customer interactions, the banking and finance industry employs machine learning algorithms and natural language processing (NLP) (DBS, 2023). AI is also being utilized to detect fraudulent messages and emails, as it can analyze data more quickly and identify patterns more efficiently than humans. Additionally, there is a growing trend of digitalization in financial transactions worldwide, along with an increased use of AI in risk management and predictive analytics.

AI Data Analytics Benefits

It utilizes advanced machine learning algorithms and data analytics techniques to process vast amounts of financial data. By leveraging these tools, financial institutions can gain deeper insights into market trends, customer behavior, and risk factors. This enhanced understanding allows them to make more informed decisions. There are top four key applications, including fraud detection, risk management, customer engagement and operational efficiency.

1. Improve fraud detection

Fraud detection is among the main use cases propelling the financial services industry’s use of AI. Transaction data may be analyzed by machine learning algorithms to find irregularities that can point to fraud. AI can issue a review notice if a credit card is used in an odd location. Fraud detection software often does this by keeping an eye on user behavior, apps, transactions, and APIs. By doing this, fraud is stopped before it creates major problems.

>> Read more: Best Future of AI Fraud Detection and Prevention in BFSI

2. Enhance risk management

AI-powered analytics is also revolutionizing risk management in financial services. By analyzing historical data and market trends, AI tools can pinpoint potential risks and offer insights for mitigation. This capability is especially beneficial for regulatory compliance, as financial institutions need to navigate complex and evolving regulations. AI streamlines compliance processes by automatically monitoring transactions for suspicious activities and ensuring adherence to all regulatory requirements.

3. Improve customer engagement and personalization

One of the most significant impacts of AI-powered analytics in financial services is the enhancement of customer experience through personalized services. According to NVIDIA’s 2024 report, many financial institutions are prioritizing AI to offer customized products and services tailored to individual customer needs.

Personalized Banking Services: Banks and financial institutions are leveraging AI to create personalized banking experiences. AI algorithms analyze transaction histories, spending patterns, and financial goals to recommend tailored investment products or savings plans. This personalized approach not only improves customer satisfaction but also fosters loyalty and trust.

>> Read more: Approved Role of AI in Banking and Insurance in 2025

Virtual Assistants and Chatbots: AI-powered virtual assistants and chatbots are transforming customer service in the financial sector. These tools can manage a wide range of customer inquiries, from checking account balances to providing investment advice, all while ensuring a seamless and efficient experience. AI-driven chatbots continuously learn from each interaction, enhancing their ability to assist customers effectively.

4. Engage operational efficiency

AI-powered analytics significantly enhances operational efficiency in financial services by streamlining processes. By automating routine tasks, such as data entry and transaction processing, institutions can save valuable time and resources. This automation not only reduces human error but also allows employees to focus on more complex and strategic activities. Predictive analytics further contributes to this efficiency by forecasting trends and identifying potential issues before they arise, enabling proactive decision-making (Roseth, 2024).

Moreover, the cost reductions associated with AI-driven automation are substantial. Financial institutions can lower operational costs by minimizing manual intervention and optimizing resource allocation. This efficiency leads to quicker turnaround times for services, enhancing overall customer satisfaction. As AI technologies continue to evolve, their ability to improve processes and reduce costs will be crucial for maintaining a competitive edge in the ever-changing financial landscape.

AI Data Analytics and AI in FinTech

FinTech’s artificial intelligence and analytics are revolutionizing the financial services sector by presenting fresh chances for creativity, productivity, and client interaction. AI is changing how financial institutions function and provide value to their clients, from improving customer experience and fraud detection to streamlining investment strategies and propelling product creation. For financial organizations, the growing use of analytics driven by AI offers a substantial potential. They may better manage the difficulties of the modern financial environment by using these technology. They may also speed up sluggish operations. Long-term success will result from this.

Conclusion

Overall, there are four main benefits of AI data analytics. Fraud detection involves analyzing transaction patterns to identify and prevent fraudulent activities in real time. In addition, risk management enhances credit scoring models and risk analysis by processing vast amounts of financial data. Financial institutions also gain customer engagement by having a deeper understanding of consumer behavior and preferences to tailor financial products and services. Lastly, AI-powered analytics improves operational efficiency by streamlining processes and reducing costs through automation and predictive analytics.